Citibank 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

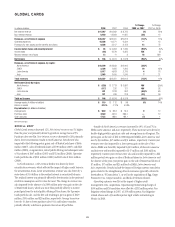

GLOBAL WEALTH MANAGEMENT

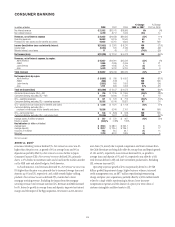

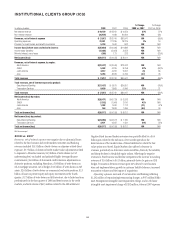

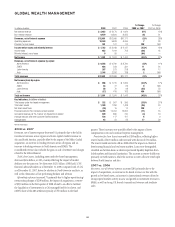

In millions of dollars 2008 2007 2006

% Change

2008 vs. 2007

% Change

2007 vs. 2006

Net interest revenue $ 2,622 $ 2,174 $ 1,922 21% 13%

Non-interest revenue 9,979 10,824 8,255 (8) 31

Revenues, net of interest expense $12,601 $12,998 $10,177 (3)% 28%

Operating expenses 10,548 9,849 8,006 723

Provision for loan losses 301 101 24 NM NM

Income before taxes and minority interest $ 1,752 $ 3,048 $ 2,147 (43)% 42%

Income taxes 652 1,019 703 (36) 45

Minority interest, net of taxes 955 — (84) —

Net income $ 1,091 $ 1,974 $ 1,444 (45)% 37%

Revenues, net of interest expense by region:

North America $ 9,295 $ 9,790 $ 8,790 (5)% 11%

EMEA 604 543 331 11 64

Latin America 357 373 318 (4) 17

Asia 2,345 2,292 738 2NM

Total revenues $12,601 $12,998 $10,177 (3)% 28%

Net income (loss) by region:

North America $ 968 $ 1,415 $ 1,209 (32)% 17%

EMEA 84 77 23 9NM

Latin America 56 72 48 (22) 50

Asia (17) 410 163 NM NM

Total net income $ 1,091 $ 1,974 $ 1,443 (45)% 37%

Key indicators: (in billions of dollars)

Total assets under fee-based management $ 332 $ 507 $ 399 (35)% 27%

Total client assets 1,320 1,784 1,438 (26) 24

Net client asset flows (25) 15 14 NM 7

Financial advisors (FA) / bankers (actual number) 13,765 15,454 13,694 (11) 13

Annualized revenue per FA / banker (in thousands of dollars) 849 880 740 (4) 19

Average deposits and other customer liability balances 126 117 107 89

Average loans 63 54 42 17 29

NM Not meaningful.

2008 vs. 2007

Revenues, net of interest expense decreased 3% primarily due to the fall in

investment revenues across regions and lower capital markets revenue in

Asia and North America, partially offset by the impact of the Nikko Cordial

acquisition, an increase in lending revenues across all regions and an

increase in banking revenues in North America and EMEA. The

consolidated revenue also includes the gain on sale of CitiStreet and charges

related to the ARS settlement.

Total client assets, including assets under fee-based management,

decreased $464 billion, or 26%, mainly reflecting the impact of market

declines over the past year. Net flows were $(25) billion. GWM had 13,765

financial advisors/bankers as of December 31, 2008, compared with 15,454

as of December 31, 2007, driven by attrition in North America and Asia,as

well as the elimination of low performing bankers and advisors.

Operating expenses increased 7% primarily due to higher repositioning/

restructuring charges of $298 million, the impact of acquisitions, a reserve

of $250 million in the first quarter of 2008 related to an offer to facilitate

the liquidation of investments in a Citi-managed fund for its clients, and

GWM’s share of the ARS settlement penalty of $50 million in the third

quarter. These increases were partially offset by the impact of lower

compensation costs and continued expense management.

Provision for loan losses increased by $200 million, reflecting higher

reserve builds of $149 million and increased write-downs of $51 million.

The reserve builds and write-offs in 2008 reflect the impact on clients of

deteriorating financial and real estate markets. Loans were downgraded,

classified and written-down as clients experienced liquidity depletion from

failed markets and financial institutions. The increase in reserve builds was

primarily in North America, while the increase in write-offs were evenly split

between North America and Asia.

2007 vs. 2006

Revenues, net of interest expense increased 28% primarily due to the

impact of acquisitions, an increase in fee-based revenues in line with the

growth in fee-based assets, an increase in international revenues driven by

strong capital markets activity in Asia and growth in investment revenue in

EMEA, as well as strong U.S. branch transactional revenue and syndicate

sales.

36