Citibank 2015 Annual Report Download - page 285

Download and view the complete annual report

Please find page 285 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.267

Credit Spread

Credit spread is a component of the security representing its credit quality.

Credit spread reflects the market perception of changes in prepayment,

delinquency and recovery rates, therefore capturing the impact of other

variables on the fair value. Changes in credit spread affect the fair value of

securities differently depending on the characteristics and maturity profile of

the security. For example, credit spread is a more significant driver of the fair

value measurement of a high yield bond as compared to an investment grade

bond. Generally, the credit spread for an investment grade bond is also more

observable and less volatile than its high yield counterpart.

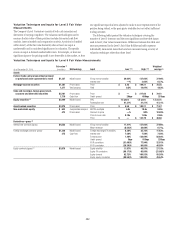

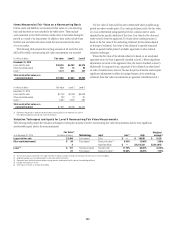

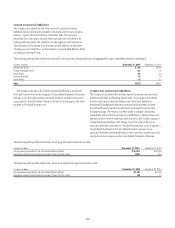

Qualitative Discussion of the Ranges of Significant

Unobservable Inputs

The following section describes the ranges of the most significant

unobservable inputs used by the Company in Level 3 fair value

measurements. The level of aggregation and the diversity of instruments held

by the Company lead to a wide range of unobservable inputs that may not be

evenly distributed across the Level 3 inventory.

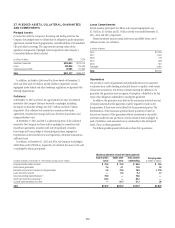

Correlation

There are many different types of correlation inputs, including credit

correlation, cross-asset correlation (such as equity-interest rate correlation),

and same-asset correlation (such as interest rate-interest rate correlation).

Correlation inputs are generally used to value hybrid and exotic instruments.

Generally, same-asset correlation inputs have a narrower range than cross-

asset correlation inputs. However, due to the complex and unique nature

of these instruments, the ranges for correlation inputs can vary widely

across portfolios.

Volatility

Similar to correlation, asset-specific volatility inputs vary widely by asset type.

For example, ranges for foreign exchange volatility are generally lower and

narrower than equity volatility. Equity volatilities are wider due to the nature

of the equities market and the terms of certain exotic instruments. For most

instruments, the interest rate volatility input is on the lower end of the range;

however, for certain structured or exotic instruments (such as market-linked

deposits or exotic interest rate derivatives), the range is much wider.

Yield

Ranges for the yield inputs vary significantly depending upon the type of

security. For example, securities that typically have lower yields, such as

municipal bonds, will fall on the lower end of the range, while more illiquid

securities or securities with lower credit quality, such as certain residual

tranche asset-backed securities, will have much higher yield inputs.

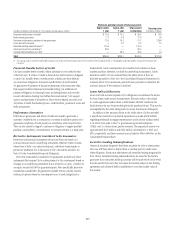

Credit Spread

Credit spread is relevant primarily for fixed income and credit instruments;

however, the ranges for the credit spread input can vary across instruments.

For example, certain fixed income instruments, such as certificates of deposit,

typically have lower credit spreads, whereas certain derivative instruments

with high-risk counterparties are typically subject to higher credit spreads

when they are uncollateralized or have a longer tenor. Other instruments,

such as credit default swaps, also have credit spreads that vary with the

attributes of the underlying obligor. Stronger companies have tighter credit

spreads, and weaker companies have wider credit spreads.

Price

The price input is a significant unobservable input for certain fixed

income instruments. For these instruments, the price input is expressed as

a percentage of the notional amount, with a price of $100 meaning that

the instrument is valued at par. For most of these instruments, the price

varies between zero to $100, or slightly above $100. Relatively illiquid assets

that have experienced significant losses since issuance, such as certain

asset-backed securities, are at the lower end of the range, whereas most

investment grade corporate bonds will fall in the middle to the higher end of

the range. For certain structured debt instruments with embedded derivatives,

the price input may be above $100 to reflect the embedded features of the

instrument (for example, a step-up coupon or a conversion option).

The price input is also a significant unobservable input for certain equity

securities; however, the range of price inputs varies depending on the nature

of the position, the number of shares outstanding and other factors.

Mean Reversion

A number of financial instruments require an estimate of the rate at which

the interest rate reverts to its long term average. Changes in this estimate can

significantly affect the fair value of these instruments. However, sometimes

there is insufficient external market data to calibrate this parameter,

especially when pricing more complex instruments. The level of mean

reversion affects the correlation between short and long term interest rates.

The fair values of more complex instruments, such as Bermudan swaptions

(options with multiple exercise dates) and constant maturity spread options

or structured debts with these embedded features, are more sensitive to the

changes in this correlation as compared to less complex instruments, such as

caps and floors.