Citibank 2015 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.247

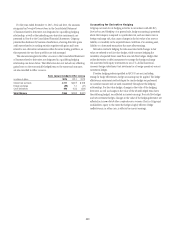

Credit-Risk-Related Contingent Features in Derivatives

Certain derivative instruments contain provisions that require the Company

to either post additional collateral or immediately settle any outstanding

liability balances upon the occurrence of a specified event related to the

credit risk of the Company. These events, which are defined by the existing

derivative contracts, are primarily downgrades in the credit ratings of the

Company and its affiliates. The fair value (excluding CVA) of all derivative

instruments with credit-risk-related contingent features that were in a net

liability position at both December 31, 2015 and December 31, 2014 was

$22 billion and $30 billion, respectively. The Company had posted $19 billion

and $27 billion as collateral for this exposure in the normal course of

business as of December 31, 2015 and December 31, 2014, respectively.

A downgrade could trigger additional collateral or cash settlement

requirements for the Company and certain affiliates. In the event that

Citigroup and Citibank were downgraded a single notch by all three major

rating agencies as of December 31, 2015, the Company could be required

to post an additional $1.8 billion as either collateral or settlement of the

derivative transactions. Additionally, the Company could be required to

segregate with third-party custodians collateral previously received from

existing derivative counterparties in the amount of $0.1 billion upon

the single notch downgrade, resulting in aggregate cash obligations and

collateral requirements of approximately $1.9 billion.

Derivatives Accompanied by Financial Asset Transfers

The Company executes total return swaps which provide it with synthetic

exposure to substantially all of the economic return of the securities or other

financial assets referenced in the contract. In certain cases, the derivative

transaction is accompanied by the Company’s transfer of the referenced

financial asset to the derivative counterparty, most typically in response

to the derivative counterparty’s desire to hedge, in whole or in part, its

synthetic exposure under the derivative contract by holding the referenced

asset in funded form. In certain jurisdictions these transactions qualify as

sales, resulting in derecognition of the securities transferred (see Note 1 to

the Consolidated Financial Statements for further discussion of the related

sale conditions for transfers of financial assets). For a significant portion of

the transactions, the Company has also executed another total return swap

where the Company passes on substantially all of the economic return of

the referenced securities to a different third party seeking the exposure. In

those cases, the Company is not exposed, on a net basis, to changes in the

economic return of the referenced securities.

These transactions generally involve the transfer of the Company’s

liquid government bonds, convertible bonds, or publicly traded corporate

equity securities from the trading portfolio and are executed with third-

party financial institutions. The accompanying derivatives are typically

total return swaps. The derivatives are cash settled and subject to ongoing

margin requirements.

When the conditions for sale accounting are met, the Company reports

the transfer of the referenced financial asset as a sale and separately reports

the accompanying derivative transaction. These transactions generally do

not result in a gain or loss on the sale of the security, because the transferred

security was held at fair value in the Company’s trading portfolio. For

transfers of financial assets accounted for by the Company as a sale, where

the Company has retained substantially all of the economic exposure to the

transferred asset through a total return swap executed in contemplation

of the initial sale with the same counterparty and still outstanding as of

December 31, 2015, both the asset carrying amounts derecognized and gross

cash proceeds received as of the date of derecognition were $1.0 billion. At

December 31, 2015, the fair value of these previously derecognized assets

was $1.0 billion and the fair value of the total return swaps was $7 million

recorded as gross derivative assets and $35 million recorded as gross

derivative liabilities. The balances for the total return swaps are on a gross

basis, before the application of counterparty and cash collateral netting,

and are included primarily as equity derivatives in the tabular disclosures in

this Note.