Citibank 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

Regulatory Capital Standards Developments

Countercyclical Capital Buffer

In December 2015, the Federal Reserve Board released a proposed policy

statement on the framework that would be followed in setting the amount

of the U.S. Countercyclical Capital Buffer for Advanced Approaches banking

organizations. In accordance with the U.S. Basel III rules, the amount

of the applicable Countercyclical Capital Buffer is equal to the weighted

average of Countercyclical Capital Buffer amounts established by the Federal

Reserve Board for the national jurisdictions where the Advanced Approaches

banking organization has private sector credit exposures. As a result, the

Countercyclical Capital Buffer may differ for each Advanced Approaches

banking organization.

The Federal Reserve Board’s proposed framework for setting the U.S.

Countercyclical Capital Buffer encompasses a number of financial-system

vulnerabilities, as well as a wide range of financial and macroeconomic

quantitative indicators. However, given that no single indicator or fixed set

of indicators can adequately capture all the key vulnerabilities in the U.S.

economy and financial system, the types of indicators and models considered

in assessments of the appropriate level of the Countercyclical Capital Buffer

are likely to change over time.

The Federal Reserve Board expects to consider the applicable level of the

U.S. Countercyclical Capital Buffer at least once per year. An increase in the

amount of the Countercyclical Capital Buffer for U.S.-based credit exposures

would generally have an effective date 12 months after such determination,

while a decrease in the amount of the Countercyclical Capital Buffer would

generally become effective the day after such determination.

Revisions to the Standardized Approach for Credit Risk

In December 2015, the Basel Committee on Banking Supervision (Basel

Committee) issued a second consultative document which proposes various

revisions to the Standardized Approach in deriving credit risk-weighted

assets. As proposed, the revised Standardized Approach seeks to balance risk

sensitivity and complexity, and to promote comparability of credit risk-

weighted assets across banking organizations and jurisdictions.

The proposal would, in part, revise the Standardized Approach in

measuring credit risk-weighted assets with respect to certain on-balance sheet

assets, such as in relation to the risk-weighting methodologies employed with

respect to bank, corporate, and real estate (both residential and commercial)

exposures; the treatment of off-balance sheet commitments; and aspects of

the credit risk mitigation framework. Moreover, the proposal would permit

the use of external credit ratings combined with due diligence requirements

in the calculation of credit risk-weighted assets for exposures to banks and

corporates, while also providing alternative approaches for jurisdictions that

do not allow the use of external credit ratings for risk-based capital purposes,

such as the U.S. Prior to finalizing the proposal, the Basel Committee will be

conducting a comprehensive quantitative impact study so as to assist with

assessing the risk-weighting calibration for each of the affected exposure

classes, as well as will evaluate the appropriate implementation and

transitional arrangements. The U.S. banking agencies have indicated that

any changes to the U.S. Basel III rules as a result of the Basel Committee’s

proposed revisions to the Standardized Approach would apply primarily to

large, internationally active banking organizations.

Revised Minimum Capital Requirements for Market Risk

In January 2016, the Basel Committee issued a final rule which sets forth

a revised market risk capital framework, resulting from the so-called

“fundamental review of the trading book” and four quantitative impact

studies over several years.

The final rule establishes a revised boundary between the trading book

and banking book which, in part, provides more prescriptive guidance as to

qualifying trading book positions as well as imposes heightened restrictions

and, in certain instances, additional capital charges, on the transfer of

positions between the trading book and banking book. Moreover, the final

rule also revises both the internal models approach and the standardized

approach in certain respects. With regard to the internal models approach,

the final rule introduces a more comprehensive model to measure market

risk, provides for a more granular model approval process, and reduces the

regulatory capital benefits of hedging activities and portfolio diversification.

The final rule revises the standardized approach, in part, by calibrating it

more closely to the internal models approach by increasing reliance on risk

sensitivity inputs in the calculation of market risk capital requirements.

The deadline for national jurisdictions to implement the revised market risk

capital framework is January 1, 2019, with the effective date for banking

organizations to begin reporting under the revised framework, subject to any

required supervisory approvals, being December 31, 2019.

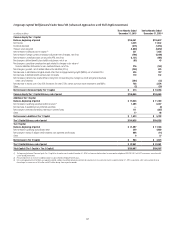

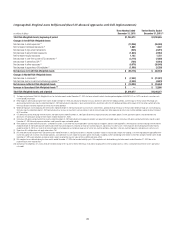

If the U.S. banking agencies were to adopt the Basel Committee’s final

rule unchanged, Citi believes its market risk-weighted assets could increase

significantly. However, as set forth in the tables above, as of December 31,

2015, Citi’s market risk-weighted assets constituted approximately 6% of its

total risk-weighted assets. Accordingly, Citi currently believes that the overall

impact to its total risk-weighted assets and thus its risk-based capital ratios

would not be material. Nevertheless, the ultimate impact to Citi’s market

risk-weighted assets and potentially its risk-based capital ratios is uncertain

and is subject to several factors including, but not limited to, the U.S.

banking agencies’ implementation of a final rule, potential changes in the

scale and scope of future market risk model approvals as well as potential

risk mitigation actions.