Citibank 2015 Annual Report Download - page 302

Download and view the complete annual report

Please find page 302 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.284

clean title to the inventory, insuring it, and attesting that there are no third

party encumbrances. The counterparty is a non-Chinese subsidiary of a large

multinational corporation, and the counterparty’s obligations under the

contracts are guaranteed by the parent company.

On July 22, 2014, Citibank and CGML commenced proceedings in the

Commercial Court in London to enforce their rights against the counterparty

under the relevant agreements in relation to approximately $285 million in

financing. That counterparty and a Chinese warehouse provider previously

brought actions in the English courts to establish the parties’ rights and

obligations under these agreements. In early December 2014, the English

court conducted a preliminary trial concerning, among other issues, the

question of whether Citibank and/or CGML had appropriately accelerated

their counterparty’s obligation to repay under the applicable agreements,

given these facts and circumstances. The High Court in London issued a

judgment on May 22, 2015 holding that the Citigroup affiliates had properly

served bring forward event notices, but that because the metal had not

been properly delivered, the counterparty did not yet have to pay Citibank

and CGML.

As a result of various filings by the parties, on January 15, 2016, Citibank

and CGML were informed by the English Court of Appeal (i) that their

application for permission to appeal certain aspects of the High Court’s

2015 judgment had been granted; and (ii) that the counterparty had also

been given permission to appeal certain aspects of the 2015 judgment.

Various procedural matters continue. Additional information concerning

this action is publicly available in court filings under the claim reference:

Mercuria Energy Trading PTE Ltd & Another v. Citibank, N.A. & Another,

Claim No. 2014 Folio 709, Appeal Nos. 2015/2407 (Citigroup) and 2015/2395

(Mercuria) as regards the appeals.

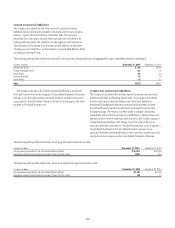

The financings at issue are carried at fair value. As with any position

carried at fair value, Citigroup adjusts the positions and records a gain or loss

on the Consolidated Statement of Income in accordance with GAAP.

Credit Crisis-Related Litigation and Other Matters

Citigroup and Related Parties have been named as defendants in numerous

legal actions and other proceedings asserting claims for damages and

related relief for losses arising from the global financial credit crisis that

began in 2007. Such matters include, among other types of proceedings,

claims asserted by: (i) individual investors and purported classes of

investors in Citigroup’s common and preferred stock and debt, alleging

violations of the federal securities laws, foreign laws, state securities and

fraud law, and the Employee Retirement Income Security Act (ERISA); and

(ii) individual investors and purported classes of investors in securities and

other investments underwritten, issued or marketed by Citigroup, including

securities issued by other public companies, collateralized debt obligations

(CDOs), mortgage-backed securities (MBS), auction rate securities,

investment funds, and other structured or leveraged instruments, which have

suffered losses as a result of the credit crisis. These matters have been filed in

state and federal courts across the U.S. and in foreign tribunals, as well as in

arbitrations before the Financial Industry Regulatory Authority (FINRA) and

other arbitration associations.

In addition to these litigations and arbitrations, Citigroup continues to

cooperate fully in response to subpoenas and requests for information from

the Securities and Exchange Commission (SEC), FINRA, state attorneys

general, the U.S. Department of Justice and subdivisions thereof, the Office

of the Special Inspector General for the Troubled Asset Relief Program, bank

regulators, and other government agencies and authorities, in connection

with various formal and informal (and, in many instances, industry-wide)

inquiries concerning Citigroup’s mortgage-related conduct and business

activities, as well as other business activities affected by the credit crisis. These

business activities include, but are not limited to, Citigroup’s sponsorship,

packaging, issuance, marketing, trading, servicing and underwriting of CDOs

and MBS, its origination, sale or other transfer, servicing, and foreclosure of

residential mortgages, and its origination and securitization of auto loans.

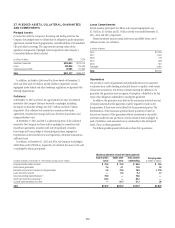

Mortgage-Related Litigation and Other Matters

Securities Actions: Beginning in November 2007, Citigroup and Related

Parties were named as defendants in a variety of class and individual

securities actions filed by investors in Citigroup’s equity and debt securities

in state and federal courts relating to Citigroup’s disclosures regarding its

exposure to subprime-related assets.

Citigroup and Related Parties have been named as defendants in a variety

of putative class actions and individual actions arising out of Citigroup’s

exposure to CDOs and other assets that declined in value during the financial

crisis. Many of these matters have been dismissed or settled. These actions

assert a wide range of claims, including claims under the federal securities

laws, foreign securities laws, ERISA, and state law. Additional information

concerning certain of these actions is publicly available in court filings under

the docket numbers 10 Civ. 9646 (S.D.N.Y.) (Stein, J.), 11 Civ. 7672 (S.D.N.Y.)

(Koeltl, J.), 13-4488, 13-4504, and 15-2461 (2d Cir.).

Beginning in November 2007, certain Citigroup affiliates also have

been named as defendants arising out of their activities as underwriters

of securities in actions brought by investors in securities issued by public

companies adversely affected by the credit crisis. Many of these matters

have been dismissed or settled. As a general matter, issuers indemnify

underwriters in connection with such claims, but in certain of these matters

Citigroup affiliates are not being indemnified or may in the future cease to be

indemnified because of the financial condition of the issuer.

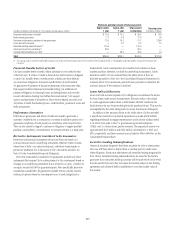

Mortgage-Backed Securities and CDO Investor Actions: Beginning in

July 2010, Citigroup and Related Parties have been named as defendants in

complaints filed by purchasers of MBS and CDOs sold or underwritten by

Citigroup. The complaints generally assert that defendants made material

misrepresentations and omissions about the credit quality of the assets

underlying the securities or the manner in which those assets were selected,

and typically assert claims under Section 11 of the Securities Act of 1933,

state blue sky laws, and/or common-law misrepresentation-based causes

of action.