Citibank 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

LIQUIDITY RISK

OVERVIEW

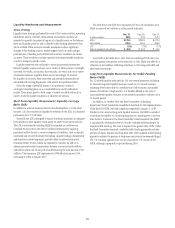

Adequate and diverse sources of funding and liquidity are essential to Citi’s

businesses. Funding and liquidity risks arise from several factors, many of

which are mostly or entirely outside Citi’s control, such as disruptions in the

financial markets, changes in key funding sources, credit spreads, changes

in Citi’s credit ratings and political and economic conditions in certain

countries. For additional information, see “Risk Factors” above.

Citi’s funding and liquidity objectives are aimed at (i) funding its existing

asset base; (ii) growing its core businesses in Citicorp; (iii) maintaining

sufficient liquidity, structured appropriately, so that Citi can operate under

a variety of adverse circumstances, including potential firm-specific and/or

market liquidity events in varying durations and severity; and (iv) satisfying

regulatory requirements. Citigroup’s primary liquidity objectives are

established by entity, and in aggregate, across two major categories:

• Citibank; and

• the non-bank and other, which includes the parent holding company

(Citigroup), Citi’s broker-dealer subsidiaries and other non-bank

subsidiaries that are consolidated into Citigroup, as well as Banamex and

Citibank (Switzerland) AG.

At an aggregate level, Citigroup’s goal is to maintain sufficient funding

in amount and tenor to fully fund customer assets and to provide an

appropriate amount of cash and high-quality liquid assets (as discussed

further below), even in times of stress. The liquidity risk management

framework provides that certain entities be self-sufficient or net providers

of liquidity, including in conditions established under their designated

stress tests.

Citi’s primary sources of funding include (i) deposits via Citi’s bank

subsidiaries, which are Citi’s most stable and lowest cost source of long-

term funding, (ii) long-term debt (primarily senior and subordinated

debt) primarily issued at the parent and certain bank subsidiaries, and

(iii) stockholders’ equity. These sources may be supplemented by short-term

borrowings, primarily in the form of secured funding transactions.

As referenced above, Citigroup works to ensure that the structural tenor

of these funding sources is sufficiently long in relation to the tenor of its

asset base. The goal of Citi’s asset/liability management is to ensure that

there is excess tenor in the liability structure relative to the liquidity profile of

the assets. This reduces the risk that liabilities will become due before asset

maturities or monetizations through sale, and in turn generates liquidity.

This liquidity is held primarily in the form of high-quality liquid assets

(HQLA), as set forth in the table below.

Citi’s Treasurer has overall responsibility for management of Citi’s HQLA.

Citi’s liquidity is managed via a centralized treasury model by Corporate

Treasury, in conjunction with regional and in-country treasurers. Pursuant

to this approach, Citi’s HQLA is managed with emphasis on asset-liability

management and entity-level liquidity adequacy throughout Citi.

Citi’s Chief Risk Officer is responsible for the overall risk profile of Citi’s

HQLA. The Chief Risk Officer and Citi’s CFO co-chair Citi’s Asset Liability

Management Committee (ALCO), which includes Citi’s Treasurer and

other senior executives. ALCO sets the strategy of the liquidity portfolio and

monitors its performance. Significant changes to portfolio asset allocations

need to be approved by ALCO.

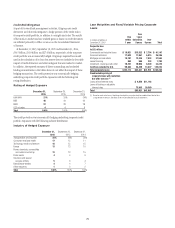

High-Quality Liquid Assets (HQLA)

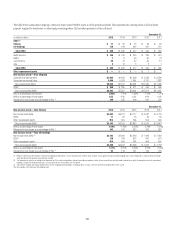

Citibank Non-Bank and Other (1) Total

In billions of dollars

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Available cash $ 52.4 $ 68.9 $ 65.2 $16.9 $21.5 $37.5 $ 69.3 $ 90.4 $102.7

U.S. sovereign 110.1 119.6 112.4 32.4 22.4 27.1 142.4 142.0 139.5

U.S. agency/agency MBS 63.8 60.1 56.4 1.0 1.0 0.8 64.9 61.1 57.1

Foreign government debt(2) 84.8 87.6 97.3 14.9 15.5 12.8 99.7 103.0 110.2

Other investment grade 1.0 0.8 1.8 1.2 1.5 1.4 2.2 2.4 3.1

Total $312.1 $337.0 $333.1 $66.4 $61.9 $79.6 $378.5 $398.9 $412.6

Note: Amounts set forth in the table above are as of period end and may increase or decrease intra-period in the ordinary course of business. For securities, the amounts represent the liquidity value that potentially could be

realized, and thus exclude any securities that are encumbered, as well as the haircuts that would be required for securities financing transactions.

(1) “Non-Bank and Other” includes the parent holding company (Citigroup), Citi’s broker-dealer subsidiaries and other non-bank subsidiaries that are consolidated into Citigroup as well as Banamex and Citibank

(Switzerland) AG. Banamex and Citibank (Switzerland) AG account for approximately $6 billion of the “Non-Bank and Other” HQLA balance as of December 31, 2015.

(2) Foreign government debt includes securities issued or guaranteed by foreign sovereigns, agencies and multilateral development banks. Foreign government debt securities are held largely to support local liquidity

requirements and Citi’s local franchises, and principally include government bonds from Hong Kong, India, Korea and Mexico.