Citibank 2015 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

255

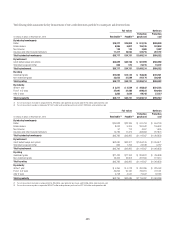

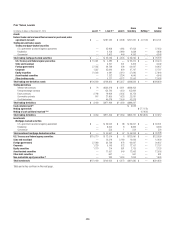

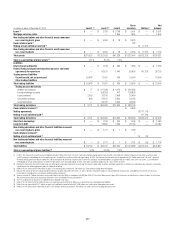

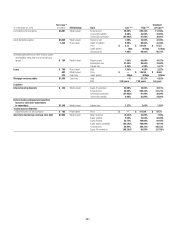

In millions of dollars at December 31, 2015 Level 1 (1) Level 2 (1) Level 3

Gross

inventory Netting (2)

Net

balance

Loans (5) $ — $ 2,839 $ 2,166 $ 5,005 $ — $ 5,005

Mortgage servicing rights — — 1,781 1,781 — 1,781

Non-trading derivatives and other financial assets measured

on a recurring basis, gross $ — $ 7,882 $ 180 $ 8,062

Cash collateral paid (6) 8

Netting of cash collateral received $ (1,949)

Non-trading derivatives and other financial assets measured

on a recurring basis $ — $ 7,882 $ 180 $ 8,070 $ (1,949) $ 6,121

Total assets $260,938 $1,013,230 $ 32,637 $1,311,724 $(610,568) $701,156

Total as a percentage of gross assets (7) 20.0% 77.5% 2.5%

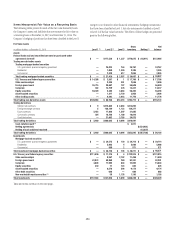

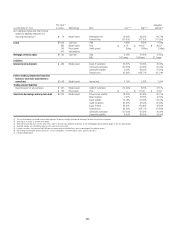

Liabilities

Interest-bearing deposits $ — $ 1,156 $ 434 $ 1,590 $ — $ 1,590

Federal funds purchased and securities loaned or sold under

agreements to repurchase — 76,507 1,247 77,754 (40,911) 36,843

Trading account liabilities

Securities sold, not yet purchased 48,452 9,176 199 57,827 — 57,827

Other trading liabilities — 2,093 — 2,093 — 2,093

Total trading liabilities $ 48,452 $ 11,269 $ 199 $ 59,920 $ — $ 59,920

Trading derivatives

Interest rate contracts $ 5 $ 393,321 $ 2,578 $ 395,904

Foreign exchange contracts 6 133,404 503 133,913

Equity contracts 2,244 21,875 2,397 26,516

Commodity contracts 263 17,329 2,961 20,553

Credit derivatives — 30,682 3,486 34,168

Total trading derivatives $ 2,518 $ 596,611 $ 11,925 $ 611,054

Cash collateral received (8) $ 13,628

Netting agreements $(524,481)

Netting of cash collateral paid (42,609)

Total trading derivatives $ 2,518 $ 596,611 $ 11,925 $ 624,682 $(567,090) $ 57,592

Short-term borrowings $ — $ 1,198 $ 9 $ 1,207 $ — $ 1,207

Long-term debt — 18,342 6,951 25,293 — 25,293

Non-trading derivatives and other financial liabilities measured

on a recurring basis, gross $ — $ 1,626 $ 14 $ 1,640

Cash collateral received (9) 37

Netting of cash collateral paid $ (53)

Total non-trading derivatives and other financial liabilities measured

on a recurring basis $ — $ 1,626 $ 14 $ 1,677 $ (53) $ 1,624

Total liabilities $ 50,970 $ 706,709 $ 20,779 $ 792,123 $(608,054) $184,069

Total as a percentage of gross liabilities (7) 6.5% 90.8% 2.7%

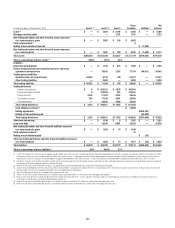

(1) In 2015, the Company transferred assets of approximately $3.3 billion from Level 1 to Level 2, respectively, primarily related to foreign government securities and equity securities not traded in active markets. In 2015,

the Company transferred assets of approximately $4.4 billion from Level 2 to Level 1, respectively, primarily related to foreign government bonds and equity securities traded with sufficient frequency to constitute a

liquid market. In 2015, the Company transferred liabilities of approximately $0.6 billion from Level 2 to Level 1. In 2015, the Company transferred liabilities of approximately $0.4 billion from Level 1 to Level 2.

(2) Represents netting of: (i) the amounts due under securities purchased under agreements to resell and the amounts owed under securities sold under agreements to repurchase; and (ii) derivative exposures covered by

a qualifying master netting agreement and cash collateral offsetting.

(3) Reflects the net amount of $47,520 million of gross cash collateral paid, of which $42,609 million was used to offset trading derivative liabilities.

(4) Amounts exclude $0.9 billion investments measured at Net Asset Value (NAV) in accordance with ASU No. 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate

Net Asset Value per Share (or Its Equivalent). See Note 1 to the Consolidated Financial Statements.

(5) There is no allowance for loan losses recorded for loans reported at fair value.

(6) Reflects the net amount of $61 million of gross cash collateral paid, of which $53 million was used to offset non-trading derivative liabilities.

(7) Because the amount of the cash collateral paid/received has not been allocated to the Level 1, 2 and 3 subtotals, these percentages are calculated based on total assets and liabilities measured at fair value on a

recurring basis, excluding the cash collateral paid/received on derivatives.

(8) Reflects the net amount of $56,855 million of gross cash collateral received, of which $43,227 million was used to offset trading derivative assets.

(9) Reflects the net amount of $1,986 million of gross cash collateral received, of which $1,949 million was used to offset non-trading derivative assets.