Citibank 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

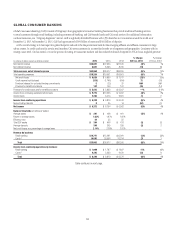

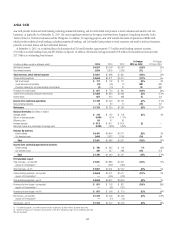

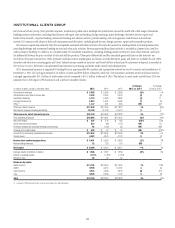

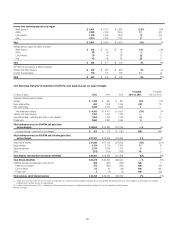

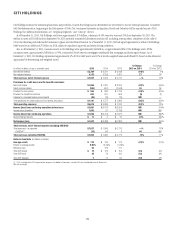

The discussion of the results of operations for ICG below excludes the impact of CVA/DVA for all periods presented. Presentations of the results of

operations, excluding the impact of CVA/DVA and the impact of gains/(losses) on hedges on accrual loans, are non-GAAP financial measures. For a

reconciliation of these metrics to the reported results, see the table above.

2015 vs. 2014

Net income decreased 4%, primarily driven by higher credit costs, partially

offset by lower expenses.

• Revenues were largely unchanged, reflecting lower revenues in Markets

and securities services (decrease of 1%) and a modest increase in

revenues in Banking (increase of 1%, but unchanged excluding the

gains/(losses) on hedges on accrual loans). Citi expects revenues in ICG,

particularly in its Markets and securities services businesses, will likely

continue to reflect the overall market environment.

Within Banking:

• Investment banking revenues decreased 3%, largely reflecting an

industry-wide activity decline in underwriting activity. Advisory revenues

increased 16%, reflecting increased target client activity and strength in

the overall M&A market. Equity underwriting revenues decreased 28%

driven by the lower market activity and a decline in wallet share resulting

from continued share fragmentation. Debt underwriting revenues

increased 1%, driven by increased wallet share in investment grade debt

and strong performance in investment grade loans in the second half of

2015, partially offset by the lower market activity and decreased wallet

share in high-yield and leveraged loans.

• Treasury and trade solutions revenues were largely unchanged.

Excluding the impact of FX translation, revenues increased 6%, as

continued growth in deposit balances across regions and improved

spreads, particularly in North America, were partially offset by continued

declines in trade balances and spreads. End-of-period deposit balances

increased 3% (7% excluding the impact of FX translation), largely driven

by Asia and Latin America. Average trade loans decreased 12% (9%

excluding the impact of FX translation), as the business maintained

origination volumes while reducing lower spread assets and increasing

asset sales to optimize returns (see “Managing Global Risk—Liquidity

Risk” below).

• Corporate lending revenues increased 8%. Excluding the impact of

gains/(losses) on hedges on accrual loans, revenues decreased 3%.

Excluding the impact of FX translation and gains/(losses) on hedges on

accrual loans, revenues increased 3% as continued growth in average loan

balances, lower hedge premium costs and an improvement in mark-to-

market adjustments were partially offset by lower spreads, particularly

in EMEA.

• Private bank revenues increased 8%, reflecting strength in North

America, Asia and EMEA, primarily due to growth in loan volumes and

deposit balances, improved spreads in banking and higher managed

investments revenues, partially offset by continued spread compression

in lending.

Within Markets and securities services:

• Fixed income markets revenues decreased 7%, driven by North America,

primarily due to a volatile trading environment during 2015 due to

macroeconomic uncertainty. The decrease in fixed income markets

revenues resulted from a decline in spread products revenues (credit

markets, securitized markets and municipals), partially offset by strength

in rates and currencies. Rates and currencies revenues increased 4% due

to higher revenues in local markets and overall G10 products, partially

offset by G10 foreign exchange.

• Equity markets revenues increased 13%, primarily reflecting improved

performance across products, including derivatives and prime finance,

with strength in Asia and EMEA.

• Securities services revenues increased 4%. Excluding the impact of FX

translation, revenues increased 15%, reflecting increased client activity

and higher client balances.

Expenses decreased 2% as efficiency savings, the impact of FX translation

and lower repositioning charges were partially offset by increased regulatory

and compliance costs and compensation expense.

Provisions increased $872 million to $929 million, primarily reflecting

a net loan loss reserve build ($722 million), compared to a net loan loss

reserve release ($219 million) in 2014. The net loan loss reserve build

included approximately $530 million for energy and energy-related

exposures, including $250 million in the fourth quarter of 2015, due to the

significant decline in commodity prices during the second half of 2015.

(For additional information on Citi’s energy and energy-related exposures,

see “Managing Global Risk—Credit Risk—Corporate Credit” below.) The

remainder of the build during 2015 was primarily due to volume growth and

overall macroeconomic conditions.

The higher net loan loss reserve build during 2015 was partially offset

by lower net credit losses. Net credit losses decreased 25%, primarily due to

the absence of net credit losses of approximately $165 million related to the

Petróleos Mexicanos (Pemex) supplier program, which were incurred during

2014 (for additional information, see Citi’s Form 8-K filed with the SEC

on February 28, 2014), partially offset by increased net credit losses related

to a limited number of energy and energy-related exposures, including

approximately $75 million in the fourth quarter of 2015.

Looking to 2016, cost of credit in ICG will largely depend on the price of

oil and other commodity prices as well as macroeconomic conditions. To

the extent commodity prices remain at year-end 2015 levels, or deteriorate

further, ICG expects to incur additional loan loss reserve builds in its

energy and energy-related portfolios, which could be significant, and Citi’s

corporate non-accrual loans could be negatively impacted. Such events as

well as macroeconomic conditions could also negatively impact Citi’s other

corporate credit portfolios.