Citibank 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

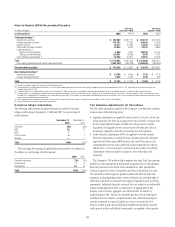

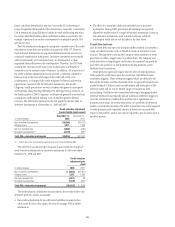

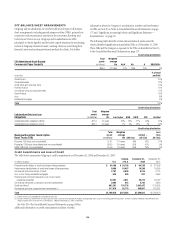

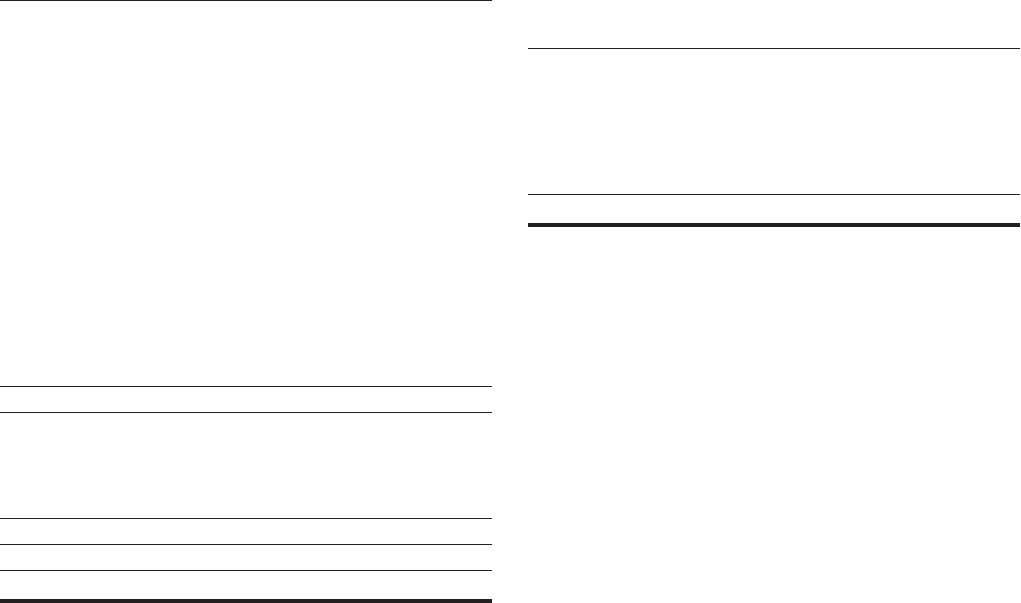

Components of Capital Under Regulatory Guidelines

In millions of dollars at year end 2008 2007 (1)

Tier 1 Capital

Common stockholders’ equity (2) $ 70,966 $ 113,447

Qualifying perpetual preferred stock 70,664 —

Qualifying mandatorily redeemable securities of subsidiary

trusts 23,899 23,594

Minority interest 1,268 4,077

Less: Net unrealized gains (losses) on securities

available-for-sale, net of tax (3) (9,647) 471

Less: Accumulated net losses on cash flow hedges, net of

tax (5,189) (3,163)

Less: Pension liability adjustment, net of tax (4) (2,615) (1,196)

Less: Cumulative effect included in fair value of financial

liabilities attributable to credit worthiness, net of tax (5) 3,391 1,352

Less: Restricted core capital elements (6) —1,364

Less: Disallowed deferred tax assets (7) 23,520 —

Less: Intangible assets:

Goodwill 27,132 41,053

Other disallowed intangible assets 10,607 10,511

Other (840) (1,500)

Total Tier 1 Capital $118,758 $ 89,226

Tier 2 Capital

Allowance for credit losses (8) $ 12,806 $ 15,778

Qualifying debt (9) 24,791 26,690

Unrealized marketable equity securities gains (3) 43 1,063

Restricted core capital elements (6) — 1,364

Total Tier 2 Capital $ 37,640 $ 44,895

Total Capital (Tier 1 and Tier 2) $156,398 $ 134,121

Risk-weighted assets (10) $996,247 $1,253,321

(1) Reclassified to conform to the current period’s presentation.

(2) Reflects prior period adjustment to opening retained earnings as presented in the Consolidated

Statement of Changes in Stockholders’ Equity on page 118.

(3) Tier 1 Capital excludes unrealized gains and losses on debt securities available-for-sale in accordance

with regulatory risk-based capital guidelines. Institutions are required to deduct from Tier 1 Capital net

unrealized holding gains on available-for-sale equity securities with readily determinable fair values,

net of tax. The federal bank regulatory agencies permit institutions to include in Tier 2 Capital up to

45% of pretax net unrealized holding gains on available-for-sale equity securities with readily

determinable fair values, net of tax.

(4) The FRB granted interim capital relief for the impact of adopting SFAS 158.

(5) The impact of including Citigroup’s own credit rating in valuing liabilities for which the fair value option

has been selected is excluded from Tier 1 Capital, in accordance with regulatory risk-based capital

guidelines.

(6) Represents the excess of allowable restricted core capital in Tier 1 Capital. Restricted core capital is

limited to 25% of all core capital elements, net of goodwill.

(7) Of the Company’s $44 billion of net deferred tax assets at December 31, 2008, $14 billion were

includable without limitation in regulatory capital pursuant to the risk-based capital guidelines, while

$24 billion exceeds the limitation imposed by these guidelines and as “disallowed deferred tax assets”

were deducted in arriving at Tier 1 Capital. The Company’s other $6 billion of net deferred tax assets

at December 31, 2008, primarily represented the deferred tax effects of unrealized gains and losses

on available-for-sale debt securities, which are permitted to be excluded prior to deriving the amount

of net deferred tax assets subject to limitation under the guidelines. The Company had no disallowed

deferred tax assets at December 31, 2007.

(8) Can include up to 1.25% of risk-weighted assets. Any excess allowance is deducted from risk-

weighted assets.

(9) Includes qualifying subordinated debt in an amount not exceeding 50% of Tier 1 Capital.

(10) Includes risk-weighted credit equivalent amounts, net of applicable bilateral netting agreements, of

$102.9 billion for interest rate, commodity and equity derivative contracts, foreign-exchange contracts

and credit derivatives as of December 31, 2008, compared with $91.3 billion as of December 31,

2007. Market-risk-equivalent assets included in risk-weighted assets amounted to $101.8 billion at

December 31, 2008 and $109.0 billion at December 31, 2007. Risk-weighted assets also include the

effect of other off-balance-sheet exposures, such as unused loan commitments and letters of credit,

and reflect deductions for certain intangible assets and any excess allowance for credit losses.

Common stockholders’ equity decreased approximately $42.4 billion to

$71.0 billion, representing 3.7% of total assets as of December 31, 2008 from

$113.4 billion and 5.2% at December 31, 2007.

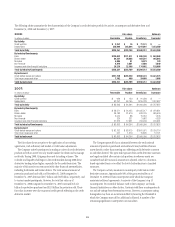

Common Equity

The table below summarizes the change in common stockholders’ equity

during 2008:

In billions of dollars

Common equity, December 31, 2007 $113.4

Net loss (27.7)

Employee benefit plans and other activities 4.1

Dividends (7.6)

Issuance of shares for Nikko Cordial acquisition 4.4

Issuance of common stock 4.9

Net change in Accumulated other comprehensive income (loss), net of tax (20.5)

Common equity, December 31, 2008 $ 71.0

As of December 31, 2008, $6.7 billion of stock repurchases remained

under authorized repurchase programs after no material repurchases were

made in 2008 and $0.7 billion of repurchases were made in 2007. Under

TARP, the Company is restricted from repurchasing common stock, subject

to certain exceptions, including in the ordinary course of business as part of

employee benefit programs. In addition, in accordance with various TARP

programs, Citigroup has agreed not to pay a quarterly common stock

dividend exceeding $0.01 per share per quarter for three years (beginning in

2009) without the consent of the U.S. Treasury. See “TARP and Other

Regulatory Programs” on page 44.

The Company is currently in ongoing discussions with the Federal

Reserve Board regarding an increase to the Company’s risk-weighted assets

resulting from certain liquidity-facility transactions relating to the

Company’s primary credit card securitization trusts. This increase in risk-

weighted assets will affect the calculation of the Company’s risk-based

capital ratios. However, the timing and extent of the increase is not yet

certain, pending completion of discussions with the Federal Reserve Board.

See Note 23 to the Consolidated Financial Statements on page 175.

Tangible Common Equity (TCE)

The Company and its bank regulators view the Tier 1 Capital Ratio as being

the most important measure of risk capital for bank holding companies.

Citigroup’s Tier 1 Capital Ratio was 11.92% at December 31, 2008 compared

to 7.12% at December 31, 2007.

Tangible common equity (TCE) represents Common equity less

Goodwill and Intangible assets (excluding MSRs). TCE was $29.7 billion at

December 31, 2008, compared to $58.1 billion at December 31, 2007. The

TCE Ratio (TCE divided by risk-weighted assets) was 3.0% at December 31,

2008 compared to 4.6% at December 31, 2007. The primary drivers of the

decline in TCE during the year were the 2008 net loss of $27.7 billion, and

an increase in negative Accumulated other comprehensive income (AOCI)

of $21 billion.

On February 27, 2009, the Company announced an exchange offer of its

common stock for up to $27.5 billion of its existing preferred securities and

trust preferred securities. The U.S. government will match this exchange up

to a maximum of $25 billion of its preferred. These transactions are intended

to increase the Company’s TCE. See “Outlook for 2009” on page 7.

95