Citibank 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

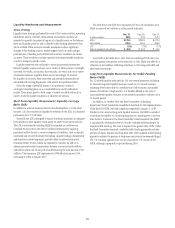

Liquidity Monitoring and Measurement

Stress Testing

Liquidity stress testing is performed for each of Citi’s major entities, operating

subsidiaries and/or countries. Stress testing and scenario analyses are

intended to quantify the potential impact of a liquidity event on the balance

sheet and liquidity position, and to identify viable funding alternatives that

can be utilized. These scenarios include assumptions about significant

changes in key funding sources, market triggers (such as credit ratings),

potential uses of funding and political and economic conditions in certain

countries. These conditions include expected and stressed market conditions

as well as Company-specific events.

Liquidity stress tests are conducted to ascertain potential mismatches

between liquidity sources and uses over a variety of time horizons (overnight,

one week, two weeks, one month, three months, one year) and over a variety

of stressed conditions. Liquidity limits are set accordingly. To monitor

the liquidity of an entity, these stress tests and potential mismatches are

calculated with varying frequencies, with several tests performed daily.

Given the range of potential stresses, Citi maintains a series of

contingency funding plans on a consolidated basis and for individual

entities. These plans specify a wide range of readily available actions for a

variety of adverse market conditions or idiosyncratic stresses.

Short-Term Liquidity Measurement: Liquidity Coverage

Ratio (LCR)

In addition to internal measures that Citi has developed for a 30-day stress

scenario, Citi also monitors its liquidity by reference to the LCR, as calculated

pursuant to the U.S. LCR rules.

Generally, the LCR is designed to ensure that banks maintain an adequate

level of HQLA to meet liquidity needs under an acute 30-day stress scenario.

The LCR is calculated by dividing HQLA by estimated net outflows over

a stressed 30-day period, with the net outflows determined by applying

prescribed outflow factors to various categories of liabilities, such as deposits,

unsecured and secured wholesale borrowings, unused lending commitments

and derivatives-related exposures, partially offset by inflows from assets

maturing within 30 days. Banks are required to calculate an add-on to

address potential maturity mismatches between contractual cash outflows

and inflows within the 30-day period in determining the total amount of net

outflows. The minimum LCR requirement is 90% effective January 2016,

increasing to 100% in January 2017.

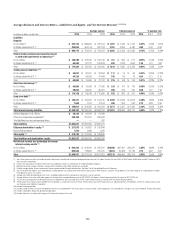

The table below sets forth the components of Citi’s LCR calculation and

HQLA in excess of net outflows as of the periods indicated:

In billions of dollars

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

HQLA $378.5 $ 398.9 $ 412.6

Net outflows 336.5 355.6 368.6

LCR 112% 112% 112%

HQLA in excess of net outflows $ 42.0 $ 43.3 $ 44.0

As set forth in the table above, Citi’s LCR was unchanged both year-over-

year and quarter-over-quarter, as the reduction in Citi’s HQLA was offset by a

reduction in net outflows, reflecting reductions in Citi’s long-term debt and

short-term borrowings.

Long-Term Liquidity Measurement: Net Stable Funding

Ratio (NSFR)

For 12-month liquidity stress periods, Citi uses several measures, including

its internal long-term liquidity measure, based on a 12-month scenario

assuming deterioration due to a combination of idiosyncratic and market

stresses of moderate to high severity. It is broadly defined as the ratio of

unencumbered liquidity resources to net stressed cumulative outflows over a

12-month period.

In addition, in October 2014, the Basel Committee on Banking

Supervision (Basel Committee) issued final standards for the implementation

of the Basel III NSFR, with full compliance required by January 1, 2018.

Similar to Citi’s internal long-term liquidity measure, the NSFR is intended

to measure the stability of a banking organization’s funding over a one-year

time horizon. Pursuant to the Basel Committee’s final standards, the NSFR

is calculated by dividing the level of a bank’s available stable funding by its

required stable funding. The ratio is required to be greater than 100%. Under

the Basel Committee standards, available stable funding primarily includes

portions of equity, deposits and long-term debt, while required stable funding

primarily includes the portion of long-term assets which are deemed illiquid.

The U.S. banking agencies have not yet proposed the U.S. version of the

NSFR, although a proposal is expected during 2016.