Citibank 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

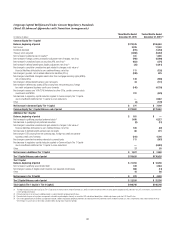

CAPITAL RESOURCES

Overview

Capital is used principally to support assets in Citi’s businesses and to

absorb credit, market, and operational losses. Citi primarily generates

capital through earnings from its operating businesses. Citi may augment

its capital through issuances of common stock, noncumulative perpetual

preferred stock and equity issued through awards under employee benefit

plans, among other issuances. During 2015, Citi continued to raise capital

through noncumulative perpetual preferred stock issuances amounting to

approximately $6.3 billion, resulting in a total of approximately $16.7 billion

outstanding as of December 31, 2015. In addition, during 2015, Citi returned

a total of approximately $5.9 billion of capital to common shareholders in

the form of share repurchases (approximately 101 million common shares)

and dividends.

Further, Citi’s capital levels may also be affected by changes in accounting

and regulatory standards as well as the impact of future events on Citi’s

business results, such as corporate and asset dispositions.

Capital Management

Citigroup’s capital management framework is designed to ensure that

Citigroup and its principal subsidiaries maintain sufficient capital consistent

with each entity’s respective risk profile, management targets, and all

applicable regulatory standards and guidelines. Citi assesses its capital

adequacy against a series of internal quantitative capital goals, designed

to evaluate the Company’s capital levels in expected and stressed economic

environments. Underlying these internal quantitative capital goals are

strategic capital considerations, centered on preserving and building

financial strength. The Citigroup Capital Committee, with oversight from

the Risk Management Committee of Citigroup’s Board of Directors, has

responsibility for Citi’s aggregate capital structure, including the capital

assessment and planning process, which is integrated into Citi’s capital

plan. Balance sheet management, including oversight of capital adequacy,

for Citigroup’s subsidiaries is governed by each entity’s Asset and Liability

Committee. For additional information regarding Citi’s capital planning and

stress testing exercises, see “Capital Planning and Stress Testing” below.

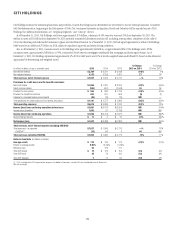

Current Regulatory Capital Standards

Citi is subject to regulatory capital standards issued by the Federal Reserve

Board which, commencing with 2014, constitute the U.S. Basel III

rules. These rules establish an integrated capital adequacy framework,

encompassing both risk-based capital ratios and leverage ratios.

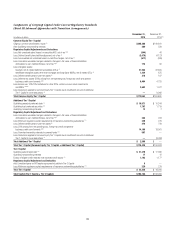

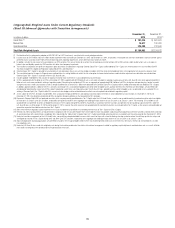

Risk-Based Capital Ratios

The U.S. Basel III rules set forth the composition of regulatory capital

(including the application of regulatory capital adjustments and

deductions), as well as two comprehensive methodologies (a Standardized

Approach and Advanced Approaches) for measuring total risk-weighted

assets. Total risk-weighted assets under the Advanced Approaches, which

are primarily models based, include credit, market, and operational risk-

weighted assets. Conversely, the Standardized Approach excludes operational

risk-weighted assets and generally applies prescribed supervisory risk weights

to broad categories of credit risk exposures. As a result, credit risk-weighted

assets calculated under the Advanced Approaches are more risk sensitive than

those calculated under the Standardized Approach. Market risk-weighted

assets are derived on a generally consistent basis under both approaches.

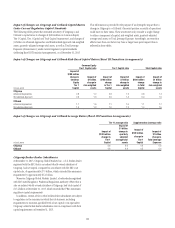

The U.S. Basel III rules establish stated minimum Common Equity

Tier 1 Capital, Tier 1 Capital and Total Capital ratios for substantially all

U.S. banking organizations, including Citi and Citibank, N.A. (Citibank).

Moreover, these rules provide for both a fixed Capital Conservation Buffer

and a discretionary Countercyclical Capital Buffer, which would be available

to absorb losses in advance of any potential impairment of regulatory

capital below the stated minimum risk-based capital ratio requirements. In

December 2015, the Federal Reserve Board voted to affirm the Countercyclical

Capital Buffer amount at the current level of 0%, and issued a proposed

framework for implementing the Countercyclical Capital Buffer in the future.

For additional information regarding the Federal Reserve Board’s proposed

policy statement on the Countercyclical Capital Buffer, see “Regulatory

Capital Standards Developments” below.

Further, the U.S. Basel III rules implement the “capital floor provision”

of the so-called “Collins Amendment” of the Dodd-Frank Act, which requires

Advanced Approaches banking organizations, such as Citi and Citibank, to

calculate each of the three risk-based capital ratios (Common Equity Tier 1

Capital, Tier 1 Capital, and Total Capital) under both the Standardized

Approach starting on January 1, 2015 (or, for 2014, prior to the effective date

of the Standardized Approach, the Basel I credit risk and Basel II.5 market

risk capital rules) and the Advanced Approaches and publicly report (as well

as measure compliance against) the lower of each of the resulting risk-based

capital ratios.