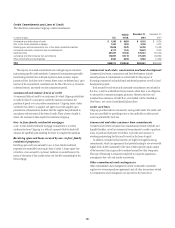

Citibank 2015 Annual Report Download - page 303

Download and view the complete annual report

Please find page 303 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.285

The majority of these matters have been resolved through settlement or

otherwise. As of December 31, 2015, the aggregate original purchase amount

of the purchases at issue in the pending litigations was approximately

$1.2 billion, and the aggregate original purchase amount of the purchases

covered by tolling agreements with investors threatening litigation was

approximately $500 million. Additional information concerning certain of

these actions is publicly available in court filings under the docket numbers

13-1729-II (Tenn. Ch. Ct.) (McCoy, C.), 650212/2012 (N.Y. Sup. Ct.)

(Kornreich, J.), and 12 Civ. 3868 (S.D.N.Y.) (Forrest, J.).

Mortgage-Backed Security Repurchase Claims: Various parties to

MBS securitizations and other interested parties have asserted that certain

Citigroup affiliates breached representations and warranties made in

connection with mortgage loans sold into securitization trusts (private-

label securitizations). Typically, these claims are based on allegations

that securitized mortgages were not underwritten in accordance with the

applicable underwriting standards. Citigroup also has received numerous

inquiries, demands for loan files, and requests to toll (extend) the applicable

statutes of limitation for representation and warranty claims relating to its

private-label securitizations. These inquiries, demands and requests have

been made by trustees of securitization trusts and others.

On April 7, 2014, Citigroup entered into an agreement with 18

institutional investors represented by Gibbs & Bruns LLP regarding the

resolution of representation and warranty repurchase claims related

to certain legacy securitizations. Pursuant to the agreement, Citigroup

made a binding offer to the trustees of 68 Citigroup-sponsored mortgage

securitization trusts to pay $1.125 billion to the trusts to resolve these claims,

plus certain fees and expenses. The 68 trusts covered by the agreement

represent all of the trusts established by Citigroup’s legacy Securities and

Banking business during 2005-2008 for which Citigroup affiliates made

representations and warranties to the trusts. The trustees accepted the

settlement for 64 trusts in whole, and four in part. Pursuant to the terms of

the settlement agreement, the trustees’ acceptance was subject to a judicial

approval proceeding. On December 18, 2015, the court filed a decision and

order approving the trustees’ entry into the settlement and finding that the

trustees, in entering the settlement, had exercised their authority reasonably

and in good faith. Additional information concerning this proceeding is

publicly available in court filings under the docket number 653902/2014

(N.Y. Sup. Ct.) (Friedman, J.).

To date, trustees have filed six actions against Citigroup seeking to enforce

certain of these contractual repurchase claims that were excluded from the

April 7, 2014 settlement in connection with four private-label securitizations.

Citigroup has reached an agreement with the trustees to resolve three of these

actions, and those actions were dismissed with prejudice on January 26, 2016.

The remaining three actions are in various stages of discovery. In the

aggregate, plaintiffs are asserting repurchase claims in the remaining

actions as to approximately 2,900 loans that were securitized into these

three securitizations, as well as any other loans that are later found to have

breached representations and warranties. Additional information concerning

these actions is publicly available in court filings under the docket numbers

13 Civ. 2843 (S.D.N.Y.) (Daniels, J.), 13 Civ. 6989 (S.D.N.Y.) (Daniels, J.),

653816/2013 (N.Y. Sup. Ct.) (Kornreich, J.), 653919/2014 (N.Y. Sup. Ct.),

653929/2014 (N.Y. Sup. Ct.), and 653930/2014 (N.Y. Sup. Ct.).

Mortgage-Backed Securities Trustee Actions: On June 18, 2014, a group

of investors in 48 RMBS trusts for which Citibank served or currently serves

as trustee filed a complaint in New York State Supreme Court in BLACKROCK

ALLOCATION TARGET SHARES: SERIES S. PORTFOLIO, ET AL. V. CITIBANK,

N.A. The complaint, like those filed against other RMBS trustees, alleges

that Citibank failed to pursue contractual remedies against securitization

sponsors and servicers. This action was withdrawn without prejudice,

effective December 17, 2014. On November 24, 2014, largely the same

group of investors filed an action in the United States District Court for the

Southern District of New York, captioned FIXED INCOME SHARES: SERIES

M ET AL. V. CITIBANK N.A., alleging similar claims relating to 27 MBS

trusts for which Citibank allegedly served or currently serves as trustee. On

September 8, 2015, the United States District Court for the Southern District

of New York dismissed all claims as to 24 of the 27 trusts and allowed certain

of the claims to proceed as to the other three trusts. Additional information

concerning this action is publicly available in court filings under the docket

number 14-cv-9373 (S.D.N.Y.) (Furman, J.).

On November 24, 2015, largely the same group of investors filed another

action in the New York State Supreme Court, captioned FIXED INCOME

SHARES: SERIES M, ET AL. V. CITIBANK N.A., related to the 24 trusts

dismissed from the federal court action and one additional trust, asserting

claims similar to the original complaint filed in state court. Additional

information concerning this action is publicly available in court filings

under the docket number 653891/2015 (N.Y. Sup. Ct.) (Ramos, J.).

On August 19, 2015, the Federal Deposit Insurance Corporation as

receiver for a financial institution filed a civil action against Citibank in the

United States District Court for the Southern District of New York, captioned

FEDERAL DEPOSIT INSURANCE CORPORATION AS RECEIVER FOR

GUARANTY BANK V. CITIBANK N.A. The complaint concerns one RMBS trust

for which Citibank formerly served as trustee, and alleges that Citibank failed

to pursue contractual remedies against the sponsor and servicers of that trust.

Additional information concerning this action is publicly available in court

filings under the docket number 15-cv-6574 (S.D.N.Y.) (Carter, J.).

Counterparty and Investor Actions

In 2010, Abu Dhabi Investment Authority (ADIA) commenced an

arbitration (ADIA I) against Citigroup before the International Center for

Dispute Resolution (ICDR), alleging statutory and common law claims in

connection with its $7.5 billion investment in Citigroup in December 2007.

ADIA sought rescission of the investment agreement or, in the alternative,

more than $4 billion in damages. On October 14, 2011, the arbitration panel

issued a final award and statement of reasons finding in favor of Citigroup

on all claims asserted by ADIA.