Citibank 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

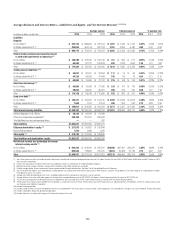

Total Loss-Absorbing Capacity (TLAC)

In November 2015, the Federal Reserve Board issued a notice of proposed

rulemaking that would impose minimum loss-absorbing capacity and

long-term debt requirements on global systemically important bank holding

companies (GSIBs), including Citi, the intended purpose of which would be

to facilitate the orderly resolution of U.S. GSIBs under the U.S. Bankruptcy

Code and Title II of the Dodd-Frank Act. There are significant uncertainties

and interpretive issues arising from the Federal Reserve Board’s proposal. For

additional information, see “Risk Factors—Liquidity Risks” above. For an

additional discussion of the method 1 and method 2 GSIB capital surcharge

methodology as well as other regulatory capital aspects of the TLAC proposal,

see “Capital Resources” above.

Pursuant to the proposal, U.S. GSIBs would be required to issue and

maintain minimum levels of external TLAC and eligible long-term debt

(LTD), each set by reference to the GSIB’s consolidated risk-weighted assets

(RWA) and total leverage exposure. The proposed minimum external TLAC

requirement would be the greater of (i) 18% of the GSIB’s RWA plus the

applicable external TLAC buffer and (ii) 9.5% of its total leverage exposure.

The applicable external TLAC buffer equals the 2.5% capital conservation

buffer, plus any applicable countercyclical capital buffer, plus the GSIB’s

capital surcharge as determined under method 1 of the GSIB surcharge rule.

Accordingly, Citi’s total estimated current TLAC requirement would be 22.5%

of RWA under the proposal. Breach of the proposed external TLAC buffer

would subject the GSIB to restrictions on distributions and discretionary

bonus payments. The proposed minimum external LTD requirement would

be the greater of (i) 6% of the GSIB’s RWA plus its capital surcharge as

determined under method 2 of the GSIB surcharge rule, for a total estimated

current requirement of 9% of RWA for Citi and (ii) 4.5% of the GSIB’s total

leverage exposure.

As proposed, external TLAC would generally include (i) Common Equity

Tier 1 Capital and Additional Tier 1 Capital issued directly by the bank

holding company plus (ii) eligible external LTD. Eligible external LTD,

which is a subcategory of external TLAC, would include unsecured, “plain

vanilla” debt securities (i.e., would not include structured notes or securities

containing derivative-linked features) issued directly by the bank holding

company, governed by U.S. law and with a remaining maturity greater than

one year. Further, pursuant to what has been referred to as the “haircut”

provision, otherwise eligible external LTD with a remaining maturity of less

than two years would be subject to a 50% haircut for purposes of meeting the

minimum external LTD requirement. In addition, otherwise eligible external

LTD which provides for acceleration of the payment of principal and interest

other than upon the occurrence of insolvency or non-payment would not be

eligible LTD.

Designed to further enhance the resolvability of a U.S. GSIB, the proposal

would also prohibit or limit certain financial arrangements at the bank

holding company level, or what are referred to as “clean holding company”

requirements. Pursuant to these requirements, the bank holding company

would be prohibited from having certain types of third-party liabilities,

including short-term debt, derivatives and other qualified financial

contracts, liabilities guaranteed by a subsidiary (i.e., upstream guarantees)

and guarantees of subsidiary liabilities or similar arrangements if the

liability or guarantee includes a default right linked to the insolvency of

the bank holding company (i.e., downstream guarantees with cross default

provisions). In addition, the clean holding company requirements would

limit the third-party, non-contingent liabilities of the bank holding company

that are not related to TLAC or LTD and are pari passu with or junior to

eligible external LTD, including structured notes and various operating

liabilities, to 5% of the U.S. GSIB’s outstanding external TLAC.

The proposal would further require that U.S. GSIBs deduct from their

regulatory capital any investment in unsecured debt issued by GSIBs in

excess of certain thresholds. This deduction would be required regardless of

the tenor of the instrument and regardless of whether the debt instrument

would qualify as eligible external LTD.

While not included in its proposed requirements, the Federal Reserve

Board also indicated in its notice of proposed rulemaking that it was

considering imposing “domestic internal TLAC” requirements for the

material operating subsidiaries of U.S. GSIBs. The Board indicated any

such requirements would be designed to, among other things, require the

maintenance of “contributable resources” (in the form of high-quality liquid

assets) at the bank holding company and/or “prepositioned resources” at the

level of the material operating subsidiaries (in the form of debt and equity

investments in the subsidiaries).

The proposed effective date for the requirements included in the proposal

would be January 1, 2019, with the exception of the RWA component of the

external TLAC requirement, which would be 16% as of January 1, 2019 and

would increase to 18% on January 1, 2022.

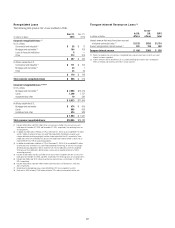

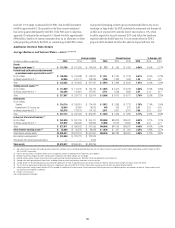

Secured Funding Transactions and Short-

Term Borrowings

As referenced above, Citi supplements its primary sources of funding with

short-term borrowings. Short-term borrowings generally include (i) secured

funding transactions (securities loaned or sold under agreements to

repurchase, or repos) and (ii) to a lesser extent, short-term borrowings

consisting of commercial paper and borrowings from the FHLB and other

market participants (see Note 18 to the Consolidated Financial Statements for

further information on Citigroup’s and its affiliates’ outstanding short-term

borrowings). Citi has purposefully reduced its other short-term borrowings,

including FHLB borrowings, as it continued to grow its high-quality deposits.

Secured Funding

Secured funding is primarily accessed through Citi’s broker-dealer

subsidiaries to fund efficiently both secured lending activity and a portion

of securities inventory held in the context of market making and customer

activities. Citi also executes a smaller portion of its secured funding

transactions through its bank entities, which is typically collateralized by