Citibank 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

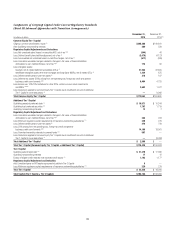

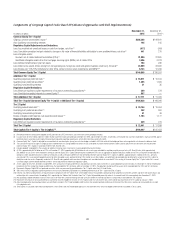

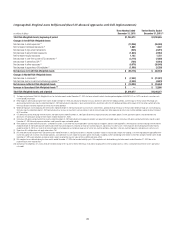

Components of Citigroup Capital Under Basel III (Advanced Approaches with Full Implementation)

In millions of dollars

December 31,

2015

December 31,

2014 (1)

Common Equity Tier 1 Capital

Citigroup common stockholders’ equity (2) $205,286 $199,841

Add: Qualifying noncontrolling interests 145 165

Regulatory Capital Adjustments and Deductions:

Less: Accumulated net unrealized losses on cash flow hedges, net of tax (3) (617) (909)

Less: Cumulative unrealized net gain related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax (4) 441 279

Less: Intangible assets:

Goodwill, net of related deferred tax liabilities (DTLs) (5) 21,980 22,805

Identifiable intangible assets other than mortgage servicing rights (MSRs), net of related DTLs 3,586 4,373

Less: Defined benefit pension plan net assets 794 936

Less: Deferred tax assets (DTAs) arising from net operating loss, foreign tax credit and general business credit carry-forwards (6) 23,659 23,626

Less: Excess over 10%/15% limitations for other DTAs, certain common stock investments, and MSRs (6)(7) 8,723 12,299

Total Common Equity Tier 1 Capital $146,865 $136,597

Additional Tier 1 Capital

Qualifying perpetual preferred stock (2) $ 16,571 $ 10,344

Qualifying trust preferred securities (8) 1,365 1,369

Qualifying noncontrolling interests 31 35

Regulatory Capital Deductions:

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries (9) 229 279

Less: Permitted ownership interests in covered funds (10) 567 —

Total Additional Tier 1 Capital $ 17,171 $ 11,469

Total Tier 1 Capital (Common Equity Tier 1 Capital + Additional Tier 1 Capital) $164,036 $148,066

Tier 2 Capital

Qualifying subordinated debt (11) $ 20,744 $ 16,094

Qualifying trust preferred securities (12) 342 350

Qualifying noncontrolling interests 41 46

Excess of eligible credit reserves over expected credit losses (13) 1,163 1,177

Regulatory Capital Deduction:

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries (9) 229 279

Total Tier 2 Capital $ 22,061 $ 17,388

Total Capital (Tier 1 Capital + Tier 2 Capital) (14) $186,097 $165,454

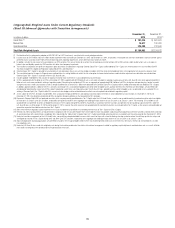

(1) Restated to reflect the retrospective adoption of ASU 2014-01 for LIHTC investments, consistent with current period presentation.

(2) Issuance costs of $147 million and $124 million related to preferred stock outstanding at December 31, 2015 and December 31, 2014, respectively, are excluded from common stockholders’ equity and netted against

preferred stock in accordance with Federal Reserve Board regulatory reporting requirements, which differ from those under U.S. GAAP.

(3) Common Equity Tier 1 Capital is adjusted for accumulated net unrealized gains (losses) on cash flow hedges included in AOCI that relate to the hedging of items not recognized at fair value on the balance sheet.

(4) The cumulative impact of changes in Citigroup’s own creditworthiness in valuing liabilities for which the fair value option has been elected and own-credit valuation adjustments on derivatives are excluded from

Common Equity Tier 1 Capital, in accordance with the U.S. Basel III rules.

(5) Includes goodwill “embedded” in the valuation of significant common stock investments in unconsolidated financial institutions.

(6) Of Citi’s approximately $47.8 billion of net DTAs at December 31, 2015, approximately $16.8 billion of such assets were includable in regulatory capital pursuant to the U.S. Basel III rules, while approximately

$31.0 billion of such assets were excluded in arriving at Common Equity Tier 1 Capital. Comprising the excluded net DTAs was an aggregate of approximately $32.4 billion of net DTAs arising from net operating loss,

foreign tax credit and general business credit carry-forwards as well as temporary differences that were deducted from Common Equity Tier 1 Capital. In addition, approximately $1.4 billion of net DTLs, primarily

consisting of DTLs associated with goodwill and certain other intangible assets, partially offset by DTAs related to cash flow hedges, are permitted to be excluded prior to deriving the amount of net DTAs subject to

deduction under these rules. Separately, under the U.S. Basel III rules, goodwill and these other intangible assets are deducted net of associated DTLs in arriving at Common Equity Tier 1 Capital, while Citi’s current

cash flow hedges and the related deferred tax effects are not required to be reflected in regulatory capital.

(7) Assets subject to 10%/15% limitations include MSRs, DTAs arising from temporary differences and significant common stock investments in unconsolidated financial institutions. At December 31, 2015, the deduction

related only to DTAs arising from temporary differences that exceeded the 10% limitation, while at December 31, 2014, the deduction related to all three assets which exceeded both the 10% and 15% limitations.

(8) Represents Citigroup Capital XIII trust preferred securities, which are permanently grandfathered as Tier 1 Capital under the U.S. Basel III rules.

(9) 50% of the minimum regulatory capital requirements of insurance underwriting subsidiaries must be deducted from each of Tier 1 Capital and Tier 2 Capital.

(10) Effective July 2015, banking entities are required to be in compliance with the “Volcker Rule” of the Dodd-Frank Act that prohibits conducting certain proprietary investment activities and limits their ownership of, and

relationships with, covered funds. Accordingly, Citi is required by the “Volcker Rule” to deduct from Tier 1 Capital all permitted ownership interests in covered funds that were acquired after December 31, 2013.

(11) Non-qualifying subordinated debt issuances which consist of those with a fixed-to-floating rate step-up feature where the call/step-up date has not passed are excluded from Tier 2 Capital.

(12) Represents the amount of non-grandfathered trust preferred securities eligible for inclusion in Tier 2 Capital under the U.S. Basel III rules, which will be fully phased-out of Tier 2 Capital by January 1, 2022.

(13) Advanced Approaches banking organizations are permitted to include in Tier 2 Capital eligible credit reserves that exceed expected credit losses to the extent that the excess reserves do not exceed 0.6% of credit

risk-weighted assets.

(14) Total Capital as calculated under Advanced Approaches, which differs from the Standardized Approach in the treatment of the amount of eligible credit reserves includable in Tier 2 Capital.