Citibank 2015 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.244

For derivatives designated as net investment hedges, Citigroup follows the

forward-rate method outlined in ASC 815-35-35-16 through 35-26. According

to that method, all changes in fair value, including changes related to the

forward-rate component of the foreign currency forward contracts and the

time value of foreign currency options, are recorded in the Foreign currency

translation adjustment account within Accumulated other comprehensive

income (loss).

For foreign-currency-denominated debt instruments that are designated

as hedges of net investments, the translation gain or loss that is recorded in

the Foreign currency translation adjustment account is based on the spot

exchange rate between the functional currency of the respective subsidiary

and the U.S. dollar, which is the functional currency of Citigroup. To the

extent the notional amount of the hedging instrument exactly matches the

hedged net investment and the underlying exchange rate of the derivative

hedging instrument relates to the exchange rate between the functional

currency of the net investment and Citigroup’s functional currency (or, in the

case of a non-derivative debt instrument, such instrument is denominated in

the functional currency of the net investment), no ineffectiveness is recorded

in earnings.

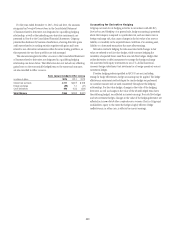

The pretax gain (loss) recorded in the Foreign currency translation

adjustment account within Accumulated other comprehensive income

(loss), related to the effective portion of the net investment hedges, is

$2,475 million, $2,890 million and $2,370 million for the years ended

December 31, 2015 2014 and 2013, respectively.

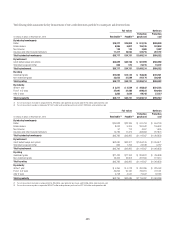

Credit Derivatives

Citi is a market maker and trades a range of credit derivatives. Through these

contracts, Citi either purchases or writes protection on either a single name

or a portfolio of reference credits. Citi also uses credit derivatives to help

mitigate credit risk in its corporate and consumer loan portfolios and other

cash positions, and to facilitate client transactions.

Citi monitors its counterparty credit risk in credit derivative contracts. As

of December 31, 2015 and December 31, 2014, approximately 98% of the

gross receivables are from counterparties with which Citi maintains collateral

agreements. A majority of Citi’s top 15 counterparties (by receivable balance

owed to Citi) are banks, financial institutions or other dealers. Contracts

with these counterparties do not include ratings-based termination events.

However, counterparty ratings downgrades may have an incremental effect by

lowering the threshold at which Citi may call for additional collateral.

The range of credit derivatives entered into includes credit default swaps,

total return swaps, credit options and credit-linked notes.

A credit default swap is a contract in which, for a fee, a protection seller

agrees to reimburse a protection buyer for any losses that occur due to a

predefined credit event on a reference entity. These credit events are defined

by the terms of the derivative contract and the reference credit and are

generally limited to the market standard of failure to pay on indebtedness

and bankruptcy of the reference credit and, in a more limited range of

transactions, debt restructuring. Credit derivative transactions that reference

emerging market entities will also typically include additional credit events

to cover the acceleration of indebtedness and the risk of repudiation or a

payment moratorium. In certain transactions, protection may be provided

on a portfolio of reference entities or asset-backed securities. If there is no

credit event, as defined by the specific derivative contract, then the protection

seller makes no payments to the protection buyer and receives only the

contractually specified fee. However, if a credit event occurs as defined in

the specific derivative contract sold, the protection seller will be required to

make a payment to the protection buyer. Under certain contracts, the seller of

protection may not be required to make a payment until a specified amount

of losses has occurred with respect to the portfolio and/or may only be

required to pay for losses up to a specified amount.

A total return swap typically transfers the total economic performance of

a reference asset, which includes all associated cash flows, as well as capital

appreciation or depreciation. The protection buyer receives a floating rate of

interest and any depreciation on the reference asset from the protection seller

and, in return, the protection seller receives the cash flows associated with

the reference asset plus any appreciation. Thus, according to the total return

swap agreement, the protection seller will be obligated to make a payment

any time the floating interest rate payment plus any depreciation of the

reference asset exceeds the cash flows associated with the underlying asset.

A total return swap may terminate upon a default of the reference asset or

a credit event with respect to the reference entity subject to the provisions of

the related total return swap agreement between the protection seller and the

protection buyer.

A credit option is a credit derivative that allows investors to trade or hedge

changes in the credit quality of a reference entity. For example, in a credit

spread option, the option writer assumes the obligation to purchase or sell

credit protection on the reference entity at a specified “strike” spread level.

The option purchaser buys the right to sell credit default protection on the

reference entity to, or purchase it from, the option writer at the strike spread

level. The payments on credit spread options depend either on a particular

credit spread or the price of the underlying credit-sensitive asset or other

reference. The options usually terminate if a credit event occurs with respect

to the underlying reference entity.

A credit-linked note is a form of credit derivative structured as a debt

security with an embedded credit default swap. The purchaser of the note

effectively provides credit protection to the issuer by agreeing to receive a

return that could be negatively affected by credit events on the underlying

reference credit. If the reference entity defaults, the note may be cash settled

or physically settled by delivery of a debt security of the reference entity. Thus,

the maximum amount of the note purchaser’s exposure is the amount paid

for the credit-linked note.