Citibank 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

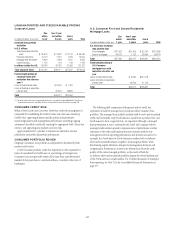

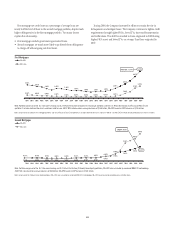

Second, the Company continues to evaluate each of its portfolios to

identify those customers who might be eligible to refinance or modify their

mortgages and stay in their homes, offering them different solutions. The

Citi Homeowner Assistance program is an example of such efforts,

preemptively reaching out to homeowners not currently behind on their

mortgage payments, but that may require help to remain current on their

mortgages. These efforts focus particularly on borrowers in geographies

facing extreme economic distress.

Third, the Company has initiated various mortgage foreclosure

moratoriums. See “Citigroup Mortgage Foreclosure Moratoriums” on page

59.

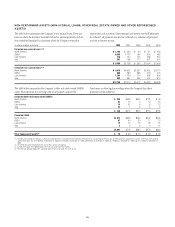

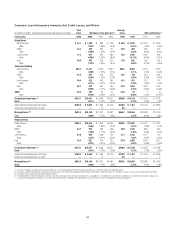

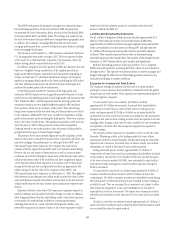

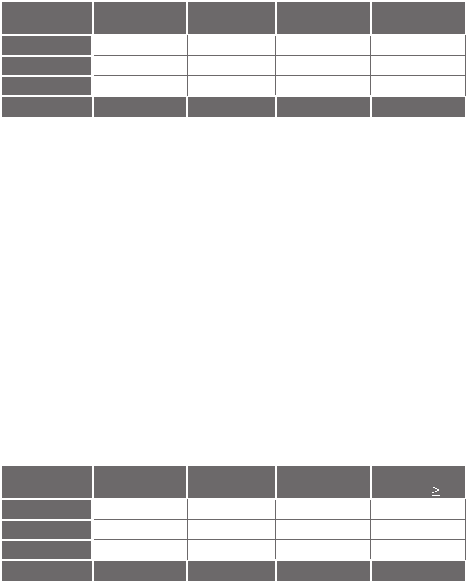

The following tables detail the Company’s first and second U.S. Consumer

mortgage portfolio by origination channels, geographic distribution and

origination vintage.

By Origination Channel

The Company’s U.S. Consumer mortgage portfolio was originated from three

main channels: retail, broker and correspondent.

• Retail: loans originated through a direct relationship with the borrower.

• Broker: loans originated through a mortgage broker, where the Company

underwrites the loan directly with the borrower.

• Correspondent: loans originated and funded by a third party, where the

Company purchases the closed loans after the correspondent has funded

the loan. Includes loans acquired in large bulk purchases from other

mortgage originators. These types of purchases, used primarily in 2006

and 2007, mainly focused on non-prime and second-lien loans to be held

on Citigroup’s balance sheet. This method of acquisition was

discontinued in 2007, and the current correspondent channel focuses on

acquisition of loans eligible for sale to the GSEs.

First Mortgages: December 31, 2008

RETAIL

CHANNEL

(in billions of dollars)

BROKER

TOTAL

CORRESPONDENT

90+DPD

2.48%

5.23%

8.79%

5.66%

FIRST MORTGAGES

FICO<620

$11.5

$1.5

$9.3

$22.4

CHANNEL

% TOTAL

39.8%

17.4%

42.8%

100.0%

FIRST

MORTGAGES

$53.4

$23.3

$57.3

$133.9

Note: Data at origination. $134 billion portfolio excludes Canada and Puerto Rico, First Collateral Services

(commercial portfolio), deferred fees/costs, loans held-for-sale and loans sold with recourse. Excluding

Government insured loans, 90+DPD for the first mortgage portfolio is 5.13%.

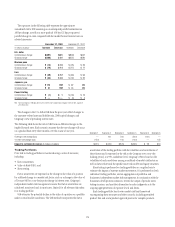

As of December 31, 2008, approximately 43% of the first mortgage

portfolio was originated through the correspondent channel, a reduction

from approximately 47% as of the end of 2007. Given that loans originated

through correspondents have exhibited higher 90+DPD delinquency rates

than retail originated mortgages, the Company terminated business with a

number of correspondent sellers in 2007 and 2008. During 2008, over 96% of

the loans originated through this channel were eligible to be sold to the

GSEs. During 2008, the Company has severed relationships with a number of

brokers, only maintaining those who have produced strong, high-quality

and profitable volume.

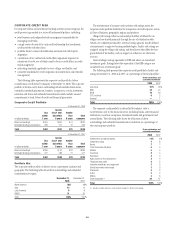

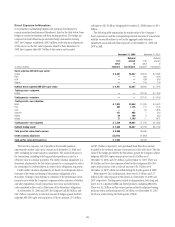

Second Mortgages: December 31, 2008

RETAIL

CHANNEL

(in billions of dollars)

BROKER

TOTAL

CORRESPONDENT

90+DPD

0.91%

3.24%

4.03%

2.39%

SECOND MORTGAGES

LTV 90%

$2.2

$4.0

$11.0

$17.2

CHANNEL

% TOTAL

45.6%

27.8%

26.6%

100.0%

SECOND

MORTGAGES

$26.9

$16.4

$15.7

$59.0

Note: Data at origination. Second mortgage 90+DPD rate calculated by OTS methodology.

For second mortgages, approximately 54% of the loans were originated

through third-party channels. As these mortgages have demonstrated a

higher incidence of delinquencies, the Company no longer originates second

mortgages through third-party channels, which represented 59% of the

portfolio as of the end of 2007.

63