Citibank 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

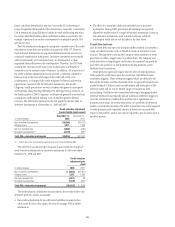

Mandatorily Redeemable Securities of Subsidiary Trusts

Total mandatorily redeemable securities of subsidiary trusts (trust preferred

securities), which qualify as Tier 1 Capital, were $23.899 billion at

December 31, 2008, as compared to $23.594 billion at December 31, 2007. In

2008, Citigroup did not issue any new enhanced trust preferred securities.

The FRB issued a final rule, with an effective date of April 11, 2005, which

retains trust preferred securities in Tier 1 Capital of bank holding companies,

but with stricter quantitative limits and clearer qualitative standards. Under

the rule, after a five-year transition period, the aggregate amount of trust

preferred securities and certain other restricted core capital elements

included in Tier 1 Capital of internationally active banking organizations,

such as Citigroup, would be limited to 15% of total core capital elements, net

of goodwill, less any associated deferred tax liability. The amount of trust

preferred securities and certain other elements in excess of the limit could be

included in Tier 2 Capital, subject to restrictions. At December 31, 2008,

Citigroup had approximately 11.8% against the limit. The Company expects

to be within restricted core capital limits prior to the implementation date of

March 31, 2009.

The FRB permits additional securities, such as the equity units sold to

ADIA, to be included in Tier 1 Capital up to 25% (including the restricted

core capital elements in the 15% limit) of total core capital elements, net of

goodwill less any associated deferred tax liability. At December 31, 2008,

Citigroup had approximately 16.1% against the limit.

The FRB granted interim capital relief for the impact of adopting SFAS

158 at December 31, 2008 and December 31, 2007.

The FRB and the FFIEC may propose amendments to, and issue

interpretations of, risk-based capital guidelines and reporting instructions.

These may affect reported capital ratios and net risk-weighted assets.

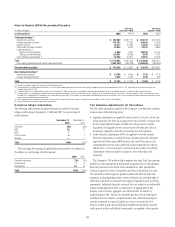

Capital Resources of Citigroup’s Depository Institutions

Citigroup’s subsidiary depository institutions in the United States are subject

to risk-based capital guidelines issued by their respective primary federal

bank regulatory agencies, which are similar to the FRB’s guidelines. To be

“well capitalized” under federal bank regulatory agency definitions,

Citigroup’s depository institutions must have a Tier 1 Capital Ratio of at least

6%, a Total Capital (Tier 1 + Tier 2 Capital) Ratio of at least 10% and a

Leverage Ratio of at least 5%, and not be subject to a regulatory directive to

meet and maintain higher capital levels.

At December 31, 2008, all of Citigroup’s subsidiary depository institutions

were “well capitalized” under the federal regulatory agencies’ definitions,

including Citigroup’s primary depository institution, Citibank, N.A., as noted

in the following table:

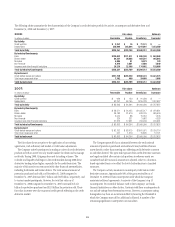

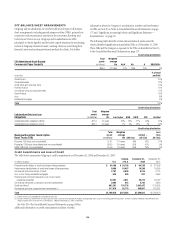

Citibank, N.A. Components of Capital and Ratios Under

Regulatory Guidelines

In billions of dollars at year end 2008 2007

Tier 1 Capital $ 71.0 $ 82.0

Total Capital (Tier 1 and Tier 2) 108.4 121.6

Tier 1 Capital Ratio 9.94% 8.98%

Total Capital Ratio (Tier 1 and Tier 2) 15.18 13.33

Leverage Ratio (1) 5.82 6.65

(1) Tier 1 Capital divided by adjusted average assets.

Citibank, N.A. had a net loss for 2008 amounting to $6.2 billion.

During 2008, Citibank, N.A. received contributions from its parent

company of $6.1 billion. Citibank, N.A. did not issue any additional

subordinated notes in 2008. Total subordinated notes issued to Citicorp

Holdings Inc. that were outstanding at December 31, 2008 and December 31,

2007 and included in Citibank, N.A.’s Tier 2 Capital, amounted to $28.2

billion. Citibank, N.A. received an additional $14.3 billion in capital

contribution from its parent company in January 2009. The impact of this

contribution is not reflected in the table above. The substantial events in

2008 impacting the capital of Citigroup, and the potential future events

discussed on page 94 under “Citigroup Regulatory Capital Ratios,” also

affected, or could affect, Citibank, N.A.

96