Citibank 2015 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

181

agreements, and that the exercise of rights by the non-defaulting party to

terminate and close-out transactions on a net basis under these agreements

will not be stayed or avoided under applicable law upon an event of default

including bankruptcy, insolvency or similar proceeding.

A legal opinion may not have been sought or obtained for certain

jurisdictions where local law is silent or sufficiently ambiguous to determine

the enforceability of offsetting rights or where adverse case law or conflicting

regulation may cast doubt on the enforceability of such rights. In some

jurisdictions and for some counterparty types, the insolvency law for a

particular counterparty type may be nonexistent or unclear as overlapping

regimes may exist. For example, this may be the case for certain sovereigns,

municipalities, central banks and U.S. pension plans.

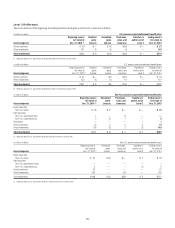

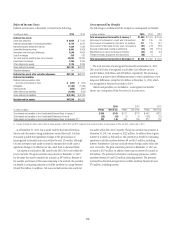

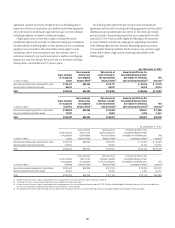

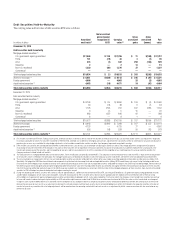

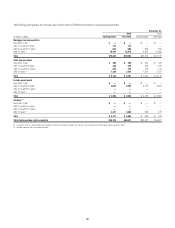

The following tables present the gross and net resale and repurchase

agreements and securities borrowing and lending agreements and the related

offsetting amount permitted under ASC 210-20-45. The tables also include

amounts related to financial instruments that are not permitted to be offset

under ASC 210-20-45 but would be eligible for offsetting to the extent that

an event of default occurred and a legal opinion supporting enforceability

of the offsetting rights has been obtained. Remaining exposures continue

to be secured by financial collateral, but the Company may not have sought

or been able to obtain a legal opinion evidencing enforceability of the

offsetting right.

As of December 31, 2015

In millions of dollars

Gross amounts

of recognized

assets

Gross amounts

offset on the

Consolidated

Balance Sheet (1)

Net amounts of

assets included on

the Consolidated

Balance Sheet (2)

Amounts not offset on the

Consolidated Balance Sheet

but eligible for offsetting

upon counterparty default (3)

Net

amounts (4)

Securities purchased under agreements to resell $176,167 $56,390 $119,777 $ 92,039 $ 27,738

Deposits paid for securities borrowed 99,873 — 99,873 16,619 83,254

Total $276,040 $56,390 $219,650 $108,658 $110,992

In millions of dollars

Gross amounts

of recognized

liabilities

Gross amounts

offset on the

Consolidated

Balance Sheet (1)

Net amounts of

liabilities included

on the Consolidated

Balance Sheet (2)

Amounts not offset on the

Consolidated Balance Sheet

but eligible for offsetting

upon counterparty default (3)

Net

amounts (4)

Securities sold under agreements to repurchase $188,040 $56,390 $131,650 $60,641 $71,009

Deposits received for securities loaned 14,657 — 14,657 3,226 11,431

Total $202,697 $56,390 $146,307 $63,867 $82,440

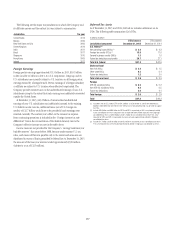

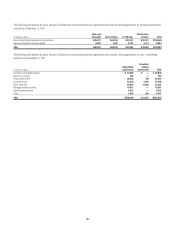

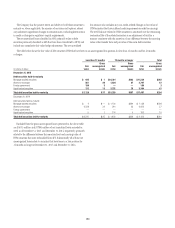

As of December 31, 2014

In millions of dollars

Gross amounts

of recognized

assets

Gross amounts

offset on the

Consolidated

Balance Sheet (1)

Net amounts of

assets included on

the Consolidated

Balance Sheet (2)

Amounts not offset on the

Consolidated Balance Sheet

but eligible for offsetting upon

counterparty default (3)

Net

amounts (4)

Securities purchased under agreements to resell $180,318 $56,339 $123,979 $ 94,353 $ 29,626

Deposits paid for securities borrowed 118,591 — 118,591 15,139 103,452

Total $298,909 $56,339 $242,570 $109,492 $133,078

In millions of dollars

Gross amounts

of recognized

liabilities

Gross amounts

offset on the

Consolidated

Balance Sheet (1)

Net amounts of

liabilities included

on the Consolidated

Balance Sheet (2)

Amounts not offset on the

Consolidated Balance Sheet

but eligible for offsetting upon

counterparty default (3)

Net

amounts (4)

Securities sold under agreements to repurchase $203,543 $56,339 $147,204 $ 72,928 $74,276

Deposits received for securities loaned 25,900 — 25,900 5,190 20,710

Total $229,443 $56,339 $173,104 $ 78,118 $94,986

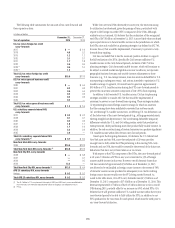

(1) Includes financial instruments subject to enforceable master netting agreements that are permitted to be offset under ASC 210-20-45.

(2) The total of this column for each period excludes Federal funds sold/purchased. See tables above.

(3) Includes financial instruments subject to enforceable master netting agreements that are not permitted to be offset under ASC 210-20-45 but would be eligible for offsetting to the extent that an event of default has

occurred and a legal opinion supporting enforceability of the offsetting right has been obtained.

(4) Remaining exposures continue to be secured by financial collateral, but the Company may not have sought or been able to obtain a legal opinion evidencing enforceability of the offsetting right.