Citibank 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

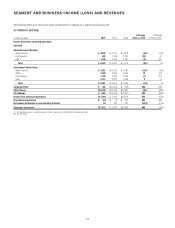

year, driven by an increase of 3% in both Citicorp and Citi Holdings’ revenues.

(Citi’s results of operations excluding the impact of FX translation are

non-GAAP financial measures. Citi believes the presentation of its results

of operations excluding the impact of FX translation provides a more

meaningful depiction for investors of the underlying fundamentals of

its businesses.)

Expenses

Citigroup expenses decreased 21% versus the prior year to $43.6 billion.

Excluding the impact of the mortgage settlement in the prior year, Citigroup

expenses declined 15% driven by significantly lower legal and related

expenses ($1.5 billion compared to $5.8 billion in the prior year) and

repositioning costs ($472 million compared to $1.6 billion in the prior

year), as well as the impact of FX translation (which lowered expenses by

approximately $2.6 billion in 2015 compared to the prior year). Excluding

the impact of both the mortgage settlement in the prior year and FX

translation, Citigroup’s expenses declined 10%, mainly driven by the lower

legal and related expenses and repositioning costs.

Excluding the impact of FX translation, which lowered reported expenses

by approximately $2.4 billion in 2015 compared to the prior year, Citicorp

expenses decreased 9% also driven by significantly lower legal and related

expenses and repositioning costs. Citicorp expenses in 2015 included legal

and related expenses of $1.1 billion, compared to $4.8 billion in the prior

year, and $278 million of repositioning costs, compared to $1.5 billion in the

prior year.

Citi Holdings’ expenses were $4.6 billion, down 52% from the prior year.

Excluding the impact of the mortgage settlement in the prior year, Citi

Holdings’ expenses decreased 22%, primarily driven by the ongoing decline

in Citi Holdings assets as well as lower legal and related expenses.

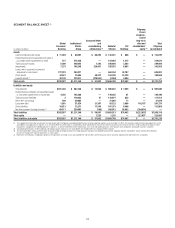

Credit Costs

Citi’s total provisions for credit losses and for benefits and claims of $7.9

billion increased 6% from the prior year. Excluding the impact of the

mortgage settlement in the prior year, Citi’s total provisions for credit losses

and for benefits and claims increased 7% as a lower net loan loss reserve

release was partially offset by lower net credit losses.

Net credit losses of $7.3 billion declined 19% versus the prior year.

Consumer net credit losses declined 19% to $7.1 billion, mostly reflecting

continued improvements in North America Citi-branded cards and Citi retail

services in Citicorp as well as the North America mortgage portfolio within

Citi Holdings. Corporate net credit losses declined 19% to $234 million.

As previously disclosed, corporate net credit losses in 2014 included

approximately $165 million of net credit losses related to the Pemex supplier

program in Mexico (for additional information, see “Institutional Clients

Group” below). Excluding these net credit losses in the prior year, net credit

losses increased by approximately $111 million, primarily related to a

limited number of energy and energy-related corporate loans, predominantly

incurred during the latter part of 2015 (for additional information, see

“Institutional Clients Group” and “Credit Risk—Corporate Credit” below).

The net release of allowance for loan losses and unfunded lending

commitments was $120 million in 2015, compared to a $2.4 billion release

in 2014, excluding the impact of the mortgage settlement in the prior year.

Citicorp’s net reserve build was $409 million, compared to a net loan loss

reserve release of $1.4 billion in 2014. The build in 2015 was primarily driven

by net loan loss reserve builds in Institutional Clients Group (ICG) during

the latter part of 2015, including approximately $530 million for energy and

energy-related exposures. Overall, Citi expects its credit costs in Citicorp will

likely be higher in 2016 as compared to 2015 given that it believes the vast

majority of its net loan loss reserve releases have occurred as credit quality

has largely stabilized.

Citi Holdings’ net reserve release, excluding the impact of the mortgage

settlement in the prior year, decreased $443 million from the prior year

to $529 million, primarily reflecting lower net releases related to the

North America mortgage portfolio.

For additional information on Citi’s consumer and corporate credit costs

and allowance for loan losses, see “Credit Risk” below.

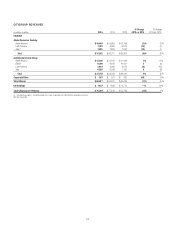

Capital

Citi continued to grow its regulatory capital during 2015, even as it returned

approximately $5.9 billion of capital to its shareholders in the form of

common stock repurchases and dividends. Citigroup’s Tier 1 Capital and

Common Equity Tier 1 Capital ratios, on a fully implemented basis, were

13.5% and 12.1% as of December 31, 2015, respectively, compared to 11.5%

and 10.6% as of December 31, 2014 (all based on the Basel III Advanced

Approaches for determining risk-weighted assets). Citigroup’s Supplementary

Leverage ratio as of December 31, 2015, on a fully implemented basis, was

7.1%, compared to 5.9% as of December 31, 2014. For additional information

on Citi’s capital ratios and related components, including the impact of Citi’s

DTAs on its capital ratios, see “Capital Resources” below.