Citibank 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

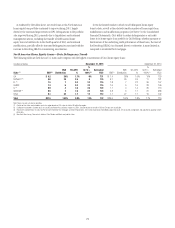

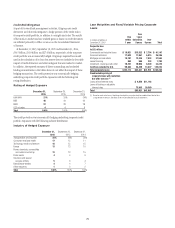

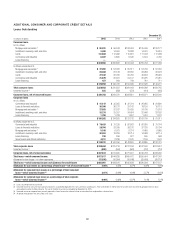

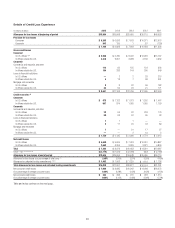

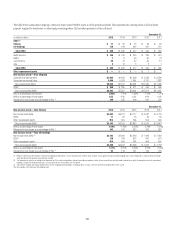

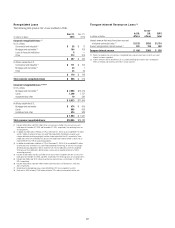

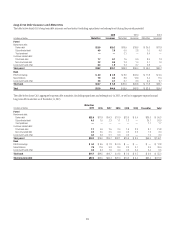

In millions of dollars 2015 2014 2013 2012 2011

Allowance for loan losses at end of period (13)

Citicorp $10,616 $11,465 $13,174 $14,623 $16,699

Citi Holdings 2,010 4,529 6,474 10,832 13,416

Total Citigroup $12,626 $15,994 $19,648 $25,455 $30,115

Allowance by type

Consumer $ 9,916 $13,605 $17,064 $22,679 $27,236

Corporate 2,710 2,389 2,584 2,776 2,879

Total Citigroup $12,626 $15,994 $19,648 $25,455 $30,115

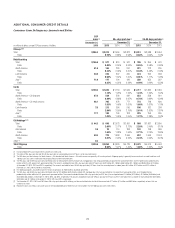

(1) 2012 includes approximately $635 million of incremental charge-offs related to the Office of the Comptroller of the Currency (OCC) guidance issued in the third quarter of 2012, which required mortgage loans to

borrowers that have gone through Chapter 7 U.S. Bankruptcy Code to be written down to collateral value. There was a corresponding approximate $600 million release in the third quarter of 2012 Allowance for loan

losses related to these charge-offs. 2012 also includes a benefit to charge-offs of approximately $40 million related to finalizing the impact of the OCC guidance in the fourth quarter of 2012.

(2) 2012 includes approximately $370 million of incremental charge-offs related to previously deferred principal balances on modified loans in the first quarter of 2012. These charge-offs were related to anticipated

forgiveness of principal in connection with the national mortgage settlement. There was a corresponding approximate $350 million reserve release in the first quarter of 2012 related to these charge-offs.

(3) Recoveries have been reduced by certain collection costs that are incurred only if collection efforts are successful.

(4) Includes all adjustments to the allowance for credit losses, such as changes in the allowance from acquisitions, dispositions, securitizations, FX translation, purchase accounting adjustments, etc.

(5) 2015 includes reductions of approximately $2.4 billion related to the sale or transfer to held-for-sale (HFS) of various loan portfolios, which includes approximately $1.5 billion related to the transfer of various real

estate loan portfolios to HFS. Additionally, 2015 includes a reduction of approximately $474 million related to FX translation.

(6) 2014 includes reductions of approximately $1.1 billion related to the sale or transfer to HFS of various loan portfolios, which includes approximately $411 million related to the transfer of various real estate loan

portfolios to HFS, approximately $204 million related to the transfer to HFS of a business in Greece, approximately $177 million related to the transfer to HFS of a business in Spain, approximately $29 million related

to the transfer to HFS of a business in Honduras, and approximately $108 million related to the transfer to HFS of various EMEA loan portfolios. Additionally, 2014 includes a reduction of approximately $463 million

related to FX translation.

(7) 2013 includes reductions of approximately $2.4 billion related to the sale or transfer to HFS of various loan portfolios, which includes approximately $360 million related to the sale of Credicard and approximately

$255 million related to a transfer to HFS of a loan portfolio in Greece, approximately $230 million related to a non-provision transfer of reserves associated with deferred interest to other assets which includes deferred

interest and approximately $220 million related to FX translation.

(8) 2012 includes reductions of approximately $875 million related to the sale or transfer to HFS of various U.S. loan portfolios.

(9) 2011 includes reductions of approximately $1.6 billion related to the sale or transfer to HFS of various U.S. loan portfolios, approximately $240 million related to the sale of the Egg Banking PLC credit card business,

approximately $72 million related to the transfer of the Citi Belgium business to held-for-sale and approximately $290 million related to FX translation.

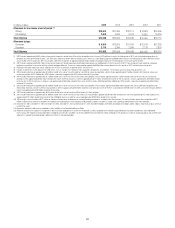

(10) 2015 includes a reclassification of $271 million of Allowance for loan losses to allowance for unfunded lending commitments, included in the Other line item. This reclassification reflects the re-attribution of $271

million in allowance for credit losses between the funded and unfunded portions of the corporate credit portfolios and does not reflect a change in the underlying credit performance of these portfolios.

(11) December 31, 2015, December 31, 2014, December 31, 2013, December 31, 2012 and December 31, 2011 exclude $5.0 billion, $5.9 billion, $5.0 billion, $5.3 billion and $5.3 billion, respectively, of loans which are

carried at fair value.

(12) Represents additional credit reserves recorded as Other liabilities on the Consolidated Balance Sheet.

(13) Allowance for loan losses represents management’s best estimate of probable losses inherent in the portfolio, as well as probable losses related to large individually evaluated impaired loans and troubled debt

restructurings. See “Significant Accounting Policies and Significant Estimates” and Note 1 to the Consolidated Financial Statements below. Attribution of the allowance is made for analytical purposes only and the entire

allowance is available to absorb probable credit losses inherent in the overall portfolio.