Citibank 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITI

ANNUAL REPORT

2008

Table of contents

-

Page 1

CITI ANNUAL REPORT 2008 -

Page 2

-

Page 3

... designed to address issues of confidence. Statements of support by the U.S. Treasury and other regulators have reinforced this effort. The exchange offer we announced in February 2009 was structured to result in the conversion of a portion of the U.S. government's preferred stock investment under... -

Page 4

... mark-to-market losses on assets in our Securities and Banking business. In addition, like all major banks, we are experiencing elevated credit losses as our customers struggle to repay loans. As credit quality deteriorated, we added to loan loss reserves. Our 2008 results reflect a net build of $14... -

Page 5

... financial services firm than Citicorp. Citi Holdings includes some great businesses that have strong market positions but are not central to our core operating strategy. Citi Holdings is made up of brokerage and asset management; consumer finance, mortgage loans, and private label credit cards; and... -

Page 6

... and international in outlook; innovation to help people and companies work more collaboratively across multiple networks and time zones; innovation to facilitate new ways of thinking about money and the role it plays in everyday life and business. Third, we will remain determined to build a culture... -

Page 7

...Revenue on Loans 56 Loan Maturities and Fixed/Variable Pricing 57 Consumer Credit Risk 57 Consumer Portfolio Review 57 Corporate Credit Risk 65 Global Corporate Portfolio Review 67 Exposure to U.S. Real Estate in Securities and Banking 68 Market Risk Management Process 72 Operational Risk Management... -

Page 8

...to purchase common stock to the U.S. Department of the Treasury, (ii) entering into a loss-sharing agreement with various U.S. government entities covering $301 billion of Company assets, and (iii) issuing $5.75 billion of senior unsecured debt guaranteed by the Federal Deposit Insurance Corporation... -

Page 9

...- Investment banking - Debt and equity markets - Lending - Private equity - Hedge funds - Real estate - Structured products - Managed futures • Transaction Services - Cash management - Trade services - Custody and fund services - Clearing services - Agency/trust services • Citigroup Investment... -

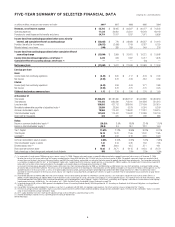

Page 10

...) from continuing operations Net income Dividends declared per common share At December 31 Total assets Total deposits Long-term debt Mandatorily redeemable securities of subsidiary trusts (4) Common stockholders' equity Total stockholders' equity Direct staff (in thousands) Ratios: Return on common... -

Page 11

..." within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those included in these statements due to a variety of... -

Page 12

... the fourth quarter of 2008. The allowance for loan losses totaled $29.6 billion at December 31, 2008, a coverage ratio of 4.27% of total loans. The effective tax rate (benefit) of (39)% in 2008 primarily resulted from the pretax losses in the Company's Securities and Banking business taxed in the... -

Page 13

...will require regulatory approvals and the resolution of tax and other issues. Citigroup has, however, managed the Company consistent with this structure since February 2009 and management reporting will reflect this structure starting with the second quarter of 2009. Citicorp Citicorp, a global bank... -

Page 14

... costs are expected to increase during 2009. • As we go into the first half of 2009, we expect NCLs for our consumer portfolios could be $1 billion to $2 billion higher each quarter when compared to the NCLs in the third quarter of 2008. At this time we believe that we will be at the higher end... -

Page 15

... Government Loss-Sharing Agreement On January 15, 2009, Citigroup entered into a definitive agreement providing for loss sharing by the UST, FDIC and the Federal Reserve Bank of New York on a $301 billion portfolio of Citigroup assets (valued as of November 21, 2008). In consideration for this loss... -

Page 16

... Revenue Marks (in millions) 2008 Sub-prime related direct exposures (2) Monoline insurers Credit Valuation Adjustment (CVA) Highly leveraged loans and financing commitments (3) Alt-A mortgage securities (4) Auction Rate Securities (ARS) (5) Commercial Real Estate (CRE) (6) Structured Investment... -

Page 17

... and second mortgages, unsecured personal loans, credit cards and auto loans. Reserves also increased due to trends in the U.S. macroeconomic environment, including the housing market downturn and rising unemployment rates. The $2.6 billion build in regions outside of North America was primarily... -

Page 18

... and support its brand and products through ownership of its many Diners Club card issuers around the world. Sale of CitiStreet On July 1, 2008, Citigroup and State Street Corporation completed the sale of CitiStreet, a benefits servicing business, to ING Group in an all-cash transaction valued at... -

Page 19

... Citi has a service contract with Wipro Limited. This transaction closed on January 20, 2009 and a loss of approximately $7 million was booked at that time. Sale of Citi's Nikko Citi Trust and Banking Corporation Citigroup has executed a definitive agreement to sell all of the shares of Nikko Citi... -

Page 20

...During the fourth quarter of 2008, Citigroup performed an impairment analysis of Japan's Nikko Asset Management fund contracts which represent the rights to manage and collect fees on investor assets and are accounted for as indefinite-lived intangible assets. As a result, an impairment loss of $937... -

Page 21

...Company's effective tax rate. STRUCTURED INVESTMENT VEHICLES (SIVs) In 2007, the Company completed its acquisition of BISYS Group, Inc. (BISYS) for $1.47 billion in cash. Citigroup completed the sale of the Retirement and Insurance Services Divisions of BISYS, making the net cost of the transaction... -

Page 22

... North America Consumer Banking business. In 2007, Citigroup completed its purchase of a 20% equity interest in Akbank, the second-largest privately owned bank by assets in Turkey for approximately $3.1 billion. This investment is accounted for using the equity method of accounting. Sabanci Holding... -

Page 23

... first quarter earnings within the S&B business. SFAS 157 also precludes the use of block discounts for instruments traded in an active market, which were previously applied to large holdings of publicly traded equity securities, and requires the recognition of trade-date gains related to certain... -

Page 24

...to manage liquidity needs and interest rate risks, and for proprietary trading and private equity investing. Substantially all of these assets and liabilities are reflected at fair value on the Company's balance sheet. In addition, certain loans, short-term borrowings, long-term debt and deposits as... -

Page 25

...Citigroup's Loan Loss Reserve Policies, as approved by the Audit and Risk Management Committee of the Company's Board of Directors. The Company's Chief Risk Officer and Chief Financial Officer review the adequacy of the credit loss reserves each quarter with representatives from the Risk and Finance... -

Page 26

...1.7 $179.0 Riskweighted assets $88.9 - 2.1 3.5 1.9 0.8 1.7 $98.9 In billions of dollars Credit cards Commercial paper conduits Private label consumer mortgages Student loans Muni bonds Mutual fund deferred sales commission securitization Investment funds Total The FASB has issued an exposure draft... -

Page 27

... fair value approach. The ten new reporting units, which remain unchanged at December 31, 2008, are Securities and Banking, Global Transaction Services, International Wealth Management, N.A. Wealth Management, North America Consumer Banking, N.A. Cards, EMEA Consumer Banking, Latin America Consumer... -

Page 28

... individual reporting unit fair values, include the increased possibility of further government intervention, unprecedented levels of volatility in stock price and short-selling. In addition, the market capitalization of Citigroup reflects the execution risk in a transaction involving Citigroup due... -

Page 29

... due to further decreases in market conditions. Based upon the foregoing discussion, as well as tax planning opportunities and other factors discussed below, the U.S. and New York State and City net operating loss carryforward period of 20 years provides enough time to utilize the DTAs pertaining... -

Page 30

... accounting requirements based upon the probability and estimability of losses. The Company reviews outstanding claims with internal counsel, as well as external counsel when appropriate, to assess probability and estimates of loss. The risk of loss is reassessed as new information becomes available... -

Page 31

...) (954) Institutional Clients Group (ICG) North America EMEA Latin America Asia Total ICG Global Wealth Management (GWM) North America EMEA Latin America Asia Total GWM $ 1,091 $ Corporate/Other Income (loss) from continuing operations Income from discontinued operations Net income (loss) NM Not... -

Page 32

...65)% 43% NM NM NM % Change 2007 vs. 2006 (30)% (81) NM NM 98 17 NM 92% NM NM NM 45 NM NM 89% (34) 47 43 59 50 28% 56% (21) 46 42 55 NM 31% NM (85)% (42) (83)% North America Global Cards Consumer Banking ICG Securities and Banking Transaction Services GWM Total North America $(29,035) $ (117) (606... -

Page 33

... (9)% Global Cards North America EMEA Latin America Asia Total Global Cards Consumer Banking North America EMEA Latin America Asia Total Consumer Banking ICG North America EMEA Latin America Asia Total ICG GWM North America EMEA Latin America Asia Total GWM Corporate/Other Total net revenues NM... -

Page 34

... and Banking Transaction Services GWM Total EMEA Latin America Global Cards Consumer Banking ICG Securities and Banking Transaction Services GWM Total Latin America Asia Global Cards Consumer Banking ICG Securities and Banking Transaction Services GWM Total Asia Corporate/Other Total net revenue... -

Page 35

..., by region: North America EMEA Latin America Asia Total revenues Net income (loss) by region: North America EMEA Latin America Asia Total net income Average assets (in billions of dollars) Return on assets Key indicators (in billions of dollars) Average loans Purchase sales Open accounts NM Not... -

Page 36

... rate at which delinquent customers advanced to write-off. A net charge to increase loan loss reserves related to an increase in reported receivables as maturing securitizations resulted in on-balance sheet funding, and also higher business volumes. Outside of North America, credit costs increased... -

Page 37

... due to a 27% decline in investment sales and a loss from the mark-to-market on the MSR asset and related hedge in North America. In North America, total revenues decreased 2%. Net interest revenue was 9% higher than the prior year, primarily due to increased average loans and deposits, up 3% and... -

Page 38

... from the sale of upstate New York branches in the prior-year period. In EMEA, revenues increased by 21% to $2.5 billion, driven by strong growth in average loans and deposits and improved net interest margin and the impact of the Egg 32 acquisition. Revenues in Latin America increased 12% versus... -

Page 39

... finance businesses. The Company also anticipates deploying TARP funds received from the U.S. government by making mortgage loans directly to homebuyers and supporting the housing market through the purchase of prime residential mortgages and mortgage-backed securities in the secondary market... -

Page 40

... Latin America Asia Total net income (loss) Net income (loss) by product: Securities and Banking Transaction Services Total net income (loss) NM Not meaningful. 2008 vs. 2007 Revenues, net of interest expense were negative due to substantial losses related to the fixed income and credit markets... -

Page 41

... to increase loan loss and unfunded lending commitment reserves reflecting a slight weakening in overall portfolio credit quality, as well as loan loss reserves for specific counterparties. Subprime-related loans accounted for 35 During 2009, the Company's Securities and Banking businesses will... -

Page 42

..., an increase in lending revenues across all regions and an increase in banking revenues in North America and EMEA. The consolidated revenue also includes the gain on sale of CitiStreet and charges related to the ARS settlement. Total client assets, including assets under fee-based management... -

Page 43

... planned integration, as well as the overall market and economic conditions, including further declines in client asset values. In addition, Citigroup's management and reporting realignment will result in the restructuring of these businesses, effective for reporting purposes in the second quarter... -

Page 44

... tax benefits increased due to a higher pretax loss in 2007, offset by a prior-year tax reserve release of $69 million relating to the resolution of the 2006 Tax Audits. Discontinued operations represent the operations in the Sale of the Asset Management Business and the Sale of the Life Insurance... -

Page 45

...to an increase in the cost of funding driven by a shift to higher cost Direct Bank and time deposits. Non-interest revenue increased 10%, mainly due to the impact of the acquisition of ABN AMRO in the first quarter of 2007, higher gains on sales of mortgage loans and growth in net servicing revenues... -

Page 46

...-downs on subprime-related exposures in the first quarter of 2008 and in commercial real estate positions and highly leveraged finance commitments. Revenues also reflected strong results in local markets sales and trading and G10 Rates and Currencies. Transaction Services revenues increased 21% to... -

Page 47

...banking operation in January 2008. S&B revenue decreased 22% due to write-downs and losses related to fixed income and equities. Transaction Services revenues increased 24%, mainly from the custody business as average deposits grew rapidly in the second half of 2007 and have remained at those levels... -

Page 48

... revenue increased 16%. Global Cards growth of 13% was driven by 12% growth in purchase sales and 18% growth in average loans. Consumer Banking, excluding Consumer Finance Japan (CFJ), grew by 10%, driven by growth of 6% in average loans and 4% growth in deposits. Transaction Services exhibited... -

Page 49

... by foreign exchange, acquisitions and portfolio purchases. Non-interest revenue increased 66% as S&B benefited from favorable market conditions. Outside of S&B, non-interest revenue increased 69% due to the $245 million gain on Visa shares in 2007 and Investment Sales in Consumer Banking and... -

Page 50

..., the FDIC increased the insurance it provides on U.S. deposits in most banks and savings associations located in the United States, including Citibank, N.A., from $100,000 to $250,000 per depositor, per insured bank. U.S. Government Loss-Sharing Agreement On January 15, 2009, Citigroup entered into... -

Page 51

... 21, 2008. Exchange Offer and U.S. Government Exchange On February 27, 2009, the Company announced an exchange offer of its common stock for up to $27.5 billion of its existing preferred securities and trust preferred securities at a conversion price of $3.25 per share. The U.S. government will... -

Page 52

... student loans through the Federal Family Education Loan Program. • Credit card lending-$5.8 billion - Citigroup is offering special credit card programs that include expanded eligibility for balance-consolidation offers, targeted increases in credit lines and targeted new account originations... -

Page 53

...businesses, capital, liquidity or other financial condition and results of operations, access to credit and the trading price of Citigroup common stock, preferred stock or debt securities. Market disruptions may increase the risk of customer or counterparty delinquency or default. The current market... -

Page 54

... has increased the Company's equity and the number of actual and diluted shares of Citigroup common stock. On February 27, 2009, Citigroup announced an exchange offer of its common stock for up to $27.5 billion of its existing preferred securities and trust preferred securities. The U.S. government... -

Page 55

... in the fair value of the positions, as well as the loss of revenues associated with selling such securities or loans. In addition, the Company routinely executes a high volume of transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks and... -

Page 56

... has become increasingly challenging. Citigroup's financial, account, data processing or other operating systems and facilities may fail to operate properly or become disabled as a result of events that are wholly or partially beyond the Company's control, such as a spike in transaction volume or... -

Page 57

... stress tests were implemented across Citi for mark-to-market, available-for-sale, and accrual portfolios. These firm-wide stress reports measure the potential impact to the Company and its component businesses of very large changes in various types of key risk factors (e.g., interest rates, credit... -

Page 58

... RISK MANAGEMENT PROCESS Credit risk is the potential for financial loss resulting from the failure of a borrower or counterparty to honor its financial or contractual obligations. Credit risk arises in many of Citigroup's business activities, including lending; sales and trading; derivatives... -

Page 59

... dollars at year end 2008 2007 (2) 2006 (2) 2005 (2) 2004 (2) Consumer loans In U.S. offices: Mortgage and real estate (1) Installment, revolving credit, and other Lease financing In offices outside the U.S.: Mortgage and real estate (1) Installment, revolving credit, and other Lease financing... -

Page 60

...6,233 Allowance for loan losses at beginning of year Provision for loan losses Consumer Corporate Gross credit losses Consumer (1) In U.S. offices In offices outside the U.S. Corporate Mortgage and real estate In U.S. offices In offices outside the U.S. Governments and official institutions outside... -

Page 61

... OREO North America EMEA Latin America Asia $1,013 67 15 2 $1,097 Other repossessed assets(4) $ 78 (1) Excludes purchased distressed loans as they are accreting interest in accordance with Statement of Position 03-3, "Accounting for Certain Loans on Debt Securities Acquired in a Transfer" (SOP... -

Page 62

... represents the Company's view of non-performing assets. As a general rule, consumer loans are charged off at 120 days past due and credit card loans are charged off at 180 days contractually past due. Consumer loans secured with non-real-estate collateral are written down to the estimated value... -

Page 63

...Global Cards and Consumer Banking Credit Policy, approving business-specific policies and procedures, monitoring business risk management performance, providing ongoing assessment of portfolio credit risk, ensuring the appropriate level of loan loss reserves, and approving new products and new risks... -

Page 64

...98% Global Cards North America Ratio EMEA Ratio Latin America Ratio Asia Ratio Consumer Banking North America Ratio EMEA Ratio Latin America Ratio Asia Ratio GWM Ratio On-balance-sheet loans (2) Ratio Securitized receivables (all in NA Cards) Credit card receivables held-for-sale (3) Managed loans... -

Page 65

...Global Wealth Management. The build of $8.216 billion in North America primarily reflected an increase in the estimate of losses across all portfolios based on weakening leading credit indicators, including increased delinquencies on first and second mortgages, unsecured personal loans, credit cards... -

Page 66

... and interest rate risks. To manage credit and liquidity risk, Citigroup sells most of the mortgage loans it originates, but retains the servicing rights. These sale transactions create an intangible asset referred to as mortgage servicing rights (MSRs). The fair value of this asset is primarily... -

Page 67

... segment has a year-end delinquency rate almost twice as high as the rate for the overall second mortgage portfolio. Net credit losses have also increased significantly. First mortgages' net credit losses as a percentage of average loans increased by close to 4.5 times since the end of 2007, while... -

Page 68

...4Q08 Note: Portfolio comprised of the U.S. Consumer Lending and U.S. Retail Distribution (Citibank) first mortgage portfolios and the U.S. Retail Distribution (CitiFinancial) Real Estate portfolio. It includes deferred fees/costs and loans held for sale. 4Q'07 NCL ratio based on average balances of... -

Page 69

...$22.4 Note: Data at origination. $134 billion portfolio excludes Canada and Puerto Rico, First Collateral Services (commercial portfolio), deferred fees/costs, loans held-for-sale and loans sold with recourse. Excluding Government insured loans, 90+DPD for the first mortgage portfolio is 5.13%. As... -

Page 70

... Services (commercial portfolio), deferred fees/costs, loans held for sale and loans sold with recourse. Excluding Government insured loans, 90+DPD for the first mortgage portfolio is 5.13%. Second Mortgages: December 31, 2008 VINTAGES (in billions of dollars) SECOND MORTGAGES VINTAGE % TOTAL... -

Page 71

...lend, letters of credit and financial guarantees. Corporate Credit Portfolio At December 31, 2008 The maintenance of accurate and consistent risk ratings across the corporate credit portfolio facilitates the comparison of credit exposure across all lines of business, geographic regions and products... -

Page 72

...outright asset sales. The purpose of these transactions is to transfer credit risk to third parties. The results of the mark-to-market and any realized gains or losses on credit derivatives are reflected in the Principal transactions line on the Consolidated Statement of Income. At December 31, 2008... -

Page 73

... North America EMEA Latin America Asia Total corporate non-accrual loans (1) Net credit losses (recoveries) Securities and Banking Transaction Services Corporate/Other Total net credit losses (recoveries) Corporate allowance for loan losses Corporate allowance for credit losses on unfunded lending... -

Page 74

... loan portfolios, the Company estimates the prepayments, defaults and loss severities based on a number of macroeconomic factors, including housing price changes, unemployment rates, interest rates, and borrower and loan attributes, such as age, credit scores, documentation status, loan-to-value... -

Page 75

... of which are securities backed by commercial real estate carried at fair value as available-for-sale investments. Changes in fair value for these trading account assets are reported in current earnings, while changes in fair value for these available-for-sale investments are reported in OCI with... -

Page 76

...Ambac Trading assets-non-subprime Subtotal trading assets Total gross fair-value direct exposure Credit valuation adjustment Total net fair-value direct exposure The fair-value exposure, net of payable and receivable positions, represents the market value of the contract as of December 31, 2008 and... -

Page 77

... cash margin received and the existing margin requirements on the total return swaps and the substantive subordinate investments made by third parties, the Company believes that the transactions largely mitigate the Company's risk related to these transferred loans. Highly leveraged financing... -

Page 78

... section on page 94. Price risk is the earnings risk from changes in interest rates, foreign exchange rates, and equity and commodity prices, and in their implied volatilities. Price risk arises in non-trading portfolios, as well as in trading portfolios. Market risks are measured in accordance with... -

Page 79

...-point change in interest rates. Citigroup's independent market risk management ensures that factor sensitivities are calculated, monitored and, in most cases, limited, for all relevant risks taken in a trading portfolio. VAR estimates the potential decline in the value of a position or a portfolio... -

Page 80

... change in the market value of its transactions. Back-testing is conducted to confirm that the daily market value losses in excess of a 99% confidence level occur, on average, only 1% of the time. The VAR calculation for the hypothetical test portfolios, with different degrees of risk concentration... -

Page 81

...to Citigroup in the trading portfolios as of December 31, 2008 and 2007, including the total VAR, the specific riskonly component of VAR, and total-general market factors only, along with the yearly averages: In millions of dollars The specific risk-only component represents the level of equity and... -

Page 82

... to address emerging threats to customers' information. The Corporate Office of Business Continuity, with the support of Senior Management, continues to coordinate global preparedness and mitigate business continuity risks by reviewing and testing recovery procedures. The operational risk standards... -

Page 83

... exceed 0.75% of total Citigroup assets: December 31, 2008 Cross-border claims on third parties Investments in and funding of local franchises December 31, 2007 In billions of dollars U.S. Banks Public Private Total Trading and short-term claims (1) Total cross-border outstandings... -

Page 84

... agreements to resell Investments Other assets Total assets Liabilities Deposits Federal funds purchased and securities loaned or sold under agreements to repurchase Short-term borrowings and long-term debt Trading account liabilities Other liabilities Total liabilities Stockholders' equity Total... -

Page 85

...Non-marketable equity securities carried at cost primarily include equity shares issued by the Federal Reserve Bank and the Federal Home Loan Bank that the Company is required to hold. Investment securities classified as available-for-sale are primarily carried at fair value with the changes in fair... -

Page 86

... the sale of the German retail banking units; and • lower international deposits, mostly driven by FX and the higher funding costs which led to customers using their excess cash reserves deposited with Citi. Average deposits increased $5 billion to $695 billion in 2008, yielding an average rate of... -

Page 87

... assets Other assets Total assets Liabilities and equity: Total deposits Federal funds purchased and securities loaned or sold under agreements to repurchase Brokerage payables Trading account liabilities Short-term borrowings Long-term debt Other liabilities Net inter-segment funding (lending... -

Page 88

... deposits and borrowing money and then lending or investing those funds. Net interest margin is calculated by dividing gross interest revenue less gross interest expense by average interest earning assets. Net interest margin improved during 2008, mainly due to the lower cost of funds, reflecting... -

Page 89

... % Average rate 2007 2006 6.26% 2008 $ 78,788 $ 2007 54,840 $ 2006 Assets Deposits with banks (5) 35,770 $ 3,119 3.96% 5.68% Federal funds sold and securities borrowed or purchased under agreements to resell (6) In U.S. offices $ 164,732 In offices outside the U.S. (5) 77,324 Total Trading... -

Page 90

.... Detailed average volume, interest revenue and interest expense exclude discontinued operations. See Note 3 to the Consolidated Financial Statements on page 136. Savings deposits consist of Insured Money Market accounts, NOW accounts, and other savings deposits. Average rates reflect prevailing... -

Page 91

... Average rate $ (226) $ Net change 873 Deposits with banks (4) Federal funds sold and securities borrowed or purchased under agreements to resell In U.S. offices In offices outside the U.S. (4) Total Trading account assets In U.S. offices In offices outside the U.S. (4) Total Investments (1) In... -

Page 92

... Average rate $ 670 1,690 $2,360 Net change $ 1,603 5,463 $ 7,066 Deposits In U.S. offices In offices outside the U.S. (4) Total Federal funds purchased and securities loaned or sold under agreements to repurchase In U.S. offices In offices outside the U.S. (4) Total Trading account liabilities... -

Page 93

...Citigroup's acting as a market maker. At the date of acquisition, most of these positions were liquid and the Company expected active and frequent buying and selling with the objective of generating profits on short-term differences in price. However, subsequent declines in value of these securities... -

Page 94

... Total debt securities reclassified to held-to-maturity investments Debt and equity securities reclassified from Trading account assets to available-for-sale investments $33,258 27,005 $60,263 $ 4,654 In millions of dollars Amortized cost(1) Carrying value at December 31, 2008(2) Fair value... -

Page 95

...sheet at the amortized cost of the loan, adjusted by the allowance for loan losses. Loans that the Company intends to sell should be classified as held for sale (HFS) and reported at the lower of cost or fair value. During the fourth quarter of 2008, Citigroup made a number of transfers from the HFS... -

Page 96

... Written options Purchased options Total equity contract notionals Commodity and other contracts Swaps Futures and forwards Written options Purchased options Total commodity and other contract notionals Credit derivatives (4) Citigroup as the Guarantor: Credit default swaps Total return swaps Credit... -

Page 97

...148 Trading derivatives (2) Interest rate contracts Foreign exchange contracts Equity contracts Commodity and other contracts Credit derivatives: (4) Citigroup as the Guarantor Citigroup as the Beneficiary Cash collateral paid/received (3) Total Less: Netting agreements and market value adjustments... -

Page 98

.... The Company uses credit derivatives to help mitigate credit risk in its corporate loan portfolio and other cash positions, to take proprietary trading positions, and to facilitate client transactions. Credit derivatives generally require that the seller of credit protection make payments to the... -

Page 99

...of any netting agreements, cash collateral, and market or credit value adjustments. The Company actively participates in trading a variety of credit derivatives products as both an active two-way market-maker for clients and to manage credit risk. During 2008, Citigroup decreased its trading volumes... -

Page 100

...; determining appropriate asset levels and return hurdles for Citigroup and individual businesses; reviewing the funding and capital markets plan for Citigroup; and monitoring interest-rate risk, corporate and bank liquidity, the impact of currency translation on non-U.S. earnings and capital... -

Page 101

... 44. The Company is currently in ongoing discussions with the Federal Reserve Board regarding an increase to the Company's risk-weighted assets resulting from certain liquidity-facility transactions relating to the Company's primary credit card securitization trusts. This increase in riskweighted... -

Page 102

... 31, 2007. In 2008, Citigroup did not issue any new enhanced trust preferred securities. The FRB issued a final rule, with an effective date of April 11, 2005, which retains trust preferred securities in Tier 1 Capital of bank holding companies, but with stricter quantitative limits and clearer... -

Page 103

... of Citigroup Global Markets Holdings Inc. (CGMHI)-are subject to various securities and commodities regulations and capital adequacy requirements of the regulatory and exchange authorities of the countries in which they operate. Specifically, the Company's U.S.-registered broker-dealer subsidiaries... -

Page 104

...student loans, auto loans, credit card loans and loans guaranteed by the Small Business Administration (SBA). An expansion of this program, announced in February 2009, could broaden the eligible collateral to encompass other types of newly issued AAA-rated asset-backed securities, such as commercial... -

Page 105

... medium-term notes, trust preferred securities, and preferred and common stock; and (ii) Citigroup Funding Inc. (CFI), a first-tier subsidiary of Citigroup, which issues commercial paper, medium-term notes and structured equity-linked and credit-linked notes, all of which are guaranteed by Citigroup... -

Page 106

... the short-term and commercial paper ratings of Citigroup and Citibank, N.A. to "A-1" from "A-1+". On February 27, 2009, Standard & Poor's placed the ratings of Citigroup Inc. and its subsidiaries on "Negative Outlook". As a result of the Citigroup guarantee, changes in ratings and ratings outlooks... -

Page 107

... other cash requirements. Because of the current credit ratings of Citigroup Inc., a one-notch downgrade of its senior debt/long-term rating would likely impact Citigroup Inc.'s commercial paper/short-term rating. As of January 31, 2009, a one-notch downgrade of the senior debt/ long-term rating of... -

Page 108

...next 12 months of Citigroup, CFI and CGMHI. • Guaranteed Money Market Notes Represents a portion of notes issued through Citi's Private Bank via a non-bank subsidiary that is an element of Parent Company funding. • Maturing Bank Loans As further described in Note 20 to the Consolidated Financial... -

Page 109

... to keep the funding options current and in line with market conditions. The management of this plan includes an analysis used to determine CGMHI's ability to withstand varying levels of stress, including rating downgrades, which could impact its liquidation horizons and required margins. CGMHI... -

Page 110

...letters of credit and foreign office guarantees Commercial and similar letters of credit One- to four-family residential mortgages Revolving open-end loans secured by one- to four-family residential properties Commercial real estate, construction and land development Credit card lines (1) Commercial... -

Page 111

... and legal requirements, and management's ability to change funding policy. For additional information regarding the Company's retirement benefit obligations, see Note 9 to the Consolidated Financial Statements on page 144. Contractual obligations by year In millions of dollars at year end 2009... -

Page 112

... and $20 million during 2008, 2007 and 2006, respectively, relating to certain investment management fees and administration costs for the U.S. plans, which are excluded from this table. Citigroup determines its assumptions for the expected rate of return on plan assets for its U.S. pension and... -

Page 113

... of fair value of assets and liabilities, see "Significant Accounting Policies and Significant Estimates" on page 18 and Notes 26, 27 and 28 to the Consolidated Financial Statements on pages 192, 202 and 207. For the foreign plans, pension expense for 2008 was reduced by the expected return of... -

Page 114

... at that date the Company's disclosure controls and procedures were effective. Financial Reporting There were no changes in the Company's internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) during the fiscal quarter ended December 31, 2008 that materially... -

Page 115

... directly to the outstanding principal. Collateralized Debt Obligations (CDOs)-security issued by a trust, representing the remaining value of expected net cash flows to the Company after payments to third-party investors and net credit losses. Leverage Ratio-The Leverage Ratio is calculated... -

Page 116

... at a future date. Securitizations-A process by which a legal entity issues to investors average interest-earning assets. Non-Qualified Plan-A retirement plan that is not subject to certain certain securities which pay a return based on the principal and interest cash flows from a pool of loans or... -

Page 117

... senior and subordinated debt, limited-life preferred stock, and the allowance for credit losses, subject to certain limitations. Unearned Compensation-The unamortized portion of a grant to employees of restricted or deferred stock measured at the market value on the date of grant. Unearned... -

Page 118

... over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). Citigroup's internal control system was designed to provide reasonable assurance to the Company's management and Board of Directors regarding the preparation and fair presentation of published financial statements in... -

Page 119

... Board (United States), the consolidated balance sheets of Citigroup as of December 31, 2008 and 2007, and the related consolidated statements of income, changes in stockholders' equity and cash flows for each of the years in the three-year period ended December 31, 2008, and our report dated... -

Page 120

... changed its methods of accounting for fair value measurements, the fair value option for financial assets and financial liabilities, uncertainty in income taxes and cash flows relating to income taxes generated by a leverage lease transaction. New /s/ KPMG York, LLP New York February 27, 2009... -

Page 121

...- Retirement Benefits 144 Note 10 - Restructuring 150 Note 11 - Income Taxes 152 Note 12 - Earnings per Share 155 Note 13 - Federal Funds, Securities Borrowed, Loaned, and Subject to Repurchase Agreements 156 Note 14 - Brokerage Receivables and Brokerage Payables 157 Note 15 - Trading Account Assets... -

Page 122

... and fees Principal transactions Administration and other fiduciary fees Realized gains (losses) from sales of investments Insurance premiums Other revenue Total non-interest revenues Total revenues, net of interest expense Provisions for credit losses and for benefits and claims Provision for loan... -

Page 123

... 92,684 Total deposits $ Federal funds purchased and securities loaned or sold under agreements to repurchase (including $138,866 and $199,854 as of December 31, 2008 and December 31, 2007, respectively, at fair value) Brokerage payables Trading account liabilities Short-term borrowings (including... -

Page 124

... stock purchase contract payments Other Balance, end of year Retained earnings Balance, beginning of year (1) Adjustment to opening balance, net of taxes (2) Adjusted balance, beginning of period Net income (loss) Common dividends (3) Preferred dividends Balance, end of year Treasury stock, at cost... -

Page 125

...the Consolidated Financial Statements on pages 122, 192 and 202 for further discussion. (6) In 2008, reflects decreased fair value of plan assets and a lower discount rate, which increased the PBO (Projected Benefit Obligation). In 2007, reflects changes in the funded status of the Company's pension... -

Page 126

... policy acquisition costs Depreciation and amortization Deferred tax (benefit) provision Provision for credit losses Change in trading account assets Change in trading account liabilities Change in federal funds sold and securities borrowed or purchased under agreements to resell Change in federal... -

Page 127

...,597 (10,659) Assets Cash and due from banks Deposits with banks Federal funds sold and securities purchased under agreements to resell Trading account assets (including $12,092 and $22,716 pledged to creditors at December 31, 2008 and December 31, 2007, respectively) Investments (including $3,028... -

Page 128

... consumer finance, mortgage lending, and retail banking products and services; investment banking, commercial banking, cash management, trade finance and e-commerce products and services; and private banking products and services. The Company includes a balance sheet and statement of changes in... -

Page 129

... page 192, the Company uses a discounted cash-flow technique to determine the fair value of securities lending and borrowing transactions. Repurchase and Resale Agreements Trading account assets include debt and marketable equity securities, derivatives in a receivable position, residual interests... -

Page 130

... represent loans and leases managed by the Global Cards and Consumer Banking businesses and GWM. As a general rule, interest accrual ceases for open-end revolving and closed-end installment and real estate loans when payments are 90 days contractually past due. For credit cards, however, the Company... -

Page 131

...mortgage and student loan classes of servicing rights are accounted for at fair value, with changes in value recorded in current earnings. Upon electing the fair-value method of accounting for its MSRs, the Company discontinued the application of SFAS 133 fair-value hedge accounting, the calculation... -

Page 132

... of expected future cash flows, using modeling techniques that incorporate management's best estimates of key assumptions, including prepayment speeds, credit losses and discount rates, when observable inputs are not available. In addition, internally calculated fair values of retained interests... -

Page 133

...Any net amount, representing hedge ineffectiveness, is reflected in current earnings. Citigroup's fair value hedges are primarily hedges of fixed-rate long-term debt, and available-for-sale securities. For cash flow hedges, in which derivatives hedge the variability of cash flows related to floating... -

Page 134

... related party transactions with certain of its subsidiaries and affiliates. These transactions, which are primarily short-term in nature, include cash accounts, collateralized financing transactions, margin accounts, derivative trading, charges for operational support and the borrowing and lending... -

Page 135

...fair value, and the current status of the payment/performance risk for certain guarantees and credit derivatives sold. Determining Fair Value in Inactive Markets On January 1, 2008, the Company adopted Staff Accounting Bulletin No. 109 (SAB 109), which requires that the fair value of a written loan... -

Page 136

... in the first quarter of 2007 earnings within the S&B business. SFAS 157 also precludes the use of block discounts for instruments traded in an active market, which were previously applied to large holdings of publicly traded equity securities, and requires the recognition of trade-date gains after... -

Page 137

... in fair value being recorded in current earnings. The classes of servicing rights are identified based on the availability of market inputs used in determining their fair values and the methods for managing their risks. The Company has elected fair value accounting for its mortgage and student loan... -

Page 138

... levels and provide a rollforward of the changes in fair value of plan assets classified as Level 3. The disclosures about plan assets required by this FSP are effective for fiscal years ending after December 15, 2009, but would have no effect on the Consolidated Balance Sheet or Statement of Income... -

Page 139

...establishes new criteria for a parent company or equity method investor to retain investment company accounting in their consolidated financial statements. Investment companies record all their investments at fair value with changes in value reflected in earnings. The Company is currently evaluating... -

Page 140

...'s Securities and Banking, and Global Wealth Management businesses. On January 29, 2008, Citigroup completed the acquisition of the remaining Nikko Cordial shares that it did not already own by issuing 175 million Citigroup common shares (approximately $4.4 billion based on the exchange terms... -

Page 141

.... Egg offers various financial products and services including online payment and account aggregation services, credit cards, personal loans, savings accounts, mortgages, insurance and investments. Results for Egg are included in Citigroup's Global Cards and EMEA Consumer Banking businesses from May... -

Page 142

... unit in North America. The total proceeds from the transaction were approximately $12.5 billion and resulted in an after-tax loss to Citigroup of $305 million. This loss is included in Income from discontinued operations on the Company's Consolidated Statement of Income for the second quarter... -

Page 143

... business sold to MetLife. In July 2006, Citigroup recognized an $85 million after-tax gain from the sale of MetLife shares. This gain was reported in income from continuing operations in ICG. In July 2006, the Company received the final closing adjustment payment related to this sale, resulting... -

Page 144

...The Global Wealth Management segment is composed of the Smith Barney Private Client businesses and Citigroup Private Bank. Smith Barney provides investment advice, financial planning and brokerage services to affluent individuals, companies and non-profits. Private Bank provides personalized wealth... -

Page 145

... dividends Trading account assets (1) Other interest Total interest revenue Commissions and fees revenue includes charges to customers for credit and bank cards, including transaction-processing fees and annual fees; advisory and equity and debt underwriting services; lending and deposit-related... -

Page 146

... Credit products (3) Equities (4) Foreign exchange (5) Commodities (6) Total ICG Consumer Banking/Global Cards (7) Global Wealth Management (7) Corporate/Other Total principal transactions revenue The Company has adopted a number of equity compensation plans under which it administers stock options... -

Page 147

... full year 2008 and full year 2009). The ultimate value of the award will be based on Citigroup's performance in each of these periods with respect to (1) total shareholder return versus Citigroup's current key competitors and (2) publicly stated return on equity (ROE) targets measured at the end of... -

Page 148

... over the grant date closing price ($36.60). The first installment of these options vested on January 22, 2009. These options do not have a reload feature. Information with respect to stock option activity under Citigroup stock option plans for the years ended December 31, 2008, 2007 and 2006... -

Page 149

... grant. The exercise price of a reload grant is the fair market value of Citigroup common stock on the date the underlying option is exercised. Reload options are intended to encourage employees to exercise options at an earlier date and to retain the shares acquired. The result of this program is... -

Page 150

...covering employees outside the United States. The U.S. qualified defined benefit plan provides benefits under a cash balance formula. However, employees satisfying certain age and service requirements remain covered by a prior final average pay formula under that plan. Effective January 1, 2008, the... -

Page 151

... year end Change in plan assets Plan assets at fair value at beginning of year Actual return on plan assets Company contributions (4) Employee contributions Acquisitions (5) Divestitures Settlements Benefits paid Foreign exchange impact Plan assets at fair value at year end Funded status of the plan... -

Page 152

... benefit expense for the Company's plans are shown in the following table: At year end 2008 2007 Discount rate U.S. plans (1) Pension Postretirement Non-U.S. plans Range (2) Weighted average Future compensation increase rate U.S. plans (3) Non-U.S. plans Range (2) Weighted average During the year... -

Page 153

... rate of return to be a longer-term assessment of return expectations, based on each plan's expected asset allocation, and does not anticipate changing this assumption annually unless there are significant changes in economic conditions or portfolio composition. Market performance over a number... -

Page 154

... plans' asset allocations for the U.S. plans at the end of 2008 and 2007, and the target allocations for 2009 by asset category based on asset fair values, are as follows: Target asset allocation Asset category Equity securities (1) Debt securities Real estate Private equity Other investments Total... -

Page 155

... paid by the Company. These estimates are subject to change, since contribution decisions are affected by various factors, such as market performance and regulatory requirements; in addition, management has the ability to change funding policy. Estimated Future Benefit Payments In December 2003... -

Page 156

... management; consolidate certain back-office, middle-office and corporate functions; increase the use of shared services; expand centralized procurement; and continue to rationalize operational spending on technology. The implementation of these restructuring initiatives also caused certain related... -

Page 157

...the year ended December 31, 2008 $23 1 3 4 42 $73 Total restructuring charges since inception (1) $ 815 142 286 98 156 $1,497 Consumer Banking Global Cards Institutional Clients Group Global Wealth Management Corporate/Other Total Citigroup (pretax) (1) Amounts shown net of $158 million related to... -

Page 158

... taxes on discontinued operations 207 Provision (benefit) for income taxes on cumulative effect of accounting changes - Income tax expense (benefit) reported in stockholders' equity related to: Foreign currency translation (2,116) Securities available-for-sale (5,468) Employee stock plans 449 Cash... -

Page 159

... credits) of $6.1 billion would have to be provided if such earnings were remitted currently. The current year's effect on the income tax expense from continuing operations is included in the Foreign income tax rate differential line in the reconciliation of the federal statutory rate to the Company... -

Page 160

... due to further decreases in market conditions. Based upon the foregoing discussion, as well as tax planning opportunities and other factors discussed below, the U.S. and New York State and City net operating loss carryforward period of 20 years provides enough time to utilize the DTAs pertaining... -

Page 161

... securities: Options Restricted and deferred stock Preferred stock Adjusted weighted average common shares outstanding applicable to diluted EPS Basic earnings per Income (loss) from continuing operations Discontinued operations Net income (loss) Diluted earnings per share (1)(2) Income (loss... -

Page 162

... is recorded at fair value as the Company elected fair value option for certain securities borrowed and loaned portfolios in accordance with SFAS 159. This election was made effective in the second quarter of 2007. Securities borrowed transactions require the Company to deposit cash with the lender... -

Page 163

... to sell or purchase the financial instruments at prevailing market prices. Credit risk is reduced to the extent that an exchange or clearing organization acts as a counterparty to the transaction. The Company seeks to protect itself from the risks associated with customer activities by requiring... -

Page 164

... earnings. (3) Non-marketable equity securities carried at cost primarily consist of shares issued by the Federal Reserve Bank, Federal Home Loan Bank, foreign central banks and various clearing houses in which Citigroup is a member. Securities Available-for-Sale The amortized cost and fair value... -

Page 165

... value Gross unrealized losses 12 months or longer Fair value Gross unrealized losses Fair value Total Gross unrealized losses In millions of dollars at year end 2008: Securities available-for-sale Mortgage-backed securities U.S. Treasury and federal agencies State and municipal Foreign government... -

Page 166

... securities issued by U.S. corporations, and other debt securities. During the fourth quarter of 2008, the Company reviewed portfolios of debt securities classified in Trading account assets and available-for-sale securities, and identified positions where there has been a change of intent to hold... -

Page 167

... Mortgage-backed securities State and municipal Other debt securities Total debt securities held-to-maturity (1) For securities transferred to held-to-maturity from Trading account assets, amortized cost is defined as the fair value amount of the securities at the date of transfer. For securities... -

Page 168

...(AOCI) for available-for-sale securities, while such losses related to held-to-maturity securities are not recorded, as these investments are carried at their amortized cost (less any permanent impairment). For securities transferred to held-to-maturity from Trading account assets, amortized cost is... -

Page 169

...cards with below-market introductory interest rates, multiple loans supported by the same collateral (e.g., home equity loans), or interest-only loans are examples of such products. However, these products are not material to Citigroup's financial position and are closely managed via credit controls... -

Page 170

... of $114 million of purchased loans accounted for under the level-yield method and $293 million under the cost recovery method. These balances represent the fair value of these loans at their acquisition date. The related total expected cash flows for the level-yield loans were $151 million at... -

Page 171

...2007, the Company changed its estimate of loan losses inherent in the Global Cards and Consumer Banking portfolios that were not yet visible in delinquency statistics. The changes in estimate were accounted for prospectively. For the quarter ended March 31, 2007, the change in estimate decreased the... -

Page 172

... foreign exchange effects on non-dollar-denominated goodwill, as well as purchase accounting adjustments. (3) As of June 30, 2008, the Company's structure was reorganized and new operating segments were established. As goodwill is required to be tested for impairment at the reporting unit level... -

Page 173

... 1,259 592 North America Cards International Cards Asia Consumer Banking Securities & Banking Global Transaction Services North America GWM International GWM While no impairment was noted in step one of our Securities and Banking reporting unit impairment test at October 31, 2008 and December 31... -

Page 174

... fund management contract. As a result, an impairment loss of $202 million, representing the remaining unamortized balance of the intangible assets, was recorded in the first quarter of 2008 operating expenses in the results of the ICG segment. The fair value was estimated using a discounted cash... -

Page 175

... notes Secured debt Citigroup Global Markets Holdings Inc. (3) Senior notes Subordinated notes Citigroup Funding Inc. (4)(5) Senior notes Total Senior notes Subordinated notes Junior subordinated notes relating to trust preferred securities Other Total Short-term borrowings consist of commercial... -

Page 176

... parent company Other Citigroup subsidiaries Citigroup Global Markets Holdings Inc. Citigroup Funding Inc. Total Long-term debt at December 31, 2008 and December 31, 2007 includes $24,060 million and $23,756 million, respectively, of junior subordinated debt. The Company formed statutory business... -

Page 177

The following table summarizes the financial structure of each of the Company's subsidiary trusts at December 31, 2008: Trust securities with distributions guaranteed by Citigroup In millions of dollars, except share amounts Issuance date Dec. 1996 July 2001 Sept. 2001 Feb. 2003 Sept. 2003 Sept. ... -

Page 178

... payable quarterly for the first five years until February 15, 2013 at $12,500 per preferred share and thereafter at $22,500 per preferred share when, as and if declared by the Company's Board of Directors. (5) Issued on December 31, 2008 as Cumulative Preferred Stock to the United States Treasury... -

Page 179

...case of federal savings banks, is required if total dividends declared in any calendar year exceed amounts specified by the applicable agency's regulations. State-chartered depository institutions are subject to dividend limitations imposed by applicable state law. As of December 31, 2008, Citigroup... -

Page 180

... cash flow hedges portfolio. (6) Reflects adjustments to funded status of pension and postretirement plans as required by SFAS 158, which is the difference between the projected benefit obligation and the fair value of the plans' assets. (7) The net unrealized loss related to securities transferred... -

Page 181

...issuance of short-term notes; • writing credit protection (e.g., guarantees, letters of credit, credit default swaps or total return swaps where the Company receives the total return or risk on the assets held by the VIE); or • certain transactions where the Company is the investment manager and... -

Page 182

... 71 $ 9 80 $ 23,899 $ - - - - $45,415 $ $ $ 45 9 54 - $30,608 $ $ $ 22 - 22 - $3,049 $ $ - - - Global Wealth Management Investment funds Other Total Corporate/Other Trust preferred securities Total Citigroup (1) (2) (3) (4) $ 23,899 $288,004 $ 162 $3,211 $1,157,054 $822,132 $46,918 $30,630... -

Page 183

... 31, 2008 (continued) In millions of dollars As of December 31, 2007 (1) Total maximum exposure to loss in significant unconsolidated VIEs (continued)(3 Total involvement with SPEs $ 125,109 550,965 14,882 1,420 $ 692,376 QSPE assets $125,109 550,902 14,882 - $690,893 Consolidated VIE assets... -

Page 184

... of the assets consolidated by the Company. The carrying amount may represent the amortized cost or the current fair value of the assets depending on the legal form of the asset (e.g., security or loan) and the Company's standard accounting policies for the asset type and line of business. The asset... -

Page 185

... their credit card balances, the cash proceeds are used to purchase new receivables and replenish the receivables in the trust. The Company relies on securitizations to fund a significant portion of its managed North America Cards business. The following table reflects amounts related to the Company... -

Page 186

... fees. In non-recourse servicing, the principal credit risk to the Company is the cost of temporary advances of funds. In recourse servicing, the servicer agrees to share credit risk with the owner of the mortgage loans, such as FNMA or FHLMC, or with a private investor, insurer or guarantor. Losses... -

Page 187

... transferring the risk of future credit losses to the purchasers of the securities issued by the trust. Securities and Banking retains servicing for a limited number of its mortgage securitizations. The Company's Consumer business provides a wide range of mortgage loan products to its customers... -

Page 188

...$ 8,380 Balance, beginning of year Originations Purchases Changes in fair value of MSRs due to changes in inputs and assumptions Transfer to Trading account assets Other changes (1) Balance, end of year (1) Represents changes due to customer payments and passage of time. The market for MSRs is not... -

Page 189

... credit card, student loan, mortgage and auto businesses, accounted for as secured borrowings: In billions of dollars December 31, 2008 $ 0.3 0.1 7.5 (0.1) $ 7.8 $ 6.3 0.3 $ 6.6 December 31, 2007 $ 0.1 0.2 7.4 (0.1) $ 7.6 $ 5.8 0.4 $ 6.2 Cash Available-for-sale securities Loans Allowance for loan... -

Page 190

... pay to investors the market value of the pool of assets owned by the CDO at maturity. Both types of CDOs are typically managed by a thirdparty asset manager. In these transactions, all of the equity and notes issued by the CDO are funded, as the cash is needed to purchase the debt securities. In... -

Page 191

... Company and related loan loss reserves are reported as part of the Company's Allowance for credit losses in Note 18 on page 165. Financings in the form of debt securities or derivatives are, in most circumstances, reported in Trading account assets and accounted for at fair value through earnings... -

Page 192

...Tender Option Bond (TOB) Trusts The Company sponsors TOB trusts that hold fixed- and floating-rate, tax-exempt securities issued by state or local municipalities. The trusts are typically single-issuer trusts whose assets are purchased from the Company and from the secondary market. The trusts issue... -

Page 193

... debt (medium-term notes and short-term commercial paper) to fund the purchase of high quality assets. The junior notes are subject to the "first loss" risk of the SIVs. The SIVs provide a variable return to the junior note investors based on the net spread between the cost to issue the senior debt... -

Page 194

... equity shares of the trust. The trust issues preferred equity securities to third-party investors and invests the gross proceeds in junior subordinated deferrable interest debentures issued by the Company. These trusts have no assets, operations, revenues or cash flows other than those related... -

Page 195

... interest rate, foreign exchange and other market/ credit risks or for their own trading purposes. As part of this process, Citigroup considers the customers' suitability for the risk involved, and the business purpose for the transaction. Citigroup also manages its derivative-risk positions through... -

Page 196

... employed is a forward foreign-exchange contract. In this type of hedge, the change in fair value of the hedged available-for-sale security attributable to the portion of foreign exchange risk hedged is reported in earnings and not Accumulated other comprehensive income-a process that serves to... -

Page 197

...to time value that, if excluded, are recognized in current earnings. The following table summarizes certain information related to the Company's hedging activities for the years ended December 31, 2008, 2007 and 2006: In millions of dollars The change in Accumulated other comprehensive income (loss... -

Page 198

... when measuring the fair value of instruments traded in an active market, which discounts were previously applied to large holdings of publicly traded equity securities. It also requires recognition of trade-date gains related to certain derivative transactions whose fair value has been determined... -

Page 199

...Level 1 of the fairvalue hierarchy. Examples include some government securities and exchange-traded equity securities. For bonds and secondary market loans traded over the counter, the Company generally determines fair value utilizing internal valuation techniques. Fair-value estimates from internal... -

Page 200

... company, initial public offerings, equity issuances, or other observable transactions. Private equity securities are generally classified in Level 3 of the fair-value hierarchy. Short-Term Borrowings and Long-Term Debt Where fair-value accounting has been elected, the fair value of non-structured... -

Page 201

... in Level 3. Alt-A Mortgage Securities The Company classifies its Alt-A mortgage securities as Held-to-Maturity, Available-for-Sale, and Trading investments. The securities classified as trading and available-for-sale are recorded at fair value with changes in fair value reported in current earnings... -

Page 202

... real estate at fair value with changes in fair value reported in earnings, including securities, loans and investments in entities that hold commercial real estate loans or commercial real estate directly. The Company also reports securities backed by commercial real estate as Available-for-sale... -

Page 203

... 5,657 5,722 Assets Federal funds sold and securities borrowed or purchased under agreements to resell Trading account assets Trading securities and loans Derivatives Investments Loans (2) Mortgage servicing rights Other financial assets measured on a recurring basis Total assets $144,547 $1,444... -

Page 204

...727 8,380 9,802 Assets Federal funds sold and securities borrowed or purchased under agreements to resell Trading account assets Trading securities and loans Derivatives Investments Loans (2) Mortgage servicing rights Other financial assets measured on a recurring basis Total assets $223,263 $938... -

Page 205

... deposits Securities sold under agreements to repurchase Trading account liabilities Securities sold, not yet purchased Derivatives, net (4) Short-term borrowings Long-term debt Other financial liabilities measured on a recurring basis (1) Changes in fair value for available-for-sale investments... -

Page 206

... sale of a corporate loan portfolio that included highly leveraged loans during the second quarter of 2008, plus $3 billion of ARS securities purchased from GWM clients, in accordance with the Auction Rate Securities settlement agreement ; (ii) The net transfer in of investment securities from Level... -

Page 207

... fair value was determined using Level 3 input factors along with a discounted cash flow approach. During the fourth quarter of 2008, the Company performed an impairment analysis of Japan's Nikko Asset Management fund contracts which represent the rights to manage and collect fees on investor assets... -

Page 208

... in fair value recorded in current earnings. The classes of servicing rights are identified based on the availability of market inputs used in determining their fair values and the methods for managing their risks. The Company has elected fair-value accounting for its mortgage and student loan... -

Page 209

... as available-for-sale Selected letters of credit hedged by credit default swaps or participation notes Certain credit products Certain hybrid financial instruments Retained interests from asset securitizations Total trading account assets Investments: Certain investments in private equity and real... -

Page 210

... convertible preferred equity securities (Legg shares) were acquired in connection with the sale of Citigroup's Asset Management business in December 2005. Prior to the election of fair-value option accounting, the shares were classified as available-for-sale securities with the unrealized loss of... -

Page 211

... Changes in fair value of funded and unfunded credit products are classified in Principal transactions in the Company's Consolidated Statement of Income. Related interest revenue is measured based on the contractual interest rates and reported as Interest revenue on trading account assets or loans... -

Page 212

... The changes in fair values of these mortgage loans is reported in Other revenue in the Company's Consolidated Statement of Income. The changes in fair value during the year ended December 31, 2008 due to instrumentspecific credit risk resulted in a $32 million loss. The change in fair value during... -

Page 213

... For additional information regarding the Company's determination of fair value, including items accounted for at fair value under SFAS 155, SFAS 156, and SFAS 159, see Note 27 on page 202. 2008 In billions of dollars at year end Liabilities Deposits Federal funds purchased and securities loaned or... -

Page 214

...segregation requirements under securities laws and regulations, derivative transactions and bank loans. The Company provides a variety of guarantees and indemnifications to Citigroup customers to enhance their credit standing and enable them to complete a wide variety of business transactions. FASB... -

Page 215

...the event that the security borrower does not return the security subject to the lending agreement and collateral held is insufficient to cover the market value of the security. Credit Card Merchant Processing Credit card merchant processing guarantees represent the Company's indirect obligations in... -

Page 216

... cardholders, Citigroup would be liable to credit or refund the cardholders. The Company's maximum potential contingent liability related to both bankcard and private label merchant processing services is estimated to be the total volume of credit card transactions that meet the requirements to be... -

Page 217

... mitigate credit risk in its corporate loan portfolio and other cash positions, to take proprietary trading positions, and to facilitate client transactions. The range of credit derivatives sold includes credit default swaps, total return swaps and credit options. A credit default swap is a contract... -

Page 218

... default swaps and options Total return swaps and other Total by instrument By rating: Investment grade Non-investment grade Not rated Total by rating Citigroup evaluates the payment/performance risk of the credit derivatives to which it stands as guarantor based on the credit rating which has been... -

Page 219

...2008 and December 31, 2007. In millions of dollars Commercial and similar letters of credit One- to four-family residential mortgages Revolving open-end loans secured by one- to four-family residential properties Commercial real estate, construction and land development Credit card lines Commercial... -

Page 220

... Balance, end of year - shares: 37,534,553 in 2008, 2007 and 2006 Surplus Balance, beginning of year Capital contribution from parent company Employee benefit plans Other (1) Balance, end of year Retained earnings Balance, beginning of year Adjustment to opening balance, net of taxes (2) Adjusted... -

Page 221

... 23, 2009, pursuant to Citibank's prior agreement with the purchasers of the $12.5 billion convertible preferred stock issued in a private offering during 2008, the conversion price was reset from $31.62 per share to $26.35 per share. The reset will result in Citigroup issuing approximately 79... -

Page 222

... schedules are presented for purposes of additional analysis but should be considered in relation to the consolidated financial statements of Citigroup taken as a whole. Citigroup Parent Company The holding company, Citigroup Inc. Citigroup Global Markets Holdings Inc. (CGMHI) Citigroup guarantees... -

Page 223

...Year ended December 31, 2008 Other Citigroup subsidiaries, eliminations and income from discontinued operations In millions of dollars Citigroup parent company CGMHI CFI CCC Associates Consolidating adjustments Citigroup consolidated Revenues Dividends from subsidiary banks and bank holding... -

Page 224

...Year ended December 31, 2007 Other Citigroup subsidiaries, eliminations and income from discontinued operations In millions of dollars Citigroup parent company CGMHI CFI CCC Associates Consolidating adjustments Citigroup consolidated Revenues Dividends from subsidiary banks and bank holding... -

Page 225

...Year ended December 31, 2006 Other Citigroup subsidiaries, eliminations and income from discontinued operations In millions of dollars Citigroup parent company CGMHI CFI CCC Associates Consolidating adjustments Citigroup consolidated Revenues Dividends from subsidiary banks and bank holding... -

Page 226

... Total assets Liabilities and stockholders' equity Deposits Federal funds purchased and securities loaned or sold Federal funds purchased and securities loaned or sold- intercompany Trading account liabilities Trading account liabilities-intercompany Short-term borrowings Short-term borrowings... -

Page 227

... Total assets Liabilities and stockholders' equity Deposits Federal funds purchased and securities loaned or sold Federal funds purchased and securities loaned or sold- intercompany Trading account liabilities Trading account liabilities-intercompany Short-term borrowings Short-term borrowings... -

Page 228

... - Change in deposits - Net change in short-term borrowings and other investment banking and brokerage borrowings - third-party (3,197) Net change in short-term borrowings and other advances - intercompany 10,118 Capital contributions from parent - Other financing activities (400) Net cash provided... -

Page 229

...debt-intercompany, net Change in deposits Net change in short-term borrowings and other investment banking and brokerage borrowings- third-party Net change in short-term borrowings and other advances-intercompany Capital contributions from parent Other financing activities Net cash provided by (used... -

Page 230

..., net Change in deposits Net change in short-term borrowings and other investment banking and brokerage borrowings- third-party Net change in short-term borrowings and other advances-intercompany Capital contributions from parent Other financing activities Net cash provided by financing activities... -

Page 231

... taxes Income (loss) from continuing operations Income from discontinued operations, net of taxes Net income (loss) Earnings per share (1) (2) Basic Income from continuing operations Net income Diluted Income from continuing operations Net income Common stock price per share High Low Close Dividends... -

Page 232

... rate 3.56% 2.53 4.01 3.42% Average Average balance interest rate $ 60,315 212,781 243,305 $516,401 3.25% 1.85 3.53 2.81% In millions of dollars at year end Banks Other demand deposits Other time and savings deposits (2) Total (1) Interest rates and amounts include the effects of risk management... -

Page 233

... Company/Financial Holding Company Dividends Citigroup's ownership of Citibank, N.A. (Citibank) and other banks makes Citigroup a "bank holding company" under U.S. law. Bank holding companies are generally limited to the business of banking, managing or controlling banks, and other closely related... -

Page 234

...broker-dealer and investment adviser with the SEC and as futures commission merchant and commodity pool operator with the Commodity Futures Trading Commission (CFTC). Subsidiaries' memberships include the New York Stock Exchange, Inc. (NYSE) and other principal United States securities exchanges, as... -

Page 235

... in the United States District Court for the Southern District of New York. Research WorldCom, Inc. Beginning in 2002, Citigroup, CGMI and certain executive officers and current and former employees (along with, in many cases, other investment banks, certain WorldCom officers and directors, and/or... -

Page 236

... executive officers and current and former employees were named as defendants in a series of putative class action lawsuits, alleging violations of the federal securities laws, including Sections 10 and 20 of the Securities Exchange Act of 1934 in connection with Citigroup research analyst reports... -

Page 237

... Mac. Citigroup Global Markets Inc., along with a number of other financial institutions, has been named as a defendant in two lawsuits pending in the United States District Court for the Southern District of New York brought by Freddie Mac shareholders who purchased preferred shares traceable to... -

Page 238

... et al., was filed against certain officers and directors of Citigroup in the Southern District of New York on August 20, 2008, asserting state law claims for breach of fiduciary duty, insider selling, abuse of control, and gross mismanagement and federal securities fraud related to ARS. On November... -

Page 239

... v. Citigroup Alternative Investments LLC, et al.: On October 17, 2008, an investor in MAT Five LLC filed a putative class action complaint in New York state court, alleging breaches of fiduciary duty relating to the marketing of shares and the management of the MAT Five fund. On November 11, 2008... -

Page 240

...On September 29, 2008, Citigroup Inc. announced that it had reached an agreement-in-principle to acquire all of the banking subsidiaries of Wachovia Corporation ("Wachovia") in an open-bank transaction assisted by the Federal Deposit Insurance Corporation. On October 3, 2008, Wachovia announced that... -

Page 241

...claims pursuant to Federal Rule of Civil Procedure 54(b) and stayed the judgment pending appeal. Defendants filed a notice of appeal on January 22, 2008, and plaintiffs cross appealed on January 30, 2008; oral argument is scheduled for March 2009. 27001 Partnership, et al. v. BT Securities Corp., et... -

Page 242

... quarter 2008 Year-to-date 2008 Open market repurchases Employee transactions Total year-to-date 2008 $ 8.06 15.20 $ - 8.37 $ 9.72 12.63 $12.42 $21.30 21.94 $21.91 (1) All open market repurchases were transacted under an existing authorized share repurchase plan. On April 17, 2006, the Board... -

Page 243

...CEO, Citi Holdings-Global Consumer Controller and Chief Accounting Officer Head, Global Institutional Bank General Counsel and Corporate Secretary Vice Chairman Head, Global Banking and Citi Alternative Investments Chief Risk Officer Chairman & CEO, Latin America & Mexico CEO, Western Europe, Middle... -

Page 244

... through December 31, 2008. The graph assumes that $100 was invested on December 31, 2003 in Citigroup's common stock, the S&P 500 Index and the S&P Financial Index and that all dividends were reinvested. Comparison of Five-Year Cumulative Total Return For the years ended Citigroup S&P 500 Index... -

Page 245

... This Annual Report on Form 10-K incorporates the requirements of the accounting profession and the Securities and Exchange Commission, including a comprehensive explanation of 2008 results. Form 10-K Part III 10. Directors, Executive Officers and Corporate Governance ...11. Executive Compensation... -

Page 246