Citibank 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

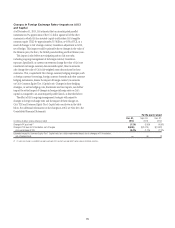

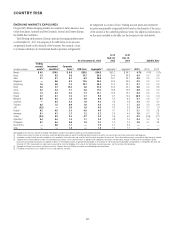

The table below provides the range of market factor VARs associated with Citi’s total trading VAR, inclusive of specific risk:

2015 2014

In millions of dollars Low High Low High

Interest rate $28 $ 84 N/A N/A

Credit spread 56 94 N/A N/A

Fully diversified interest rate and credit spread $65 $127 $84 $158

Foreign exchange 20 54 20 59

Equity 9 35 14 48

Commodity 12 37 11 27

Total trading $70 $140 $84 $163

Total trading and credit portfolio 89 158 96 188

Note: No covariance adjustment can be inferred from the above table as the high and low for each market factor will be from different close of business dates.

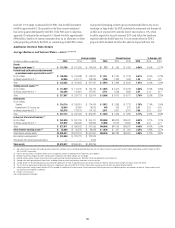

The following table provides the VAR for ICG, excluding the CVA relating to

derivative counterparties, hedges of CVA, fair value option loans and hedges

to the loan portfolio:

In millions of dollars Dec. 31, 2015

Total—all market risk

factors, including general and specific risk $ 71

Average—during year $ 85

High—during year 129

Low—during year 65

VAR Model Review and Validation

Generally, Citi’s VAR review and model validation process entails reviewing

the model framework, major assumptions, and implementation of the

mathematical algorithm. In addition, as part of the model validation

process, product specific back-testing on portfolios is periodically completed

and reviewed with Citi’s U.S. banking regulators. Furthermore, Regulatory

VAR (as described below) back-testing is performed against buy-and-hold

profit and loss on a monthly basis for multiple sub-portfolios across the

organization (trading desk level, ICG business segment and Citigroup) and

the results are shared with the U.S. banking regulators.

Significant VAR model and assumption changes must be independently

validated within Citi’s risk management organization. This validation

process includes a review by Citi’s model validation group and further

approval from its model validation review committee, which is composed

of senior quantitative risk management officers. In the event of significant

model changes, parallel model runs are undertaken prior to implementation.

In addition, significant model and assumption changes are subject to the

periodic reviews and approval by Citi’s U.S. banking regulators.

Citi uses the same independently validated VAR model for both Regulatory

VAR and Risk Management VAR (i.e., Total trading and Total trading and

credit portfolios VARs) and, as such, the model review and oversight process

for both purposes is as described above.

Regulatory VAR, which is calculated in accordance with Basel III, differs

from Risk Management VAR due to the fact that certain positions included

in Risk Management VAR are not eligible for market risk treatment in

Regulatory VAR. The composition of Risk Management VAR is discussed

under “Value at Risk” above. The applicability of the VAR model for positions

eligible for market risk treatment under U.S. regulatory capital rules is

periodically reviewed and approved by Citi’s U.S. banking regulators.

In accordance with Basel III, Regulatory VAR includes all trading book

covered positions and all foreign exchange and commodity exposures.

Pursuant to Basel III, Regulatory VAR excludes positions that fail to meet

the intent and ability to trade requirements and are therefore classified as

non-trading book and categories of exposures that are specifically excluded

as covered positions. Regulatory VAR excludes CVA on derivative instruments

and DVA on Citi’s own fair value option liabilities. CVA hedges are excluded

from Regulatory VAR and included in credit risk-weighted assets as computed

under the Advanced Approaches for determining risk-weighted assets.

Regulatory VAR Back-testing

In accordance with Basel III, Citi is required to perform back-testing to

evaluate the effectiveness of its Regulatory VAR model. Regulatory VAR back-

testing is the process in which the daily one-day VAR, at a 99% confidence

interval, is compared to the buy-and-hold profit and loss (i.e., the profit and

loss impact if the portfolio is held constant at the end of the day and re-priced

the following day). Buy-and-hold profit and loss represents the daily mark-

to-market profit and loss attributable to price movements in covered positions

from the close of the previous business day. Buy-and-hold profit and loss

excludes realized trading revenue, net interest, fees and commissions, intra-

day trading profit and loss, and changes in reserves.

Based on a 99% confidence level, Citi would expect two to three days in

any one year where buy-and-hold losses exceeded the Regulatory VAR. Given

the conservative calibration of Citi’s VAR model (as a result of taking the

greater of short- and long-term volatilities and fat-tail scaling of volatilities),

Citi would expect fewer exceptions under normal and stable market

conditions. Periods of unstable market conditions could increase the number

of back-testing exceptions.