Citibank 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.147

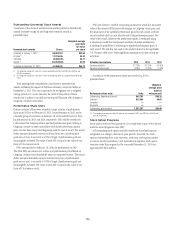

tax benefits received. Citi qualifies to elect the proportional amortization

method under the ASU for its entire LIHTC portfolio. These investments were

previously accounted for under the equity method, which resulted in losses

(due to amortization of the investment) being recognized in Other revenue

and tax credits and benefits being recognized in the Income tax expense

line. In contrast, the proportional amortization method combines the

amortization of the investment and receipt of the tax credits/benefits into one

line, Income tax expense.

Citi adopted ASU 2014-01 in the first quarter of 2015. The adoption of

this ASU was applied retrospectively and cumulatively reduced Retained

earnings by approximately $349 million, Other assets by approximately

$178 million, and deferred tax assets by approximately $171 million.

Accounting for Repurchase-to-Maturity Transactions

In June 2014, the FASB issued ASU No. 2014-11, Transfers and Servicing

(Topic 860): Repurchase-to-Maturity Transactions, Repurchase

Financings, and Disclosures. The ASU changes the accounting for

repurchase-to-maturity transactions and linked repurchase financings to

secured borrowing accounting, which is consistent with the accounting

for other repurchase agreements. The ASU also requires disclosures about

transfers accounted for as sales in transactions that are economically

similar to repurchase agreements (see Note 23 to the Consolidated Financial

Statements) and about the types of collateral pledged in repurchase

agreements and similar transactions accounted for as secured borrowings

(see Note 11 to the Consolidated Financial Statements). The ASU’s provisions

became effective for Citi in the first quarter of 2015, with the exception of the

collateral disclosures which became effective in the second quarter of 2015.

The effect of adopting the ASU is required to be reflected as a cumulative

effect adjustment to retained earnings as of the beginning of the period

of adoption. Adoption of the ASU did not have a material effect on the

Company’s financial statements.

Disclosures for Investments in Certain Entities That

Calculate Net Asset Value (NAV) per Share

In May 2015, the FASB issued ASU No. 2015-07, Fair Value Measurement

(Topic 820): Disclosures for Investments in Certain Entities That

Calculate Net Asset Value per Share (or Its Equivalent), which is intended

to reduce diversity in practice related to the categorization of investments

measured at NAV within the fair value hierarchy. The ASU removes the

current requirement to categorize investments for which fair value is

measured using the NAV per share practical expedient within the fair

value hierarchy. Citi elected to early adopt the ASU in the second quarter

of 2015. The adoption of the ASU was applied retrospectively and reduced

Level 3 assets by $1.0 billion and $1.1 billion as of December 31, 2015 and

December 31, 2014, respectively.

Discontinued Operations and Significant Disposals

The FASB issued ASU No. 2014-08, Presentation of Financial Statements

(Topic 810) and Property, Plant, and Equipment (Topic 360), Reporting

Discontinued Operations and Disclosures of Disposals of Components of

an Entity (ASU 2014-08) in April 2014. ASU 2014-08 changes the criteria

for reporting discontinued operations while enhancing disclosures. Under

the ASU, only disposals representing a strategic shift having a major effect

on an entity’s operations and financial results, such as a disposal of a

major geographic area, a major line of business or a major equity method

investment, may be presented as discontinued operations. Additionally, the

ASU requires expanded disclosures about discontinued operations that will

provide more information about the assets, liabilities, income and expenses

of discontinued operations.

The Company early-adopted the ASU in the second quarter of 2014 on

a prospective basis for all disposals (or classifications as held-for-sale) of

components of an entity that occurred on or after April 1, 2014. As a result

of the adoption of the ASU, fewer disposals will now qualify for reporting

as discontinued operations; however, disclosure of the pretax income

attributable to a disposal of a significant part of an organization that does

not qualify for discontinued operations reporting is required. The impact of

adopting the ASU was not material.

Classification of Certain Government-Guaranteed

Mortgage Loans upon Foreclosure

In August 2014, the FASB issued ASU No. 2014-14, Receivables-Troubled

Debt Restructuring by Creditors (Subtopic 310-40): Classification of

Certain Government-Guaranteed Mortgage Loans upon Foreclosure,

which requires that a mortgage loan be derecognized and a separate other

receivable be recognized upon foreclosure if the following conditions are met:

(i) the loan has a government guarantee that is not separable from the loan

before foreclosure; (ii) at the time of foreclosure, the creditor has the intent

to convey the real estate property to the guarantor and make a claim on the

guarantee, and the creditor has the ability to recover under that claim; and

(iii) at the time of foreclosure, any amount of the claim that is determined

on the basis of the fair value of the real estate is fixed. Upon foreclosure,

the separate other receivable is measured based on the amount of the loan

balance (principal and interest) expected to be recovered from the guarantor.

Citi early adopted the ASU on a modified retrospective basis in the fourth

quarter of 2014, which resulted in reclassifying approximately $130 million

of foreclosed assets from Other Real Estate Owned to a separate other

receivable that is included in Other assets. Given the modified retrospective

approach to adoption, prior periods have not been restated.