Citibank 2008 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

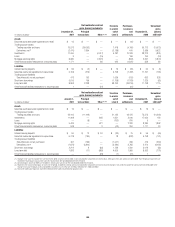

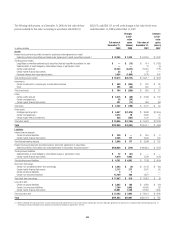

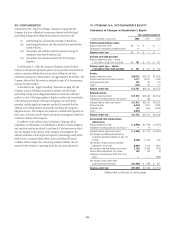

Maximum potential amount of future payments

Carrying value

(in millions)

In billions of dollars at December 31,

except carrying value in millions

Expire within

1 year

Expire after

1 year

Total amount

outstanding

2007 (2)

Financial standby letters of credit $ 43.5 $ 43.6 $ 87.1 $160.6

Performance guarantees 11.3 6.8 18.1 24.4

Derivative instruments considered to be guarantees 4.2 0.7 4.9 163.0

Loans sold with recourse — 0.5 0.5 45.5

Securities lending indemnifications (1) 153.4 — 153.4 —

Credit card merchant processing (1) 64.0 — 64.0 —

Custody indemnifications and other — 53.4 53.4 306.0

Total $276.4 $105.0 $381.4 $699.5

(1) The carrying values of guarantees of collections of contractual cash flows, securities lending indemnifications and credit card merchant processing are not material, as the Company has determined that the amount and

probability of potential liabilities arising from these guarantees are not significant.

(2) Reclassified to conform to the current period’s presentation.

Financial Standby Letters of Credit

Citigroup issues standby letters of credit which substitute its own credit for

that of the borrower. If a letter of credit is drawn down, the borrower is

obligated to repay Citigroup. Standby letters of credit protect a third party

from defaults on contractual obligations. Financial standby letters of credit

include guarantees of payment of insurance premiums and reinsurance risks

that support industrial revenue bond underwriting and settlement of

payment obligations to clearing houses, and also support options and

purchases of securities or are in lieu of escrow deposit accounts. Financial

standbys also backstop loans, credit facilities, promissory notes and trade

acceptances.

Performance Guarantees

Performance guarantees and letters of credit are issued to guarantee a

customer’s tender bid on a construction or systems-installation project or to

guarantee completion of such projects in accordance with contract terms.

They are also issued to support a customer’s obligation to supply specified

products, commodities, or maintenance or warranty services to a third party.

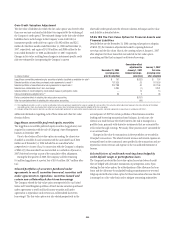

Derivative Instruments Considered to Be Guarantees

Derivatives are financial instruments whose cash flows are based on a

notional amount or an underlying instrument, where there is little or no

initial investment, and whose terms require or permit net settlement.

Derivatives may be used for a variety of reasons, including risk management,

or to enhance returns. Financial institutions often act as intermediaries for

their clients, helping clients reduce their risks. However, derivatives may also

be used to take a risk position.

The derivative instruments considered guarantees, which are presented in

the table above, include only those instruments that require Citi to make

payments to the counterparty based on changes in an underlying that is

related to an asset, a liability, or an equity security held by the guaranteed

party. More specifically, derivative instruments considered guarantees

include certain over-the-counter written put options where the counterparty

is not a bank, hedge fund or broker-dealer (such counterparties are

considered to be dealers in these markets, and may therefore not hold the

underlying instruments). However, credit derivatives sold by the Company

are excluded from this presentation, as they are disclosed separately within

this note below. In addition, non-credit derivative contracts that are cash

settled and for which the Company is unable to assert that it is probable the

counterparty held the underlying instrument at the inception of the contract

also are excluded from the disclosure above.

In instances where the Company’s maximum potential future payment is

unlimited, the notional amount of the contract is disclosed.

Guarantees of Collection of Contractual Cash Flows

Guarantees of collection of contractual cash flows protect investors in credit

card receivables securitization trusts from loss of interest relating to

insufficient collections on the underlying receivables in the trusts.

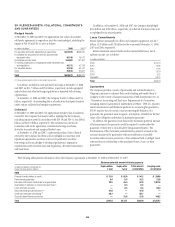

Loans Sold with Recourse

Loans sold with recourse represent the Company’s obligations to reimburse

the buyers for loan losses under certain circumstances. Recourse refers to the

clause in a sales agreement under which a lender will fully reimburse the

buyer/investor for any losses resulting from the purchased loans. This may

be accomplished by the seller’s taking back any loans that become

delinquent.

Securities Lending Indemnifications

Owners of securities frequently lend those securities for a fee to other parties

who may sell them short or deliver them to another party to satisfy some

other obligation. Banks may administer such securities lending programs for

their clients. Securities lending indemnifications are issued by the bank to

guarantee that a securities lending customer will be made whole in the event

that the security borrower does not return the security subject to the lending

agreement and collateral held is insufficient to cover the market value of the

security.

Credit Card Merchant Processing

Credit card merchant processing guarantees represent the Company’s

indirect obligations in connection with the processing of private label and

bankcard transactions on behalf of merchants.

Citigroup’s primary credit card business is the issuance of credit cards to

individuals. In addition, the Company provides transaction processing

services to various merchants with respect to bankcard and private-label

cards. In the event of a billing dispute with respect to a bankcard transaction

between a merchant and a cardholder that is ultimately resolved in the

cardholder’s favor, the third party holds the primary contingent liability to

credit or refund the amount to the cardholder and charge back the

transaction to the merchant. If the third party is unable to collect this

amount from the merchant, it bears the loss for the amount of the credit or

refund paid to the cardholder.

The Company continues to have the primary contingent liability with

respect to its portfolio of private-label merchants. The risk of loss is mitigated

as the cash flows between the third party or the Company and the merchant

are settled on a net basis and the third party or the Company has the right to

209