Citibank 2015 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176

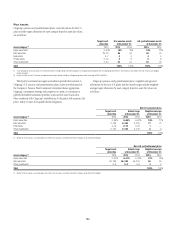

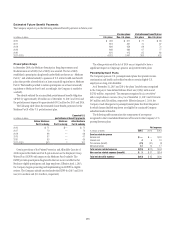

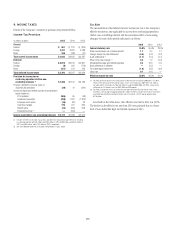

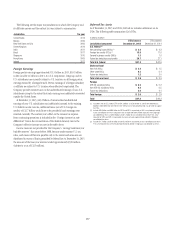

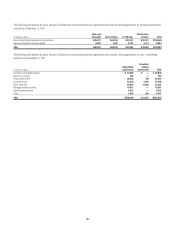

Deferred Income Taxes

Deferred income taxes at December 31 related to the following:

In millions of dollars 2015 2014

Deferred tax assets

Credit loss deduction $ 6,058 $ 7,010

Deferred compensation and employee benefits 4,110 4,676

Repositioning and settlement reserves 1,429 1,599

Unremitted foreign earnings 8,403 6,368

Investment and loan basis differences 3,248 4,808

Cash flow hedges 359 529

Tax credit and net operating loss carry-forwards 23,053 23,395

Fixed assets and leases 1,356 2,093

Other deferred tax assets 3,176 2,334

Gross deferred tax assets $51,192 $52,812

Valuation allowance ——

Deferred tax assets after valuation allowance $51,192 $52,812

Deferred tax liabilities

Deferred policy acquisition costs

and value of insurance in force $ (327) $ (415)

Intangibles (1,146) (1,636)

Debt issuances (850) (866)

Other deferred tax liabilities (1,020) (559)

Gross deferred tax liabilities $ (3,343) $ (3,476)

Net deferred tax assets $47,849 $49,336

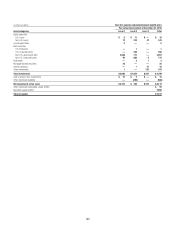

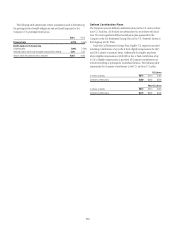

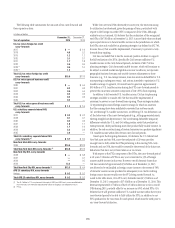

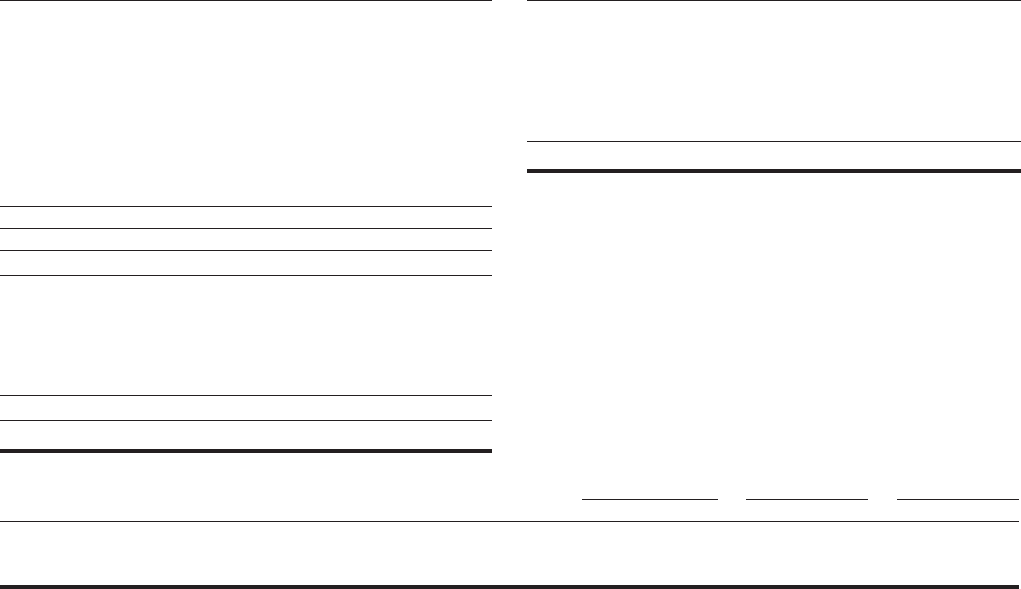

Unrecognized Tax Benefits

The following is a rollforward of the Company’s unrecognized tax benefits.

In millions of dollars 2015 2014 2013

Total unrecognized tax benefits at January 1 $1,060 $1,574 $ 3,109

Net amount of increases for current year’s tax positions 32 135 58

Gross amount of increases for prior years’ tax positions 311 175 251

Gross amount of decreases for prior years’ tax positions (61) (772) (716)

Amounts of decreases relating to settlements (45) (28) (1,115)

Reductions due to lapse of statutes of limitation (22) (30) (15)

Foreign exchange, acquisitions and dispositions (40) 6 2

Total unrecognized tax benefits at December 31 $1,235 $1,060 $ 1,574

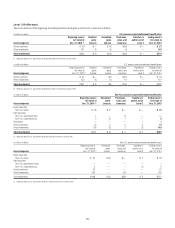

The total amounts of unrecognized tax benefits at December 31, 2015,

2014 and 2013 that, if recognized, would affect Citi’s effective tax rate,

are $0.9 billion, $0.8 billion and $0.8 billion, respectively. The remaining

uncertain tax positions have offsetting amounts in other jurisdictions or are

temporary differences, except for $0.4 billion at December 31, 2013, which

was recognized in Retained earnings in 2014.

Interest and penalties (not included in “unrecognized tax benefits”

above) are a component of the Provision for income taxes.

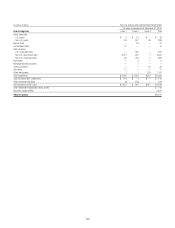

2015 2014 2013

In millions of dollars Pretax Net of tax Pretax Net of tax Pretax Net of tax

Total interest and penalties in the Consolidated Balance Sheet at January 1 $ 269 $ 169 $ 277 $173 $ 492 $ 315

Total interest and penalties in the Consolidated Statement of Income (29) (18) (1) (1) (108) (72)

Total interest and penalties in the Consolidated Balance Sheet at December 31(1) 233 146 269 169 277 173

(1) Includes $3 million, $2 million, and $2 million for foreign penalties in 2015, 2014 and 2013, respectively. Also includes $3 million for state penalties in 2015 and 2014, and $4 million in 2013.

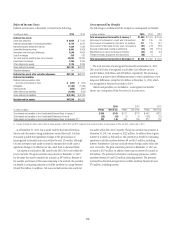

As of December 31, 2015, Citi is under audit by the Internal Revenue

Service and other major taxing jurisdictions around the world. It is thus

reasonably possible that significant changes in the gross balance of

unrecognized tax benefits may occur within the next 12 months, although

Citi does not expect such audits to result in amounts that would cause a

significant change to its effective tax rate, other than as discussed below.

Citi expects to conclude its IRS audit for the 2012-2013 cycle within the

next 12 months. The gross uncertain tax positions at December 31, 2015

for the items that may be resolved are as much as $97 million. Because of

the number and nature of the issues remaining to be resolved, the potential

tax benefit to continuing operations could be anywhere in a range between

$0 and $94 million. In addition, Citi may conclude certain state and local

tax audits within the next 12 months. The gross uncertain tax positions at

December 31, 2015 are as much as $222 million. In addition there is gross

interest of as much as $16 million. The potential tax benefit to continuing

operations could be anywhere between $0 and $155 million, including

interest. Furthermore, Citi may conclude certain foreign audits within the

next 12 months. The gross uncertain positions at December 31, 2015 are

as much as $119 million. In addition there is gross interest of as much as

$18 million. The potential tax benefit to continuing operations could be

anywhere between $0 and $22 million, including interest. The potential

tax benefit to discontinued operations could be anywhere between $0 and

$76 million, including interest.