Citibank 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

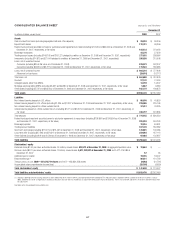

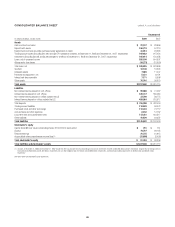

CONSOLIDATED BALANCE SHEET Citigroup Inc. and Subsidiaries

December 31

In millions of dollars, except shares 2008 2007

Assets

Cash and due from banks (including segregated cash and other deposits) $ 29,253 $ 38,206

Deposits with banks 170,331 69,366

Federal funds sold and securities borrowed or purchased under agreements to resell (including $70,305 and $84,305 as of December 31, 2008 and

December 31, 2007, respectively, at fair value) 184,133 274,066

Brokerage receivables 44,278 57,359

Trading account assets (including $148,703 and $157,221 pledged to creditors at December 31, 2008 and December 31, 2007, respectively) 377,635 538,984

Investments (including $14,875 and $21,449 pledged to creditors at December 31, 2008 and December 31, 2007, respectively) 256,020 215,008

Loans, net of unearned income

Consumer (including $36 at fair value as of December 31, 2008) 519,673 592,307

Corporate (including $2,696 and $3,727 at December 31, 2008 and December 31, 2007, respectively, at fair value) 174,543 185,686

Loans, net of unearned income $ 694,216 $ 777,993

Allowance for loan losses (29,616) (16,117)

Total loans, net $ 664,600 $ 761,876

Goodwill 27,132 41,053

Intangible assets (other than MSRs) 14,159 14,307

Mortgage servicing rights (MSRs) (including $5,657 and $8,380 at December 31, 2008 and December 31, 2007, respectively, at fair value) 5,657 8,380

Other assets (including $5,722 and $9,802 as of December 31, 2008 and December 31, 2007 respectively, at fair value) 165,272 168,875

Total assets $1,938,470 $2,187,480

Liabilities

Non-interest-bearing deposits in U.S. offices $ 60,070 $ 40,859

Interest-bearing deposits in U.S. offices (including $1,335 and $1,337 at December 31, 2008 and December 31, 2007, respectively, at fair value) 229,906 225,198

Non-interest-bearing deposits in offices outside the U.S. 37,412 43,335

Interest-bearing deposits in offices outside the U.S. (including $1,271 and $2,261 at December 31, 2008 and December 31, 2007, respectively, at

fair value) 446,797 516,838

Total deposits $ 774,185 $ 826,230

Federal funds purchased and securities loaned or sold under agreements to repurchase (including $138,866 and $199,854 as of December 31, 2008

and December 31, 2007, respectively, at fair value) 205,293 304,243

Brokerage payables 70,916 84,951

Trading account liabilities 167,478 182,082

Short-term borrowings (including $17,607 and $13,487 at December 31, 2008 and December 31, 2007, respectively, at fair value) 126,691 146,488

Long-term debt (including $27,263 and $79,312 at December 31, 2008 and December 31, 2007, respectively, at fair value) 359,593 427,112

Other liabilities (including $3,696 and $1,568 as of December 31, 2008 and December 31, 2007, respectively, at fair value) 92,684 102,927

Total liabilities $1,796,840 $2,074,033

Stockholders’ equity

Preferred stock ($1.00 par value; authorized shares: 30 million), issued shares: 828,573 at December 31, 2008, at aggregate liquidation value $ 70,664 $—

Common stock ($0.01 par value; authorized shares: 15 billion), issued shares: 5,671,743,807 at December 31, 2008 and 5,477,416,086 at

December 31, 2007 57 55

Additional paid-in capital 19,165 18,007

Retained earnings (1) 86,521 121,769

Treasury stock, at cost: 2008—221,675,719 shares and 2007—482,834,568 shares (9,582) (21,724)

Accumulated other comprehensive income (loss) (25,195) (4,660)

Total stockholders’ equity $ 141,630 $ 113,447

Total liabilities and stockholders’ equity $1,938,470 $2,187,480

(1) Citigroup’s opening Retained earnings balance has been reduced by $151 million to reflect a prior period adjustment to Goodwill. This reduction adjusts Goodwill to reflect a portion of the losses incurred in January

2002, related to the sale of an Argentinean subsidiary of Banamex, Bansud, that was recorded as an adjustment to the purchase price of Banamex. There is no tax benefit and there is no income statement impact from

this adjustment.

See Notes to the Consolidated Financial Statements.

117