Citibank 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PENSION AND POSTRETIREMENT PLANS

The Company has several non-contributory defined benefit pension plans

covering substantially all U.S. employees and has various defined benefit

pension and termination indemnity plans covering employees outside the

United States. The U.S. defined benefit plan provides benefits under a cash

balance formula. Employees satisfying certain age and service requirements

remain covered by a prior final pay formula. The Company also offers

postretirement health care and life insurance benefits to certain eligible U.S.

retired employees, as well as to certain eligible employees outside the United

States.

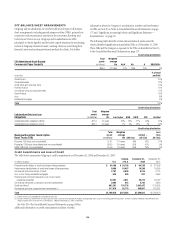

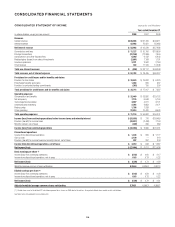

The following table shows the pension (benefit) expense and

contributions for Citigroup’s plans:

U.S. plans Non-U.S. plans

In millions of dollars 2008 2007 2006 2008 2007 2006

Pension (benefit) expense (1)(2) $(160) $179 $182 $205 $123 $115

Company

contributions (3) ———286 223 382

(1) The 2008 expense includes a $23 million curtailment loss for the U.S. plans and $22 million for the

non-U.S. plans recognized in the fourth quarter relating to the Company’s restructuring actions.

(2) The 2006 expense for the U.S. plans includes an $80 million curtailment gain recognized as of

September 30, 2006 relating to the Company’s decision to freeze benefit accruals for all cash-balance

participants after 2007.

(3) In addition, the Company absorbed $13 million, $15 million and $20 million during 2008, 2007 and

2006, respectively, relating to certain investment management fees and administration costs for the

U.S. plans, which are excluded from this table.

The following table shows the combined postretirement expense and

contributions for Citigroup’s U.S. and foreign plans:

U.S. and non-U.S. plans

In millions of dollars 2008 2007 2006

Postretirement expense (1) $115 $69 $ 71

Company contributions 103 72 260

(1) The 2008 expense includes a $6 million curtailment loss related to the Company’s fourth-quarter

restructuring actions.

Expected Rate of Return

Citigroup determines its assumptions for the expected rate of return on plan

assets for its U.S. pension and postretirement plans using a “building block”

approach, which focuses on ranges of anticipated rates of return for each

asset class. A weighted range of nominal rates is then determined based on

target allocations to each asset class. Citigroup considers the expected rate of

return to be a long-term assessment of return expectations and does not

anticipate changing this assumption annually unless there are significant

changes in investment strategy or economic conditions. This contrasts with

the selection of the discount rate, future compensation increase rate, and

certain other assumptions, which are reconsidered annually in accordance

with generally accepted accounting principles.

The expected rate of return for the U.S. pension and post-retirement plans

was 7.75% at December 31, 2008 and 8.0% at December 31, 2007 and 2006,

reflecting the performance of the global capital markets. Actual returns in

2008 were less than the expected returns, while actual returns in 2007 and

2006 were more than the expected returns. This expected amount reflects the

expected annual appreciation of the plan assets and reduces the annual

pension expense of the Company. It is deducted from the sum of service cost,

interest and other components of pension expense to arrive at the net

pension (benefit) expense. Net pension (benefit) expense for the U.S. pension

plans for 2008, 2007 and 2006 reflects deductions of $949, $889 million and

$845 million of expected returns, respectively.

106