Citibank 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

Further, because it is not clear how the Federal Reserve Board’s proprietary

stress test models may differ from the modeling techniques employed by Citi,

it is possible that Citi’s stress test results (using its own models, estimation

methodologies and processes) may not be consistent with those disclosed by

the Federal Reserve Board, thus potentially leading to additional confusion

and impacts to Citi’s perception in the market.

Citi, Its Management and Businesses Must Continually

Review, Analyze and Successfully Adapt to Ongoing

Regulatory Changes and Uncertainties in the U.S.

and Globally.

Despite the adoption of final regulations in numerous areas impacting Citi

and its businesses over the past several years, including final U.S. Basel III

capital rules, certain derivatives reforms and restrictions on proprietary

trading under the Volcker Rule, Citi, its management and businesses

continually face ongoing regulatory changes and uncertainties, both in the

U.S. and globally.

While the areas of ongoing regulatory changes and uncertainties

facing Citi are too numerous to list completely, various examples include,

but are not limited to: (i) limits on the level of credit risk Citi may have

against certain counterparties; (ii) potential changes to various aspects

of the regulatory capital framework applicable to Citi (see “Capital

Resources—Regulatory Capital Standards Developments” above);

(iii) financial transaction taxes and/or other types of increased fees on

financial institutions; (iv) international versions of the Volcker Rule and

bank structural reforms; (v) whether and to what extent the European

Union and CFTC will render any “equivalency” determinations or regulatory

acknowledgment of the equivalency of derivatives regimes; (vi) U.S. and

international requirements relating to sanctions against Russia, Iran and

other countries; and (vii) the U.S. banking agencies’ rules relating to the

net stable funding ratio, or NSFR (see “Managing Global Risk—Liquidity

Risk” below). There may also be regulatory changes not yet contemplated,

or changes that have been proposed which could take a dramatically

different form upon finalization.

Moreover, certain recent regulatory changes, while final, remain in the

implementation period, and it remains uncertain what ultimate impact

such changes will have on Citi’s businesses, results of operations or financial

condition. For example, in October and December 2015, the U.S. banking

regulators and CFTC, respectively, adopted final rules relating to margin

requirements for uncleared swaps. The final rules, which have a three-year

phase-in period beginning on September 1, 2016, will require Citi to both

collect and post margin to counterparties, as well as collect and post margin

to certain of its affiliates, in connection with any uncleared swap, with the

initial margin required to be held by unaffiliated third-party custodians.

While Citi continues to work through the implications of the final rules, it

is likely these requirements will significantly increase the cost to Citi and its

counterparties of conducting uncleared swaps and impact its current inter-

affiliate swap practices (e.g., require clearing of more inter-affiliate swaps

and/or enter into risk management swaps with third parties).

Ongoing regulatory changes and uncertainties make Citi’s and its

management’s long-term business, balance sheet and budget planning

difficult or subject to change, and can negatively impact Citi’s results of

operations, financial condition and, potentially, its strategy or organizational

structure. In addition, in many cases, business planning is required to

be based on possible or proposed rules, requirements or outcomes and

is further complicated by management’s continual need to review and

evaluate the impact on Citi’s businesses of ongoing rule proposals, final

rules and implementation guidance from numerous regulatory bodies

worldwide, which such guidance can change. Moreover, in many instances

U.S. and international regulatory initiatives have not been undertaken or

implemented on a coordinated basis, and areas of divergence have developed

with respect to the scope, interpretation, timing, structure or approach,

leading to inconsistent or even conflicting regulations, including within a

single jurisdiction. Regulatory changes have also significantly increased

Citi’s compliance risks and costs (see “Compliance, Conduct and Legal

Risks” below).

CREDIT AND MARKET RISKS

Citi’s Results of Operations Could Be Negatively Impacted

as Its Revolving Home Equity Lines of Credit Continue

to “Reset.”

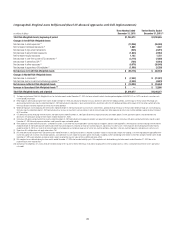

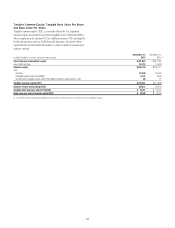

As of December 31, 2015, Citi’s home equity loan portfolio included

approximately $12.3 billion of home equity lines of credit that were still

within their revolving period and had not commenced amortization, or

“reset” (Revolving HELOCs). Of these Revolving HELOCs, approximately

66% will commence amortization during 2016 and 2017 (for additional

information, see “Managing Global Risk—Credit Risk—Consumer

Credit” below).

Before commencing amortization, Revolving HELOC borrowers are

required to pay only interest on their loans. Upon amortization, these

borrowers are required to pay both interest, usually at a variable rate, and

principal that typically amortizes over 20 years, rather than the typical

30-year amortization. As a result, Citi’s customers with Revolving HELOCs

that reset could experience “payment shock” due to the higher required

payments on the loans. Increases in interest rates could further increase

these payments, given the variable nature of the interest rates on these

loans post-reset.

Citi has experienced a higher 30+ days past due delinquency rate on

its amortizing home equity loans as compared to its total outstanding

home equity loan portfolio (amortizing and non-amortizing). Moreover,

resets to date have generally occurred during a period of historically low

interest rates, which Citi believes has likely reduced the overall payment

shock to borrowers. While Citi continues to monitor this reset risk closely

and will continue to consider any potential impact in determining its

allowance for loan loss reserves, as well as review and take additional

actions to offset potential reset risk, increasing interest rates, stricter

lending criteria and high borrower loan-to-value positions could limit