Citibank 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

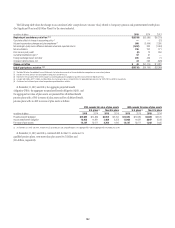

164

Discount Rate

The discount rates for the U.S. pension and postretirement plans were

selected by reference to a Citigroup-specific analysis using each plan’s

specific cash flows and compared with high-quality corporate bond indices

for reasonableness. The discount rates for the non-U.S. pension and

postretirement plans are selected by reference to high-quality corporate bond

rates in countries that have developed corporate bond markets. However,

where developed corporate bond markets do not exist, the discount rates are

selected by reference to local government bond rates with a premium added

to reflect the additional risk for corporate bonds in certain countries. Effective

in 2015, Citi rounds the discount rate for all the Significant Plans to the

nearest 5 basis points. Discount rates for All Other Plans are rounded to the

nearest 10 basis points for plans in the six largest non-U.S. countries and to

the nearest 25 basis points for the remaining non-US countries.

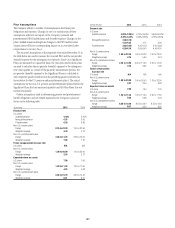

Expected Rate of Return

The Company determines its assumptions for the expected rate of return

on plan assets for its U.S. pension and postretirement plans using a

“building block” approach, which focuses on ranges of anticipated rates

of return for each asset class. A weighted average range of nominal rates

is then determined based on target allocations to each asset class. Market

performance over a number of earlier years is evaluated covering a wide

range of economic conditions to determine whether there are sound reasons

for projecting any past trends.

The Company considers the expected rate of return to be a long-term

assessment of return expectations and does not anticipate changing this

assumption unless there are significant changes in investment strategy

or economic conditions. This contrasts with the selection of the discount

rate and certain other assumptions, which are reconsidered annually (or

quarterly for the Significant Plans) in accordance with GAAP.

The expected rate of return for the U.S. pension and postretirement plans

was 7.00% at December 31, 2015, 2014 and 2013. The expected return on

assets reflects the expected annual appreciation of the plan assets and reduces

the Company’s annual pension expense. The expected return on assets is

deducted from the sum of service cost, interest cost and other components of

pension expense to arrive at the net pension (benefit) expense. Net pension

(benefit) expense for the U.S. pension plans for 2015, 2014 and 2013 reflects

deductions of $893 million, $878 million and $863 million of expected

returns, respectively.

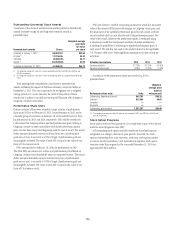

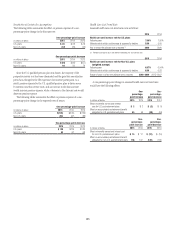

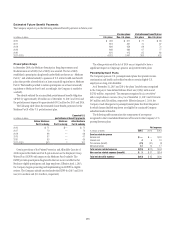

The following table shows the expected rates of return used in

determining the Company’s pension expense compared to the actual rate of

return on plan assets during 2015, 2014 and 2013 for the U.S. pension and

postretirement plans:

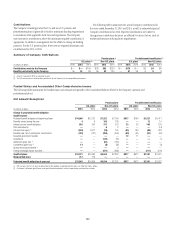

2015 2014 2013

Expected rate of return 7.00% 7.00% 7.00%

Actual rate of return (1) (1.70) 7.80 6.00

(1) Actual rates of return are presented net of fees.

For the non-U.S. pension plans, pension expense for 2015 was reduced by

the expected return of $323 million, compared with the actual return of $56

million. Pension expense for 2014 and 2013 was reduced by expected returns

of $384 million and $396 million, respectively.

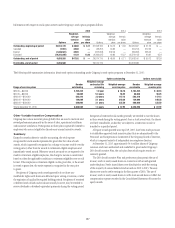

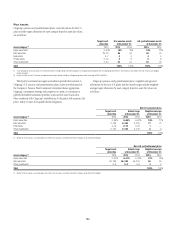

Mortality Tables

At December 31, 2015, the Company maintained the Retirement Plan 2014

(RP-2014) mortality table and adopted Mortality Projection 2015 (MP-2015)

projection table for the U.S. plans.

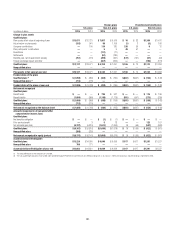

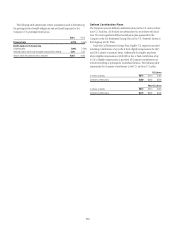

U.S. Plans 2015 (2) 2014 (3)

Mortality (1)

Pension RP-2014/MP-2015 RP-2014/MP-2014

Postretirement RP-2014/MP-2015 RP-2014/MP-2014

(1) The RP-2014 table is the white-collar RP-2014 table, with a 4% increase in rates to reflect the lower

Citigroup-specific mortality experience.

(2) The MP-2015 projection scale is projected from 2011, with convergence to 0.5% ultimate rate of

annual improvement by 2029.

(3) The MP-2014 projection scale includes a phase-out of the assumed rates of improvements from

2015 to 2027.

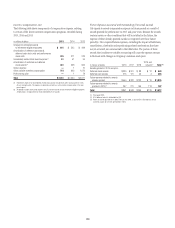

Adjustments were made to the RP-2014 tables and to the long-term rate of

mortality improvement to reflect the Citigroup specific experience. As a result,

the U.S. qualified and nonqualified pension and postretirement plans’ PBO

at December 31, 2014 increased by $1,209 million and its funded status and

AOCI decreased by $1,209 million ($737 million, net of tax). In addition, the

2015 qualified and nonqualified pension and postretirement benefit expense

increased by approximately $73 million.