Citibank 2015 Annual Report Download - page 301

Download and view the complete annual report

Please find page 301 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.283

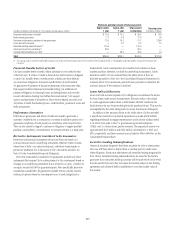

Inherent Uncertainty of the Matters Disclosed. Certain of the matters

disclosed below involve claims for substantial or indeterminate damages.

The claims asserted in these matters typically are broad, often spanning a

multi-year period and sometimes a wide range of business activities, and

the plaintiffs’ or claimants’ alleged damages frequently are not quantified

or factually supported in the complaint or statement of claim. Other matters

relate to regulatory investigations or proceedings, as to which there may

be no objective basis for quantifying the range of potential fine, penalty, or

other remedy. As a result, Citigroup is often unable to estimate the loss in

such matters, even if it believes that a loss is probable or reasonably possible,

until developments in the case or investigation have yielded additional

information sufficient to support a quantitative assessment of the range

of reasonably possible loss. Such developments may include, among other

things, discovery from adverse parties or third parties, rulings by the court

on key issues, analysis by retained experts, and engagement in settlement

negotiations. Depending on a range of factors, such as the complexity of

the facts, the novelty of the legal theories, the pace of discovery, the court’s

scheduling order, the timing of court decisions, and the adverse party’s

willingness to negotiate in good faith toward a resolution, it may be months

or years after the filing of a case or commencement of an investigation before

an estimate of the range of reasonably possible loss can be made.

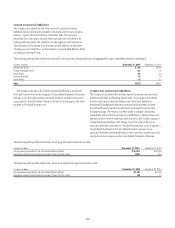

Matters as to Which an Estimate Can Be Made. For some of the matters

disclosed below, Citigroup is currently able to estimate a reasonably possible

loss or range of loss in excess of amounts accrued (if any). For some of the

matters included within this estimation, an accrual has been made because

a loss is believed to be both probable and reasonably estimable, but an

exposure to loss exists in excess of the amount accrued. In these cases, the

estimate reflects the reasonably possible range of loss in excess of the accrued

amount. For other matters included within this estimation, no accrual has

been made because a loss, although estimable, is believed to be reasonably

possible, but not probable; in these cases the estimate reflects the reasonably

possible loss or range of loss. As of December 31, 2015, Citigroup estimates

that the reasonably possible unaccrued loss for these matters ranges up to

approximately $3.5 billion in the aggregate.

These estimates are based on currently available information. As available

information changes, the matters for which Citigroup is able to estimate will

change, and the estimates themselves will change. In addition, while many

estimates presented in financial statements and other financial disclosures

involve significant judgment and may be subject to significant uncertainty,

estimates of the range of reasonably possible loss arising from litigation and

regulatory proceedings are subject to particular uncertainties. For example,

at the time of making an estimate, (i) Citigroup may have only preliminary,

incomplete, or inaccurate information about the facts underlying the claim;

(ii) its assumptions about the future rulings of the court or other tribunal

on significant issues, or the behavior and incentives of adverse parties or

regulators, may prove to be wrong; and (iii) the outcomes it is attempting to

predict are often not amenable to the use of statistical or other quantitative

analytical tools. In addition, from time to time an outcome may occur that

Citigroup had not accounted for in its estimate because it had deemed such

an outcome to be remote. For all these reasons, the amount of loss in excess

of accruals ultimately incurred for the matters as to which an estimate has

been made could be substantially higher or lower than the range of loss

included in the estimate.

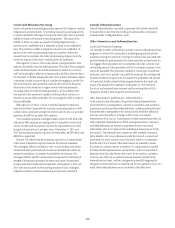

Matters as to Which an Estimate Cannot Be Made. For other matters

disclosed below, Citigroup is not currently able to estimate the reasonably

possible loss or range of loss. Many of these matters remain in very

preliminary stages (even in some cases where a substantial period of time has

passed since the commencement of the matter), with few or no substantive

legal decisions by the court or tribunal defining the scope of the claims, the

class (if any), or the potentially available damages, and fact discovery is still

in progress or has not yet begun. In many of these matters, Citigroup has

not yet answered the complaint or statement of claim or asserted its defenses,

nor has it engaged in any negotiations with the adverse party (whether

a regulator or a private party). For all these reasons, Citigroup cannot at

this time estimate the reasonably possible loss or range of loss, if any, for

these matters.

Opinion of Management as to Eventual Outcome. Subject to the

foregoing, it is the opinion of Citigroup’s management, based on current

knowledge and after taking into account its current legal accruals, that the

eventual outcome of all matters described in this Note would not be likely

to have a material adverse effect on the consolidated financial condition

of Citigroup. Nonetheless, given the substantial or indeterminate amounts

sought in certain of these matters, and the inherent unpredictability of such

matters, an adverse outcome in certain of these matters could, from time

to time, have a material adverse effect on Citigroup’s consolidated results of

operations or cash flows in particular quarterly or annual periods.

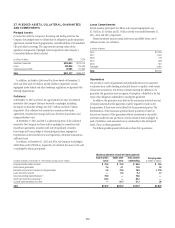

Allied Irish Bank Litigation

In 2003, Allied Irish Bank (AIB) filed a complaint in the United States District

Court for the Southern District of New York seeking to hold Citibank and

Bank of America, N.A., former prime brokers for AIB’s subsidiary Allfirst Bank

(Allfirst), liable for losses incurred by Allfirst as a result of fraudulent and

fictitious foreign currency trades entered into by one of Allfirst’s traders. In

December 2015, the remaining parties reached a settlement that released all

claims against Citibank. A notice of voluntary dismissal with prejudice was

filed on January 14, 2016. Additional information concerning this action

is publicly available in court filings under docket number 03 Civ. 3748

(S.D.N.Y.) (Batts, J.).

Commodities Financing Contracts

Beginning in May 2014, Citigroup became aware of reports of potential fraud

relating to the financing of physical metal stored at the Qingdao and Penglai

ports in China. Citibank and Citigroup Global Markets Limited (CGML)

have contracts with a counterparty in relation to the provision of financing

to that counterparty, collateralized by physical metal stored at these ports,

with the agreements providing that the counterparty would repurchase the

inventory at a specified date in the future (typically three to six months).

Pursuant to the agreements, the counterparty is responsible for providing