Citibank 2008 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

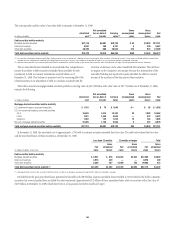

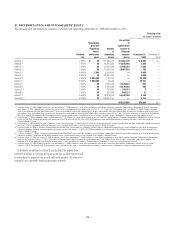

Management develops specific assumptions using as much market data

as possible and includes internal estimates as well as estimates published by

rating agencies and other third-party sources. If the models predict, given the

forward-looking assumptions, that it is not probable that a mortgage-backed

security will recover all principal and interest due, the Company records

other-than-temporary impairment in the Consolidated Statement of Income

equal to the entire decline in fair value of the mortgage-backed security.

Where a mortgage-backed security held as AFS is not deemed to be credit

impaired, management performs additional analysis to assess whether it has

the intent and ability to hold each security for a period of time sufficient for a

forecasted recovery of fair value. In most cases, management has asserted

that it has the intent and ability to hold investments for the forecasted

recovery period, which in some cases may be the security’s maturity date.

Where such an assertion has not been made, the securities’ decline in fair

value is deemed to be other-than-temporary and is recorded in earnings.

Management has asserted significant holding periods for mortgage-backed

securities that in certain cases now approach the maturity of the securities.

The weighted-average estimated life of the securities is currently

approximately 7 years for U.S. mortgage-backed securities. The estimated life

of the securities may change depending on future performance of the

underlying loans, including prepayment activity and experienced credit

losses.

In addition, because of the market disruption that occurred late in the

third quarter of 2008 for state and municipal debt securities, the analysis

regarding these potential impairments have also been refined.

As a result of these analyses, during 2008 the Company recorded

approximately $2.8 billion of pretax losses for other-than-temporary

impairments, $337 million of which was recorded on held-to-maturity

investments after they had been reclassified.

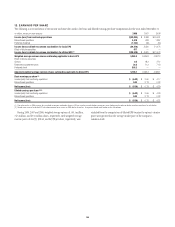

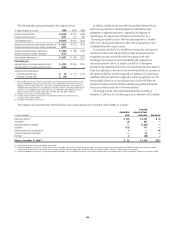

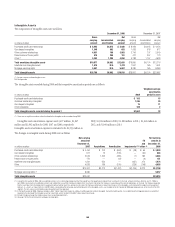

17. LOANS

In millions of dollars at year end 2008 2007 (3)

Consumer

In U.S. offices

Mortgage and real estate (1) $229,565 $251,927

Installment, revolving credit and other 130,826 140,797

Lease financing 31 3,151

$360,422 $395,875

In offices outside the U.S.

Mortgage and real estate (1) $ 48,277 $ 55,152

Installment, revolving credit and other 109,932 139,369

Lease financing 304 1,124

$158,513 $195,645

Total consumer loans $518,935 $591,520

Net unearned income $ 738 $ 787

Consumer loans, net of unearned income $519,673 $592,307

Corporate

In U.S. offices

Commercial and industrial (2) $ 33,450 $ 30,092

Loans to financial institutions 10,200 8,778

Lease financing 1,476 1,630

Mortgage and real estate (1) 6,560 2,220

$ 51,686 $ 42,720

In offices outside the U.S.

Commercial and industrial $ 99,389 $116,145

Mortgage and real estate (1) 7,480 4,156

Loans to financial institutions 18,413 20,467

Lease financing 1,850 2,292

Governments and official institutions 385 442

$127,517 $143,502

Total corporate loans $179,203 $186,222

Net unearned income(4) (4,660) (536)

Corporate loans, net of unearned income $174,543 $185,686

(1) Loans secured primarily by real estate.

(2) Includes loans not otherwise separately categorized.

(3) Reclassified to conform to current year’s presentation.

(4) Increase in unearned income in 2008 relates to the transfer of loans from the held-for-sale category to

the held-for-investment category at a discount to par.

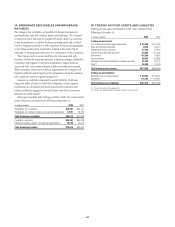

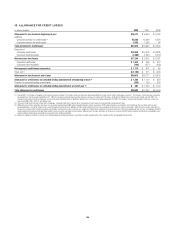

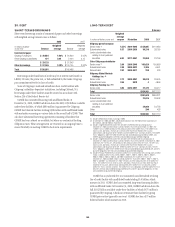

Included in the previous loan table are lending products whose terms

may give rise to additional credit issues. Credit cards with below-market

introductory interest rates, multiple loans supported by the same collateral

(e.g., home equity loans), or interest-only loans are examples of such

products. However, these products are not material to Citigroup’s financial

position and are closely managed via credit controls that mitigate their

additional inherent risk.

Impaired loans are those which Citigroup believes it is probable that it

will not collect all amounts due according to the original contractual terms

of the loan. Impaired loans include smaller-balance homogeneous loans

whose terms have been modified due to the borrower’s financial difficulties

and Citigroup granted a concession to the borrower. Such modifications may

include interest rate reductions for other than a temporary period, principal

forgiveness and/or term extensions. Valuation allowances for these loans are

estimated considering all available evidence including, as appropriate, the

present value of the expected future cash flows discounted at the loan’s

original contractual effective rate, the secondary market value of the loan

and the fair value of collateral less disposal costs. This excludes smaller-

balance homogeneous loans that have not been modified and are carried on

a non-accrual basis.

163