Citibank 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.115

Based on this announcement, Citi expects to begin using the SIMADI

rate in the first quarter of 2016 to remeasure its net bolivar-denominated

monetary assets, despite the possibly limited availability of U.S. dollars

(notwithstanding the fact that it has been described as a free floating rate)

and although the new SIMADI rate may not necessarily be reflective of

economic reality. At the expected minimum new SIMADI rate of 202 bolivars

per U.S. dollar, Citi estimates that it will incur an approximate $172 million

foreign currency loss in the first quarter of 2016, which could increase if

the bolivar continues to devalue in the new SIMADI market. Additionally,

Citi expects its revenues and expenses will be translated at the SIMADI rate

beginning in the first quarter of 2016. Because the new foreign exchange

control rules have not yet been officially published and are thus not yet

effective, however, the impact to Citi’s results of operations as a result of the

February 17th announcement is not yet certain.

Russia

During 2015, political events led to the imposition of international sanctions

against Russia (as well as Russian entities, business sectors, individuals

or otherwise). These ongoing sanctions, coupled with lower oil and other

commodity prices, particularly during the second half of 2015, have had a

significant impact on Russia’s economy, and could continue to do so. During

2015, the Russian ruble depreciated by 22% against the U.S. dollar.

Citibank operates in Russia through a subsidiary, which uses the Russian

ruble as its functional currency. Citibank’s net investment in Russia was

approximately $0.8 billion at December 31, 2015, compared to $0.9 billion at

September 30, 2015 and $1.1 billion at December 31, 2014. As of December 31,

2015, substantially all of Citibank’s net investment was hedged (subject to

related tax adjustments) using forward foreign exchange contracts. Total

third-party assets of the Russian Citibank subsidiary were approximately

$5.0 billion as of December 31, 2015, unchanged from September 30, 2015

and compared to $6.1 billion at December 31, 2014. These assets were

primarily composed of corporate and consumer loans, Russian government

debt securities, and cash on deposit with the Central Bank of Russia. The

large majority of these assets were funded by local deposits. (For additional

information on Citi’s exposures related to Russia, see “Emerging Markets

Exposures” above.)

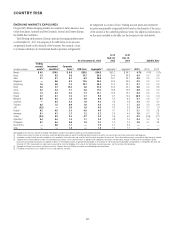

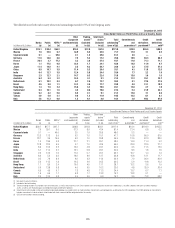

FFIEC—Cross-Border Claims on Third Parties and Local

Country Assets

Citi’s cross-border disclosures are based on the country exposure bank

regulatory reporting guidelines of the Federal Financial Institutions

Examination Council (FFIEC), as revised in December 2013. The following

summarizes some of the FFIEC key reporting guidelines:

• Amounts are based on the domicile of the ultimate obligor, counterparty,

collateral, issuer or guarantor, as applicable.

• Amounts do not consider the benefit of collateral received for securities

financing transactions (i.e., repurchase agreements, reverse repurchase

agreements and securities loaned and borrowed) and are reported based

on notional amounts.

• Netting of derivatives receivables and payables, reported at fair value, is

permitted, but only under a legally binding netting agreement with the

same specific counterparty, and does not include the benefit of margin

received or hedges.

• The netting of long and short positions for AFS securities and trading

portfolios is not permitted.

• Credit default swaps (CDS) are included based on the gross notional

amount sold and purchased and do not include any offsetting CDS on the

same underlying entity.

• Loans are reported without the benefit of hedges.

Given the requirements noted above, Citi’s FFIEC cross-border exposures

and total outstandings tend to fluctuate, in some cases, significantly, from

period to period. As an example, because total outstandings under FFIEC

guidelines do not include the benefit of margin or hedges, market volatility

in interest rates, foreign exchange rates and credit spreads may cause

significant fluctuations in the level of total outstandings, all else being equal.