Citibank 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

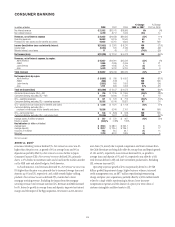

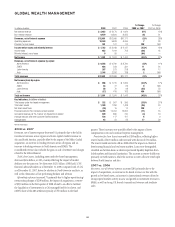

Total client assets, including assets under fee-based management,

increased $346 billion, or 24%, reflecting the inclusion of client assets from

the Nikko Cordial and Quilter acquisitions, as well as organic growth. Net

flows increased slightly compared to the prior year. Global Wealth

Management had 15,454 financial advisors/bankers as of December 31,

2007, compared with 13,694 as of December 31, 2006, driven by the Nikko

Cordial and Quilter acquisitions, as well as hiring in the Private Bank.

Operating expenses increased 23% primarily due to the impact of

acquisitions, higher variable compensation associated with the increase in

revenues, increased customer activity and charges related to headcount

reductions. Expense growth in 2007 was favorably affected by the absence of

the charge related to the initial adoption of SFAS 123(R) in the first quarter

of 2006.

Provision for loan losses increased $77 million in 2007, primarily driven

by portfolio growth and a reserve for specific non-performing loans in the

Private Bank.

Net income growth also reflected a $65 million APB 23 benefit in the

Private Bank in 2007 and the absence of a $47 million tax benefit resulting

from the resolution of 2006 Tax Audits.

OUTLOOK FOR 2009

During 2009, Citigroup’s businesses will continue to be negatively affected by

the levels of and volatility in the capital markets, the disruption in the

economic environment generally and credit costs, including the level of

interest rates, the credit environment and unemployment rates. See “Outlook

for 2009” on page 7 and “Risk Factors” on page 47.

As previously announced, the completion of the Morgan Stanley Smith

Barney joint venture is anticipated to occur in the third quarter of 2009. After

the expected completion of the joint venture transaction, which is subject to

and contingent upon regulatory approvals, a significant portion of the

earnings in the joint venture, of which Citigroup will share 49%, will be

derived from the profitability of the joint venture. Joint venture profitability

will be impacted by the ability of Smith Barney and Morgan Stanley to

execute the planned integration, as well as the overall market and economic

conditions, including further declines in client asset values.

In addition, Citigroup’s management and reporting realignment will

result in the restructuring of these businesses, effective for reporting purposes

in the second quarter of 2009, resulting in a focus on the Company’s core

assets within the businesses, such as the Private Bank, and continued efforts

to maximize the value of other assets, including Citi’s 49% stake in the

Morgan Stanley Smith Barney Joint Venture and the Company’s Nikko Asset

Management business.

37