Citibank 2015 Annual Report Download - page 292

Download and view the complete annual report

Please find page 292 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

274

Certain Investments in Unallocated Precious Metals

Citigroup invests in unallocated precious metals accounts (gold, silver,

platinum and palladium) as part of its commodity and foreign currency

trading activities or to economically hedge certain exposures from issuing

structured liabilities. Under ASC 815, the investment is bifurcated into a debt

host contract and a commodity forward derivative instrument. Citigroup

elects the fair value option for the debt host contract, and reports the debt

host contract within Trading account assets on the Company’s Consolidated

Balance Sheet. The total carrying amount of debt host contracts across

unallocated precious metals accounts was approximately $0.6 billion and

$1.2 billion at December 31, 2015 and 2014, respectively. The amounts are

expected to fluctuate based on trading activity in future periods.

As part of its commodity and foreign currency trading activities, Citi

sells (buys) unallocated precious metals investments and executes forward

purchase (sale) derivative contracts with trading counterparties. When

Citi sells an unallocated precious metals investment, Citi’s receivable from

its depository bank is repaid and Citi derecognizes its investment in the

unallocated precious metal. The forward purchase (sale) contract with the

trading counterparty indexed to unallocated precious metals is accounted

for as a derivative, at fair value through earnings. As of December 31,

2015, there were approximately $10.6 billion and $9.2 billion notional

amounts of such forward purchase and forward sale derivative contracts

outstanding, respectively.

Certain Investments in Private Equity and Real Estate

Ventures and Certain Equity Method and Other Investments

Citigroup invests in private equity and real estate ventures for the purpose

of earning investment returns and for capital appreciation. The Company

has elected the fair value option for certain of these ventures, because such

investments are considered similar to many private equity or hedge fund

activities in Citi’s investment companies, which are reported at fair value.

The fair value option brings consistency in the accounting and evaluation of

these investments. All investments (debt and equity) in such private equity

and real estate entities are accounted for at fair value. These investments are

classified as Investments on Citigroup’s Consolidated Balance Sheet.

Changes in the fair values of these investments are classified in Other

revenue in the Company’s Consolidated Statement of Income.

Citigroup also elects the fair value option for certain non-marketable

equity securities whose risk is managed with derivative instruments that are

accounted for at fair value through earnings. These securities are classified as

Trading account assets on Citigroup’s Consolidated Balance Sheet. Changes

in the fair value of these securities and the related derivative instruments are

recorded in Principal transactions.

Certain Mortgage Loans HFS

Citigroup has elected the fair value option for certain purchased and

originated prime fixed-rate and conforming adjustable-rate first mortgage

loans HFS. These loans are intended for sale or securitization and are hedged

with derivative instruments. The Company has elected the fair value option

to mitigate accounting mismatches in cases where hedge accounting is

complex and to achieve operational simplifications.

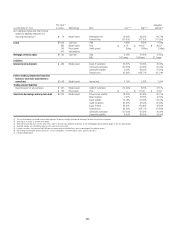

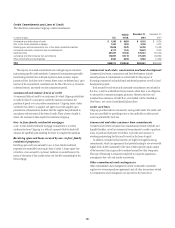

The following table provides information about certain mortgage loans HFS carried at fair value:

In millions of dollars December 31, 2015 December 31, 2014

Carrying amount reported on the Consolidated Balance Sheet $745 $1,447

Aggregate fair value in excess of unpaid principal balance 20 67

Balance of non-accrual loans or loans more than 90 days past due ——

Aggregate unpaid principal balance in excess of fair value for non-accrual loans or loans more than 90 days past due ——

The changes in the fair values of these mortgage loans are reported in

Other revenue in the Company’s Consolidated Statement of Income. There

was no net change in fair value during the years ended December 31, 2015

and 2014 due to instrument-specific credit risk. Related interest income

continues to be measured based on the contractual interest rates and reported

as Interest revenue in the Consolidated Statement of Income.