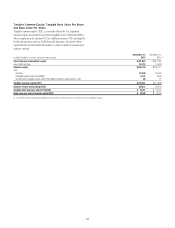

Citibank 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

LIQUIDITY RISKS

The Federal Reserve Board’s Total Loss-Absorbing Capacity

Proposal Includes Uncertainties and Potential Operational

Difficulties That Could Have a Negative Impact on Citi’s

Funding and Liquidity, Costs of Funds and Results

of Operations.

Title II of the Dodd-Frank Act grants the FDIC the authority, under certain

circumstances, to resolve systemically important financial institutions,

including Citi. The FDIC has released a notice describing its preferred “single

point of entry strategy” for such resolution, pursuant to which, generally,

a bank holding company would be placed in receivership, the unsecured

long-term debt of the holding company would bear losses and the operating

subsidiaries would be recapitalized.

Consistent with this strategy, in November 2015, the Federal Reserve Board

issued a notice of proposed rulemaking to require GSIBs, including Citi, to

(i) issue and maintain minimum levels of external “total loss-absorbing

capacity” (TLAC) and long-term debt (LTD), and (ii) adhere to various

“clean holding company” requirements at the bank holding company level,

including a prohibition on third-party short-term borrowings, derivatives and

other qualified financial contracts and certain guarantees, as well as a limit

on other non-TLAC eligible liabilities, such as structured notes and other

operating liabilities. While not included in its proposed requirements, the

Federal Reserve Board also indicated it was considering additional domestic

internal TLAC requirements for U.S. GSIBs which could require, among

other things, the “pre-positioning” of specified amounts of TLAC to certain

material subsidiaries of the bank holding company (for a summary of the

TLAC proposal, see “Managing Global Risk—Liquidity Risk” below).

There are significant uncertainties and interpretive issues arising

from the Federal Reserve Board’s proposal. With respect to the minimum

external LTD and TLAC requirements, the proposal would disqualify from

eligible LTD securities that permit acceleration for reasons other than

insolvency or non-payment of principal or interest as well as securities not

governed by U.S. law. Consistent with industry standards, the vast majority

of Citi’s otherwise eligible outstanding LTD provides for acceleration in

circumstances other than those permitted by the proposal. Additionally, Citi

has outstanding a significant amount of LTD not governed by U.S. law but

which would otherwise be eligible to count towards the minimum external

LTD requirement. Accordingly, if the requirements are adopted as proposed,

and no “grandfathering” of existing outstanding LTD is provided, Citi could

be required to refinance or issue significant amounts of additional debt,

simultaneously with other GSIBs impacted by the requirements. Further, such

ineligible debt securities would count against the limit imposed on non-TLAC

liabilities imposed under the clean holding company requirements of the

proposal, likely resulting in the need to repurchase significant amounts of

Citi’s outstanding debt in order not to be in breach of such limitations. Any

of these actions could negatively and significantly impact Citi’s funding and

liquidity management and planning, operations and costs of funds.

The clean holding company requirements pose additional operational

challenges and uncertainties. Citi, like many bank holding companies, often

guarantees the obligations of its subsidiaries, which guarantees include a

default right linked to the insolvency of Citi (i.e., downstream guarantees

with cross-default provisions). With no grandfathering of such guarantees

contemplated by the proposal, restructuring, revising or replacing the

extensive number of guarantees outstanding in order to meet the clean

holding company requirements could be costly and expose Citi to legal risk.

Further, the potential consequences of breaching the proposed clean holding

company requirements, as well as the consequences of not meeting many of

the other requirements in the Federal Reserve Board’s proposal, are not clear,

including what would be required to cure and the timeframe to do so.

In addition, any requirement to pre-position TLAC-eligible instruments

with material subsidiaries could result in additional funding inefficiencies,

increase Citi’s overall minimum TLAC requirements by reducing the

fungibility of its funding sources and require certain of Citi’s subsidiaries

to replace lower cost funding with other higher cost funding, which would

further impede Citi’s funding and liquidity management and planning, costs

of funds and results of operations.

The Maintenance of Adequate Liquidity and Funding

Depends on Numerous Factors, Including Those Outside

of Citi’s Control, Such as Market Disruptions and Increases

in Citi’s Credit Spreads.

As a global financial institution, adequate liquidity and sources of funding

are essential to Citi’s businesses. Citi’s liquidity and sources of funding can

be significantly and negatively impacted by factors it cannot control, such

as general disruptions in the financial markets, governmental fiscal and

monetary policies, regulatory changes or negative investor perceptions of

Citi’s creditworthiness.

In addition, Citi’s cost and ability to obtain deposits, secured funding

and long-term unsecured funding are directly related to its credit spreads.

Changes in credit spreads constantly occur and are market driven, including

both external market factors and factors specific to Citi, and can be highly

volatile. Citi’s credit spreads may also be influenced by movements in the

costs to purchasers of credit default swaps referenced to Citi’s long-term debt,

which are also impacted by these external and Citi-specific factors. Moreover,

Citi’s ability to obtain funding may be impaired if other market participants

are seeking to access the markets at the same time, or if market appetite is

reduced, as is likely to occur in a liquidity or other market crisis. In addition,

clearing organizations, regulators, clients and financial institutions with

which Citi interacts may exercise the right to require additional collateral

based on these market perceptions or market conditions, which could further

impair Citi’s access to and cost of funding.

As a holding company, Citi relies on dividends, distributions and other

payments from its subsidiaries to fund dividends as well as to satisfy its debt

and other obligations. Several of Citi’s U.S. and non-U.S. subsidiaries are

or may be subject to capital adequacy or other regulatory or contractual

restrictions on their ability to provide such payments, including any local

regulatory stress test requirements or potential domestic internal TLAC

requirements (as discussed above). Limitations on the payments that Citi

receives from its subsidiaries could also impact its liquidity.