Citibank 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332

|

|

communities around the world where

we live and work — even more tangible

support of our thesis that global

institutions are uniquely positioned to

help society address global problems on

a global scale.

It’s not easy to think of a greater or

more daunting challenge than climate

change. We announced our $100

billion Sustainable Progress initiative,

furthering our long-term commitment

to lend, invest and facilitate financial

solutions to reduce the impact of

climate change.

Letter to

Shareholders

We are confident that we can continue

to grow our Treasury and Trade

Solutions business (TTS). Through the

world’s largest proprietary closed-loop

payment network, we provide seamless

connectivity to the banking systems in

nearly 100 countries, facilitating some

$3 trillion worth of financial flows each

day in over 135 currencies.

Far from seeing ourselves as a

monolithic entity intent on crowding

out smaller competitors, we define our

role as being “scaled to serve” a specific

set of clients who rely on our global

network, any of whom would simply take

their business to global peers if for any

reason we were prevented from meeting

their needs.

But we don’t just serve big businesses.

In addition to being a leading provider

of financial services to multinational

corporations, last year our small business

lending in the U.S. surpassed $10 billion,

raising our total lending to the sector

over four years to just under $40 billion.

We also lent and invested nearly

$5 billion in affordable housing projects

in the U.S. last year, making us the

number one financer in a sector crucial to

strengthening communities nationwide.

2015 was also a year when we made

progress in our role as one of the

world’s leading global citizens. Over

the last year, we were able to provide

many of our stakeholders — customers,

clients, nonprofit partners and the

10th Annual Global

Community Day

During the past 10 years, Citi volunteers

have participated in more than 11,000

Global Community Day activities and

contributed over 2 million hours

of service.

We also are investing in the next

generation of leaders. The Citi

Foundation’s $50 million Pathways to

Progress initiative in the U.S. is helping

to close the skills gap between young

prospective employees and employers

by helping them to acquire the

workplace and leadership skills

critical to competing in a 21st century

economy. More than a thousand of

my Citi colleagues have donated their

time and expertise to the program,

which has reached more than 70,000

out of our target of 100,000 young

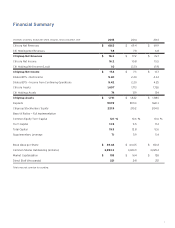

Note: Certain reclassifications have been made to the prior periods’ presentation to conform to the current period’s presentation.

1 Citigroup’s Common Equity Tier 1 (CET1) Capital ratio is a non-GAAP financial measure. For additional information, please

refer to Slide 39 of the Fourth Quarter 2015 Earnings Review available on the Citigroup Investor Relations website.

2 Citigroup’s Supplementary Leverage Ratio (SLR) is a non-GAAP financial measure. For additional information, please refer

to Slide 40 of the Fourth Quarter 2015 Earnings Review available on the Citigroup Investor Relations website.

3 Tangible Book Value (TBV) per share is a non-GAAP financial measure. For a additional information, please refer to Slide

40 of the Fourth Quarter 2015 Earnings Review available on the Citigroup Investor Relations website.

TBV/Share

3

Common Equity Tier 1 Capital Ratio

1

Supplementary Leverage Ratio

2

Citigroup — Key Capital Metrics

5.4%

4Q’124Q’134Q’1

44

Q’15

Basel III Risk-Weighted Assets (RWA) ($ Billion)

$1,206 $1,185 $1,293 $1,216

8.7%

$51.08

5.9%

7.1%

10.6%10.6%

12.1%

$55.19 $56.71 $60.61

Global Community Day offers a wide

range of service opportunities that

harness the enthusiasm and passion

of our diverse employees, with family

and friends, to help meet the

pressing needs of our communities.

In 2015, to celebrate our 10th annual

Global Community Day, more than

80,000 Citi volunteers in 487 cities

spanning 93 countries and territories

4