Citibank 2015 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.231

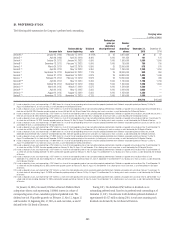

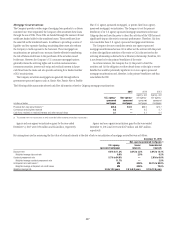

on the Company’s internal risk ratings. At December 31, 2015 and 2014, the

conduits had approximately $21.3 billion and $29.2 billion of purchased

assets outstanding, respectively, and had incremental funding commitments

with clients of approximately $11.6 billion and $13.5 billion, respectively.

Substantially all of the funding of the conduits is in the form of short-

term commercial paper. At December 31, 2015 and 2014, the weighted

average remaining lives of the commercial paper issued by the conduits

were approximately 56 and 57 days, respectively.

The primary credit enhancement provided to the conduit investors is

in the form of transaction-specific credit enhancements described above.

In addition to the transaction-specific credit enhancements, the conduits,

other than the government guaranteed loan conduit, have obtained a

letter of credit from the Company, which is equal to at least 8% to 10% of

the conduit’s assets with a minimum of $200 million. The letters of credit

provided by the Company to the conduits total approximately $1.9 billion

and $2.3 billion as of December 31, 2015 and 2014, respectively. The net

result across multi-seller conduits administered by the Company, other than

the government guaranteed loan conduit, is that, in the event defaulted

assets exceed the transaction-specific credit enhancements described above,

any losses in each conduit are allocated first to the Company and then the

commercial paper investors.

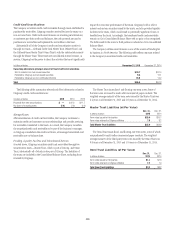

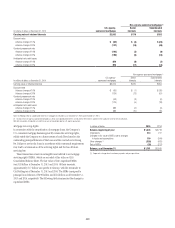

The Company also provides the conduits with two forms of liquidity

agreements that are used to provide funding to the conduits in the event

of a market disruption, among other events. Each asset of the conduits is

supported by a transaction-specific liquidity facility in the form of an asset

purchase agreement (APA). Under the APA, the Company has generally

agreed to purchase non-defaulted eligible receivables from the conduit at

par. The APA is not designed to provide credit support to the conduit, as it

generally does not permit the purchase of defaulted or impaired assets. Any

funding under the APA will likely subject the underlying conduit clients to

increased interest costs. In addition, the Company provides the conduits with

program-wide liquidity in the form of short-term lending commitments.

Under these commitments, the Company has agreed to lend to the conduits

in the event of a short-term disruption in the commercial paper market,

subject to specified conditions. The Company receives fees for providing

both types of liquidity agreements and considers these fees to be on fair

market terms.

Finally, the Company is one of several named dealers in the commercial

paper issued by the conduits and earns a market-based fee for providing

such services. Along with third-party dealers, the Company makes a market

in the commercial paper and may from time to time fund commercial

paper pending sale to a third party. On specific dates with less liquidity in

the market, the Company may hold in inventory commercial paper issued

by conduits administered by the Company, as well as conduits administered

by third parties. Separately, in the normal course of business, the Company

invests in commercial paper, including commercial paper issued by the

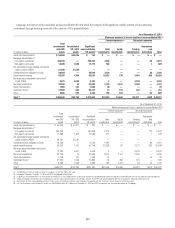

Company's conduits. At December 31, 2015 and 2014, the Company owned

$11.4 billion and $10.6 billion, respectively, of the commercial paper issued

by its administered conduits. The Company's investments were not driven by

market illiquidity and the Company is not obligated under any agreement to

purchase the commercial paper issued by the conduits.

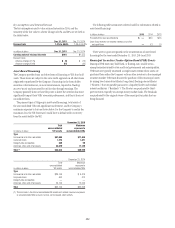

The asset-backed commercial paper conduits are consolidated by

the Company. The Company has determined that, through its roles as

administrator and liquidity provider, it has the power to direct the activities

that most significantly impact the entities’ economic performance. These

powers include its ability to structure and approve the assets purchased by the

conduits, its ongoing surveillance and credit mitigation activities, its ability

to sell or repurchase assets out of the conduits, and its liability management.

In addition, as a result of all the Company’s involvement described above,

it was concluded that the Company has an economic interest that could

potentially be significant. However, the assets and liabilities of the conduits

are separate and apart from those of Citigroup. No assets of any conduit are

available to satisfy the creditors of Citigroup or any of its other subsidiaries.

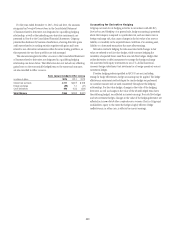

Collateralized Loan Obligations

A collateralized loan obligation (CLO) is a VIE that purchases a portfolio

of assets consisting primarily of non-investment grade corporate loans.

The CLO issues multiple tranches of debt and equity to investors to fund

the asset purchases and pay upfront expenses associated with forming the

CLO. A third-party asset manager is contracted by the CLO to purchase

the underlying assets from the open market and monitor the credit risk

associated with those assets. Over the term of the CLO, the asset manager

directs purchases and sales of assets in a manner consistent with the CLO’s

asset management agreement and indenture. In general, the CLO asset

manager will have the power to direct the activities of the entity that most

significantly impact the economic performance of the CLO. Investors in

the CLO, through their ownership of debt and/or equity in the CLO, can

also direct certain activities of the CLO, including removing the CLO asset

manager under limited circumstances, optionally redeeming the notes,

voting on amendments to the CLO’s operating documents and other

activities. The CLO has a finite life, typically 12 years.

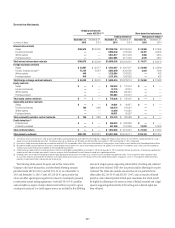

Citi serves as a structuring and placement agent with respect to the CLO.

Typically, the debt and equity of the CLO are sold to third-party investors.

On occasion, certain Citi entities may purchase some portion of the CLO’s

liabilities for investment purposes. In addition, Citi may purchase, typically

in the secondary market, certain securities issued by the CLO to support its

market making activities.

The Company does not generally have the power to direct the activities of

the entity that most significantly impact the economic performance of the

CLOs, as this power is generally held by a third-party asset manager of the

CLO. As such, those CLOs are not consolidated.