Citibank 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

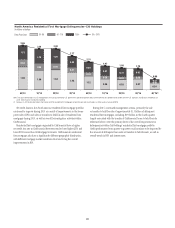

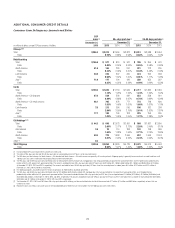

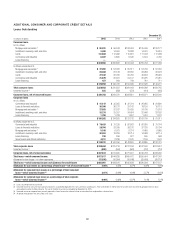

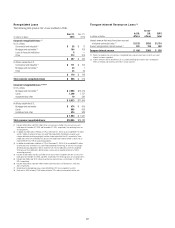

Citi’s corporate credit portfolio is also diversified by industry. The following

table shows the allocation of Citi’s total corporate credit portfolio by industry:

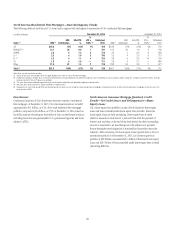

Total Exposure

December 31,

2015

September 30,

2015

December 31,

2014

Transportation and industrial 20% 21% 21%

Consumer retail and health 16 16 17

Technology, media

and telecom 12 10 9

Power, chemicals,

commodities and metals

and mining 11 10 10

Energy (1) 99 10

Banks/broker-

dealers/finance companies 77 8

Real estate 66 6

Hedge funds 56 5

Insurance and special

purpose entities 56 5

Public sector 55 5

Other industries 44 4

Total 100% 100% 100%

Note: Total exposure includes direct outstandings and unfunded lending commitments.

(1) In addition to this exposure, Citi has energy-related exposure within the “Public sector” (e.g., energy-

related state-owned entities) and “Transportation and industrial” sector (e.g., off-shore drilling entities)

included in the table above. As of December 31, 2015, Citi’s total exposure to these energy-related

entities remained largely consistent with the prior quarter, at approximately $6 billion, of which

approximately $4 billion consisted of direct outstanding funded loans.

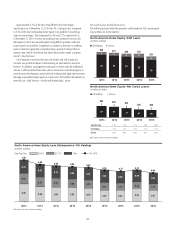

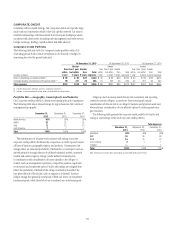

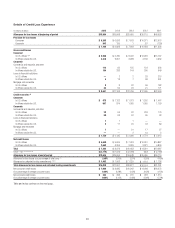

Exposure to the Energy and Energy-Related Sector

As of December 31, 2015, Citi’s total corporate credit exposure to the

energy and energy-related sector (see footnote 1 to the table above) was

approximately $58 billion, with approximately $21 billion, or 3%, of Citi’s

total outstanding loans consisting of direct outstanding funded loans. This

compared to approximately $61 billion of total corporate credit exposure

and $21 billion of direct outstanding funded loans as of September 30,

2015. In addition, as of December 31, 2015, approximately 72% of Citi’s

total corporate credit energy and energy-related exposure was in the United

States, United Kingdom and Canada (compared to approximately 73% at

September 30, 2015). Also as of December 31, 2015, approximately 80% of

Citi’s total energy and energy-related exposures were rated investment grade

(compared to approximately 79% as of September 30, 2015).

During the fourth quarter of 2015, Citi built additional energy and

energy-related loan loss reserves of approximately $250 million, and

incurred approximately $75 million of net credit losses in these portfolios.

For the full year 2015, Citi built net loan loss reserves against energy and

energy-related exposures by approximately $530 million, and incurred net

credit losses of approximately $95 million. As of December 31, 2015, Citi

held loan loss reserves against its funded energy and energy-related loans

equal to approximately 3.8% of these loans. For additional information on

energy and energy-related reserving actions in ICG, see “Institutional Clients

Group” above.

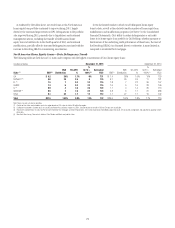

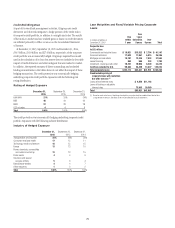

Exposure to Banks, Broker-Dealers and Finance Companies

As of December 31, 2015, Citi’s total corporate credit exposure to banks,

broker-dealers and finance companies was approximately $42 billion, of

which $29 billion represented direct outstanding funded loans, or 5% of

Citi’s total outstanding loans. These amounts were mostly unchanged when

compared to $43 billion of total corporate credit exposure and $29 billion

of direct outstanding funded loans to banks, broker-dealers and finance

companies as of September 30, 2015. Also as of December 31, 2015,

approximately 84% of Citi’s bank, broker-dealers and finance companies

total corporate credit exposure was rated investment grade.

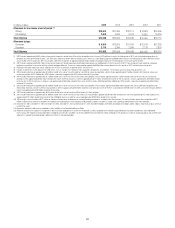

Included in the amounts noted above, Citi’s total corporate credit exposure

to banks was approximately $26 billion as of December 31, 2015 and was

not concentrated in any particular geographic region. Of this exposure, more

than 70% had a tenor of less than 12 months. As of December 31, 2015, Citi’s

direct outstanding funded loans to banks was $21 billion, or 3% of Citi’s total

outstanding loans.

In addition to the corporate lending exposures described above, Citi

has additional exposure to banks, broker-dealers and finance companies

in the form of derivatives and securities financing transactions, which

are typically executed as repurchase and reverse repurchase agreements

or securities loaned or borrowed arrangements. As of December 31, 2015,

Citi had net derivative credit exposure to banks, broker dealers and finance

companies of approximately $5 billion after the application of netting

arrangements, legally enforceable margin agreements and other collateral

arrangements. The collateral considered as part of the net derivative credit

exposure was represented primarily by high quality, liquid assets. As of

December 31, 2015, Citi had net credit exposure to banks, broker-dealers

and finance companies in the form of securities financing transactions of

$7 billion after the application of netting and collateral arrangements. The

collateral considered in the net exposure for the securities financing

transactions exposure was primarily cash and highly liquid investment

grade securities.