Citibank 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

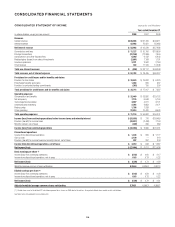

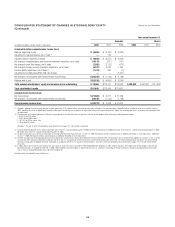

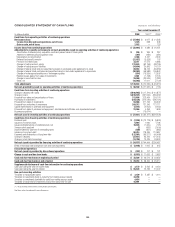

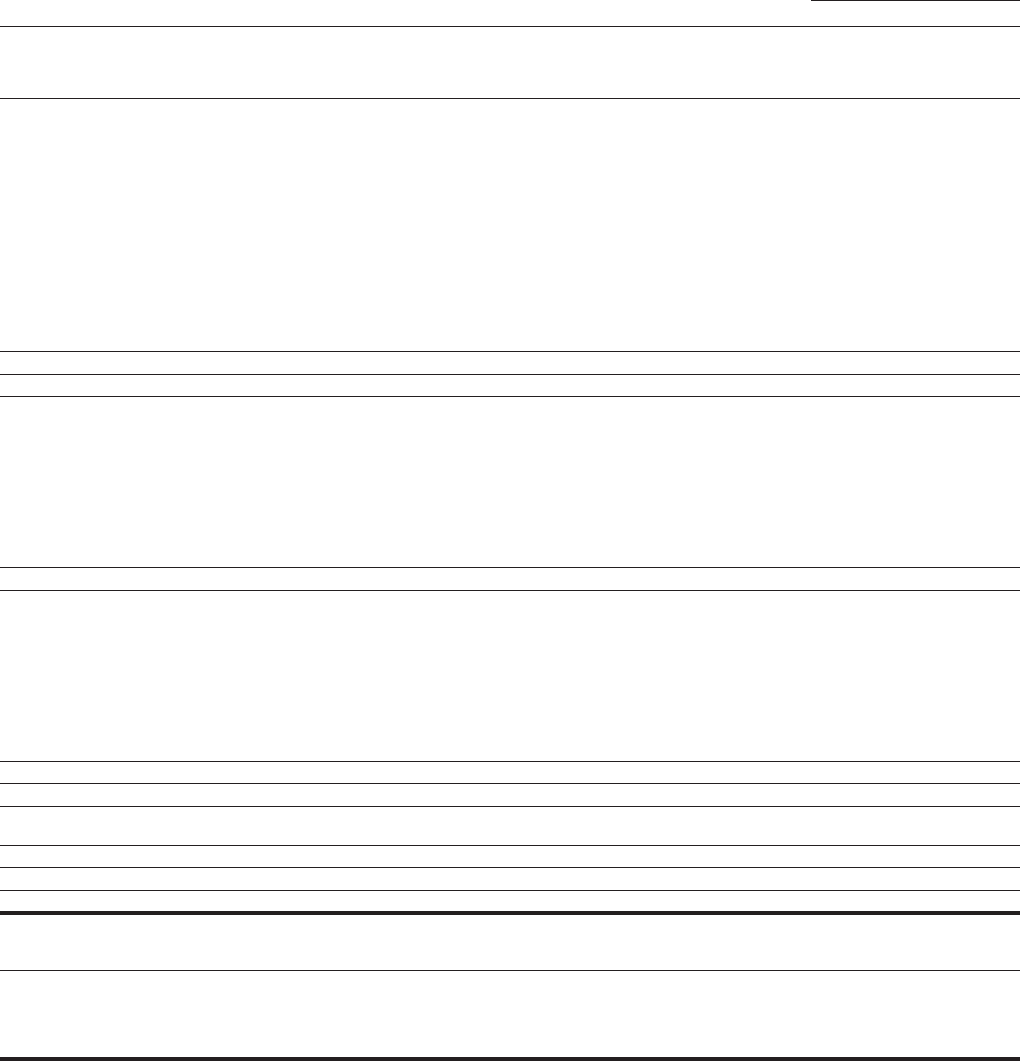

CONSOLIDATED STATEMENT OF CASH FLOWS Citigroup Inc. and Subsidiaries

Year ended December 31

In millions of dollars 2008 2007 (1) 2006 (1)

Cash flows from operating activities of continuing operations

Net income (loss) $ (27,684) $ 3,617 $ 21,538

Income from discontinued operations, net of taxes 1,478 628 948

Gain on sale, net of taxes 2,932 — 139

Income (loss) from continuing operations $ (32,094) $ 2,989 $ 20,451

Adjustments to reconcile net income to net cash provided by (used in) operating activities of continuing operations

Amortization of deferred policy acquisition costs and present value of future profits $ 206 $ 369 $ 287

Additions to deferred policy acquisition costs (397) (482) (381)

Depreciation and amortization 2,466 2,421 2,503

Deferred tax (benefit) provision (21,027) (3,928) 102

Provision for credit losses 33,311 17,574 6,988

Change in trading account assets 123,845 (62,798) (98,105)

Change in trading account liabilities (14,604) 20,893 24,779

Change in federal funds sold and securities borrowed or purchased under agreements to resell 89,933 38,143 (65,353)

Change in federal funds purchased and securities loaned or sold under agreements to repurchase (98,950) (56,983) 106,843

Change in brokerage receivables net of brokerage payables (954) (15,529) 12,503

Realized losses (gains) from sales of investments 2,061 (1,168) (1,791)

Change in loans held-for-sale 29,009 (30,649) (1,282)

Other, net (16,265) 17,611 (7,709)

Total adjustments $ 128,634 $ (74,526) $ (20,616)

Net cash provided by (used in) operating activities of continuing operations $ 96,540 $ (71,537) $ (165)

Cash flows from investing activities of continuing operations

Change in deposits with banks $(100,965) $ (17,216) $ (10,877)

Change in loans $(270,521) (361,934) (356,062)

Proceeds from sales and securitizations of loans 313,808 273,464 253,176

Purchases of investments (344,336) (274,426) (296,124)

Proceeds from sales of investments 93,666 211,753 86,999

Proceeds from maturities of investments 209,312 121,346 121,111

Capital expenditures on premises and equipment (2,541) (4,003) (4,035)

Proceeds from sales of premises and equipment, subsidiaries and affiliates, and repossessed assets 23,966 4,253 1,606

Business acquisitions —(15,614) —

Net cash used in investing activities of continuing operations $ (77,611) $ (62,377) $(204,206)

Cash flows from financing activities of continuing operations

Dividends paid $ (7,526) $ (10,778) $ (9,826)

Issuance of common stock 6,864 1,060 1,798

Issuances (Redemptions) of preferred stock, net 70,626 (1,000) (125)

Treasury stock acquired (7) (663) (7,000)

Stock tendered for payment of withholding taxes (400) (951) (685)

Issuance of long-term debt 90,414 118,496 113,687

Payments and redemptions of long-term debt (132,901) (65,517) (46,468)

Change in deposits (37,811) 93,422 121,203

Change in short-term borrowings (13,796) 10,425 33,903

Net cash (used in) provided by financing activities of continuing operations $ (24,537) $ 144,494 $ 206,487

Effect of exchange rate changes on cash and cash equivalents $ (2,948) $ 1,005 $ 645

Discontinued operations

Net cash (used in) provided by discontinued operations $ (397) $ 107 $ 121

Change in cash and due from banks $ (8,953) $ 11,692 $ 2,882

Cash and due from banks at beginning of period $ 38,206 $ 26,514 $ 23,632

Cash and due from banks at end of period $ 29,253 $ 38,206 $ 26,514

Supplemental disclosure of cash flow information for continuing operations

Cash paid during the year for income taxes $ 3,170 $ 5,923 $ 9,230

Cash paid during the year for interest $ 55,678 72,732 51,472

Non-cash investing activities

Transfers to repossessed assets $ 3,439 $ 2,287 $ 1,414

Transfers to investments (held-to-maturity) from trading account assets 33,258 ——

Transfers to investments (available-for-sale) from trading account assets 4,654 ——

Transfers to loans held for investment (loans) from loans held-for-sale 15,891 ——

(1) Reclassified to conform to the current period’s presentation.

See Notes to the Consolidated Financial Statements.

120