Citibank 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock Option Programs

The Company has a number of stock option programs for its non-employee

directors, officers and employees. Generally, in 2008, 2007, 2006 and 2005,

stock options were granted only to CAP participants who elected to receive

stock options in lieu of restricted or deferred stock awards, and to

non-employee directors who elected to receive their compensation in the

form of a stock option grant. Occasionally, stock options also may be granted

as sign-on awards. All stock options are granted on Citigroup common stock

with exercise prices that are no less than the fair market value at the time of

grant. Generally, options granted from 2003 through 2008 have six-year

terms, but there have been grants with terms of up to 10 years. Options

granted from January 2003 through 2008 typically vest ratably over three- or

four-year periods; however, directors’ options cliff vest after two years, and

vesting schedules for sign-on grants may vary. Options granted in 2004 and

2003 typically vest in thirds each year over three years (with the first vesting

date occurring 17 months after the grant date), and had 10-year terms. The

sale of shares acquired through the exercise of employee stock options

granted since January 2003 is restricted for a two-year period (and may be

subject to the stock ownership commitment of senior executives thereafter).

Prior to 2003, Citigroup options, including options granted since the date of

the merger of Citicorp and Travelers Group, Inc., generally vested at a rate of

20% per year over five years (with the first vesting date occurring 12 to 18

months following the grant date) and had 10-year terms. Certain options,

mostly granted prior to January 1, 2003, permit an employee exercising an

option under certain conditions to be granted new options (reload options)

in an amount equal to the number of common shares used to satisfy the

exercise price and the withholding taxes due upon exercise. The reload

options are granted for the remaining term of the related original option and

vest after six months. Reload options may in turn be exercised using the

reload method, given certain conditions. An option may not be exercised

using the reload method unless the market price on the date of exercise is at

least 20% greater than the option exercise price.

To further encourage employee stock ownership, the Company’s eligible

employees participated in WealthBuilder, CitiBuilder, or the Citigroup

Ownership Program. Options granted under the WealthBuilder and the

Citigroup Ownership programs vest over a five-year period, and options

granted under the CitiBuilder program vest after five years. These options did

not have a reload feature. Options have not been granted under these

programs since 2002.

On January 22, 2008, Vikram Pandit, CEO, was awarded stock options to

purchase three million shares of common stock. The options vest 25% per

year beginning on the first anniversary of the grant date and expire on the

tenth anniversary of the grant date. One-third of the options have an exercise

price equal to the NYSE closing price of Citigroup stock on the grant date

($24.40), one-third have an exercise price equal to a 25% premium over the

grant date closing price ($30.50), and one-third have an exercise price equal

to a 50% premium over the grant date closing price ($36.60). The first

installment of these options vested on January 22, 2009. These options do not

have a reload feature.

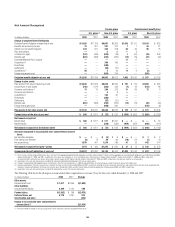

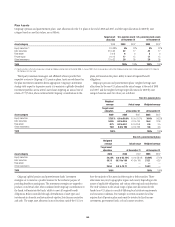

Information with respect to stock option activity under Citigroup stock option plans for the years ended December 31, 2008, 2007 and 2006 is as follows:

2008 2007 2006

Options

Weighted

average

exercise

price

Intrinsic

value

per share Options

Weighted

average

exercise

price

Intrinsic

value

per share Options

Weighted

average

exercise

price

Intrinsic

value

per share

Outstanding, beginning of period 172,767,122 $43.08 $ — 212,067,917 $41.87 $13.83 277,255,935 $40.27 $ 8.26

Granted—original 18,140,448 $24.70 — 2,178,136 $54.21 — 3,259,547 $48.87 —

Granted—reload 15,984 $28.05 — 3,093,370 $52.66 — 12,530,318 $52.30 —

Forfeited or exchanged (24,080,659) $42.19 — (8,796,402) $46.26 1.52 (14,123,110) $45.57 3.36

Expired (20,441,584) $38.88 — (843,256) $43.40 4.38 (2,021,955) $44.87 4.06

Exercised (2,540,654) $22.36 — (34,932,643) $36.62 11.16 (64,832,818) $36.37 12.56

Outstanding, end of period 143,860,657 $41.84 $ — 172,767,122 $43.08 $ — 212,067,917 $41.87 $13.83

Exercisable at end of period 123,654,795 165,024,814 179,424,900

142