Citibank 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.113

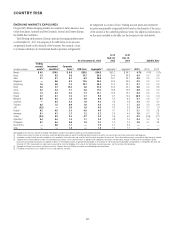

Argentina

As of December 31, 2015, Citi’s net investment in its Argentine operations was

approximately $747 million, compared to $917 million at September 30,

2015 and $780 million at December 31, 2014.

Citi uses the Argentine peso as the functional currency in Argentina

and translates its financial statements into U.S. dollars using the official

exchange rate as published by the Central Bank of Argentina. Over the last

several years, the Argentine government has imposed strict foreign exchange

controls which have limited Citi’s ability to access U.S. dollars and other

foreign currencies, repatriate capital and hedge its currency risk, among

other impacts. In the latter part of 2015, however, Argentina elected a new

president and the Argentine government took steps to loosen some of these

foreign exchange controls. While these actions were encouraging, they

did result in a devaluation of the Argentine peso to 13 pesos per one U.S.

dollar at December 31, 2015, compared to 9.4 pesos per one U.S. dollar at

September 30, 2015 and 8.6 pesos per one U.S. dollar at December 31, 2014.

The impact of devaluations of the Argentine peso on Citi’s net investment

in Argentina is reported as a translation loss in stockholders’ equity offset, to

the extent hedged, by:

• gains or losses recorded in stockholders’ equity on net investment hedges

that have been designated as, and qualify for, hedge accounting under

ASC 815 Derivatives and Hedging; and

• gains or losses recorded in earnings for its U.S. dollar-denominated

monetary assets or currency futures held in Argentina that do not qualify

as net investment hedges under ASC 815.

At December 31, 2015, Citi had cumulative translation losses related

to its investment in Argentina, net of qualifying net investment hedges, of

approximately $1.88 billion (pretax), which were recorded in stockholders’

equity. This compared to $1.66 billion (pretax) as of September 30, 2015 and

$1.51 billion (pretax) as of December 31, 2014. The cumulative translation

losses would not be reclassified into earnings unless realized upon sale or

liquidation of substantially all of Citi’s Argentine operations.

As noted above, Citi hedges currency risk in its net investment in

Argentina to the extent possible and prudent. As of December 31, 2015, Citi’s

total hedges against its net investment in Argentina were approximately

$821 million (compared to $972 million as of September 30, 2015 and

$810 million as of December 31, 2014). Of this amount, approximately

$567 million consisted of foreign currency forwards that were recorded as net

investment hedges under ASC 815 (compared to approximately $562 million

as of September 30, 2015 and $420 million as of December 31, 2014). The

remaining hedges of approximately $254 million as of December 31, 2015

(compared to $410 million as of September 30, 2015 and $390 million as

of December 31, 2014) were net U.S. dollar-denominated assets and foreign

currency futures in Citi Argentina that do not qualify for hedge accounting

under ASC 815.

Although Citi currently uses the Argentine peso as the functional

currency for its operations in Argentina, an increase in inflation resulting

in a cumulative three-year inflation rate of 100% or more would result in a

change in the functional currency to the U.S. dollar. Citi bases its evaluation

of the cumulative three-year inflation rate on the official inflation statistics

published by INDEC, the Argentine government’s statistics agency. The

cumulative three-year inflation rate as of November 30, 2015, based on

statistics published by INDEC, was approximately 57% (compared to 52%

as of December 31, 2014). While a change in the functional currency to the

U.S. dollar would not result in any immediate gains or losses to Citi, it would

result in future devaluations of the Argentine peso being recorded in earnings

for Citi’s Argentine peso-denominated assets and liabilities.

As of December 31, 2015, Citi had total third-party assets of approximately

$4.4 billion in Citi Argentina (unchanged from September 30, 2015 and

compared to $4.1 billion at December 31, 2014), primarily composed of

corporate and consumer loans and cash on deposit with and short-term

paper issued by the Central Bank of Argentina. A significant portion of these

assets was funded with local deposits. Included in the total assets were U.S.

dollar-denominated assets of approximately $918 million, compared to

approximately $562 million at September 30, 2015 and $550 million at

December 31, 2014. The sequential increase in U.S. dollar-denominated

assets was largely due to the Argentine government’s loosening of foreign

exchange controls toward the end of 2015, as referenced above. (For

additional information on Citi’s exposures related to Argentina, see

“Emerging Markets Exposures” above.)