Citibank 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

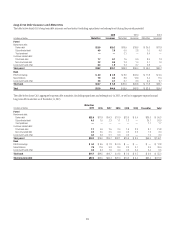

End-of-period deposits increased 1% year-over-year and remained

relatively unchanged quarter-over-quarter. Excluding the impact of FX

translation, Citigroup’s end-of-period deposits increased 4% year-over-year

and 1% sequentially, despite significant reductions in Citi Holdings deposits

from the prior-year period.

Excluding the impact of FX translation, Citicorp deposits grew 5% year-

over-year. Within Citicorp, GCB deposits increased 2% year-over-year, driven

by 5% growth in international deposits. ICG deposits increased 9% year-over-

year, with continued deposit growth in treasury and trade solutions and the

private bank.

The decline in Citi Holdings deposits from the prior-year period was

primarily driven by the now-complete transfer of Morgan Stanley Smith

Barney (MSSB) deposits to Morgan Stanley.

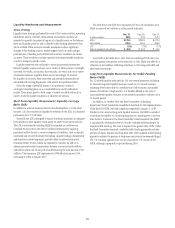

Citi monitors its deposit base across multiple dimensions, including what

Citi refers to as “LCR value” or the liquidity value of the deposit base under

the U.S. LCR rules (as discussed under “Short-Term Liquidity Measurement:

Liquidity Coverage Ratio (LCR)” below). Citi defines the liquidity value of

deposits as the percentage of deposits assumed to remain following a 30-day

period of liquidity stress. As discussed below, under the LCR rules, deposits are

assigned liquidity values based on expected behavior under stress, determined

by the type of deposit and the type of client. Generally, the LCR rules prioritize

transactional and operating accounts of consumers (including retail and

commercial banking deposits) and corporations respectively, while assigning

lower liquidity values to non-operating deposit balances of financial

institutions. As of December 31, 2015, Citi’s total deposits had an aggregate

liquidity value of approximately 73%, down slightly sequentially and

unchanged from December 31, 2014. Within the 73% total liquidity value as

of year-end 2015, Citi’s GCB deposits had a liquidity value of approximately

87% and ICG deposits, including Corporate/Other, had a liquidity value of

approximately 66%.

Long-Term Debt

Long-term debt (generally defined as debt with original maturities of one

year or more) represents the most significant component of Citi’s funding

for the parent entities and is a supplementary source of funding for the

bank entities.

Long-term debt is an important funding source due in part to its

multi-year contractual maturity structure. The weighted-average maturities

of unsecured long-term debt issued by Citigroup and its affiliates (including

Citibank) with a remaining life greater than one year (excluding remaining

trust preferred securities outstanding) was approximately 6.9 years as of

December 31, 2015, unchanged from the prior-year period and a slight

increase sequentially, due in part to the issuance of longer-dated debt

securities and the redemption of shorter-dated debt securities during the

fourth quarter of 2015.

Citi’s long-term debt outstanding at the parent includes senior and

subordinated debt and what Citi refers to as customer-related debt, consisting

of structured notes, such as equity- and credit-linked notes, as well as non-

structured notes. Citi’s issuance of customer-related debt is generally driven

by customer demand and supplements benchmark debt issuance as a source

of funding for Citi’s parent entities. Citi’s long-term debt at the bank also

includes FHLB advances and securitizations.

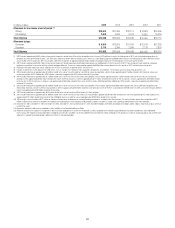

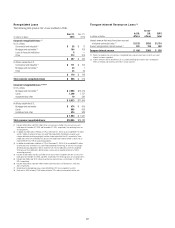

Long-Term Debt Outstanding

The following table sets forth Citi’s total long-term debt outstanding for the

periods indicated:

In billions of dollars

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Parent

Benchmark debt:

Senior debt $ 90.3 $ 99.5 $ 97.9

Subordinated debt 26.9 26.8 25.5

Trust preferred 1.7 1.7 1.7

Customer-related debt

Structured debt 21.8 23.1 22.3

Non-structured debt 3.0 3.6 5.9

Local country and other (1) 2.4 2.1 4.7

Total parent $146.1 $156.8 $158.0

Bank

FHLB borrowings $ 17.8 $ 17.3 $ 19.8

Securitizations (2) 30.9 32.0 38.1

Local country and other (1) 6.5 7.4 7.2

Total bank $ 55.2 $ 56.7 $ 65.1

Total long-term debt $201.3 $213.5 $223.1

Note: Amounts represent the current value of long-term debt on Citi’s Consolidated Balance Sheet which,

for certain debt instruments, includes consideration of fair value, hedging impacts and unamortized

discounts and premiums.

(1) Local country debt includes debt issued by Citi’s affiliates in support of their local operations.

(2) Predominantly credit card securitizations, primarily backed by Citi-branded credit card receivables.

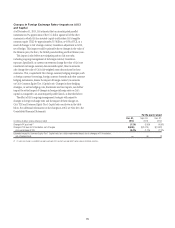

Citi’s total long-term debt outstanding decreased both year-over-year

and quarter-over-quarter, primarily due to significant buybacks of senior

and subordinated debt at the parent level during the fourth quarter of 2015

(discussed below), as well as continued reductions in securitizations at the

bank entities.

As part of its liability management, Citi has considered, and may continue

to consider, opportunities to repurchase its long-term debt pursuant to

open market purchases, tender offers or other means. Such repurchases

help reduce Citi’s overall funding costs and assist it in meeting regulatory

changes and requirements. During 2015, Citi repurchased an aggregate of

approximately $21.1 billion of its outstanding long-term debt, including

early redemptions of FHLB advances. Of this amount, approximately

$11.5 billion was repurchased in the fourth quarter of 2015 as Citi completed

significant asset sales in Citi Holdings, including the OneMain Financial

business. Accordingly, while Citi anticipates continued liability management

activities in 2016, it does not currently expect repurchases to remain at the

level experienced in 2015.