Citibank 2015 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

178

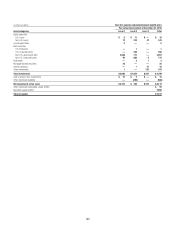

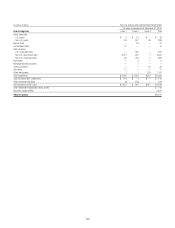

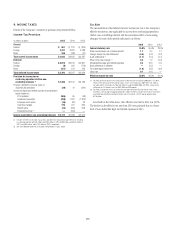

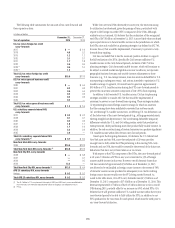

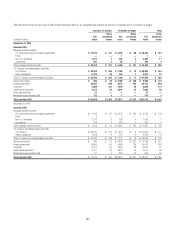

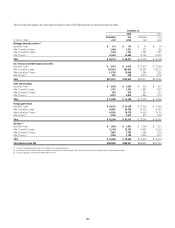

The following table summarizes the amounts of tax carry-forwards and

their expiration dates:

In billions of dollars

Year of expiration

December 31,

2015

December 31,

2014

U.S. tax return foreign tax credit

carry-forwards

2017 $ — $ 1.9

2018 4.8 5.2

2019 1.2 1.2

2020 3.1 3.1

2021 1.7 1.8

2022 3.4 3.4

2023 (1) 0.4 1.0

2025 (1) 1.3 —

Total U.S. tax return foreign tax credit

carry-forwards $15.9 $17.6

U.S. tax return general business credit

carry-forwards

2030 $ — $ 0.4

2031 0.2 0.3

2032 0.4 0.4

2033 0.3 0.3

2034 0.2 0.2

2035 0.2 —

Total U.S. tax return general business credit

carry-forwards $ 1.3 $ 1.6

U.S. subsidiary separate federal NOL

carry-forwards

2027 $ 0.2 $ 0.2

2028 0.1 0.1

2030 0.3 0.3

2031 1.5 1.7

2033 1.7 1.9

2034 2.3 2.3

2035 3.6 —

Total U.S. subsidiary separate federal NOL

carry-forwards (2) $ 9.7 $ 6.5

New York State NOL carry-forwards

2034 $14.6 $12.3

Total New York State NOL carry-forwards (2) $14.6 $12.3

New York City NOL carry-forwards

2028 $ — $ 3.8

2031 —0.1

2032 —0.5

2034 13.3 —

Total New York City NOL carry-forwards (2) $13.3 $ 4.4

APB 23 subsidiary NOL carry-forwards

Various $ 0.2 $ 0.2

Total APB 23 subsidiary NOL carry-forwards $ 0.2 $ 0.2

(1) The $1.7 billion in FTC carry-forwards that expire in 2023 and 2025 are in a non-consolidated tax

return entity but are eventually expected to be utilized in Citigroup’s consolidated tax return.

(2) Pretax.

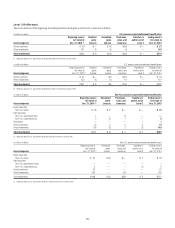

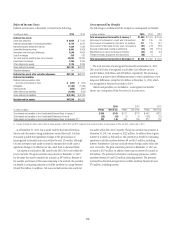

While Citi’s net total DTAs decreased year-over-year, the time remaining

for utilization has shortened, given the passage of time, particularly with

respect to the foreign tax credit (FTC) component of the DTAs. Although

realization is not assured, Citi believes that the realization of the recognized

net DTAs of $47.8 billion at December 31, 2015 is more-likely-than-not based

upon expectations as to future taxable income in the jurisdictions in which

the DTAs arise and available tax planning strategies (as defined in ASC 740,

Income Taxes) that would be implemented, if necessary, to prevent a carry-

forward from expiring.

Citi has concluded that it has the necessary positive evidence to support

the full realization of its DTAs. Specifically, Citi forecasts sufficient U.S.

taxable income in the carry-forward periods, exclusive of ASC 740 tax

planning strategies. Citi’s forecasted taxable income, which will continue to

be subject to overall market and global economic conditions, incorporates

geographic business forecasts and taxable income adjustments to those

forecasts (e.g., U.S. tax-exempt income, loan loss reserves deductible for U.S.

tax reporting in subsequent years), and actions intended to optimize its U.S.

taxable earnings. In general, Citi would need to generate approximately

$59 billion of U.S. taxable income during the FTC carry-forward periods to

prevent this most time-sensitive component of Citi’s FTCs from expiring.

In addition to its forecasted U.S. taxable income, Citi has tax planning

strategies available to it under ASC 740 that would be implemented, if

necessary, to prevent a carry-forward from expiring. These strategies include:

(i) repatriating low-taxed foreign source earnings for which an assertion

that the earnings have been indefinitely reinvested has not been made;

(ii) accelerating U.S. taxable income into, or deferring U.S. tax deductions out

of, the latter years of the carry-forward period (e.g., selling appreciated assets,

electing straight-line depreciation); (iii) accelerating deductible temporary

differences outside the U.S.; and (iv) selling certain assets that produce tax-

exempt income, while purchasing assets that produce fully taxable income. In

addition, the sale or restructuring of certain businesses can produce significant

U.S. taxable income within the relevant carry-forward periods.

Based upon the foregoing discussion, Citi believes the U.S. federal and

New York state and city NOL carry-forward period of 20 years provides

enough time to fully utilize the DTAs pertaining to the existing NOL carry-

forwards and any NOL that would be created by the reversal of the future net

deductions that have not yet been taken on a tax return.

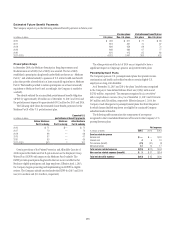

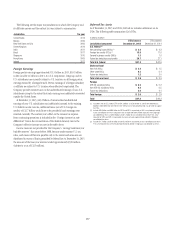

With respect to the FTCs component of the DTAs, the carry-forward period

is 10 years. Utilization of FTCs in any year is restricted to 35% of foreign

source taxable income in that year. However, overall domestic losses that

Citi has incurred of approximately $54 billion as of December 31, 2015

are allowed to be reclassified as foreign source income to the extent of 50%

of domestic source income produced in subsequent years. Such resulting

foreign source income would cover the FTCs being carried forward. As

noted in the table above, Citi’s FTC carry-forwards were $15.9 billion as of

December 31, 2015, compared to $17.6 billion as of December 31, 2014. This

decrease represented $1.7 billion of the $1.5 billion decrease in Citi’s overall

DTAs during 2015, partially offset by an increase in AOCI related DTAs. Citi

believes that it will generate sufficient U.S. taxable income within the 10-year

carry-forward period to be able to fully utilize the FTCs, in addition to any

FTCs produced in the tax return for such period, which must be used prior to

any carry-forward utilization.