Citibank 2015 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.233

From the Company’s perspective, there are two types of TOB trusts:

customer TOB trusts and non-customer TOB trusts. Customer TOB trusts are

those trusts utilized by customers of the Company to finance their municipal

securities investments. The Residuals issued by these trusts are purchased by

the customer being financed. Non-customer TOB trusts are trusts that are

used by the Company to finance its own municipal securities investments; the

Residuals issued by non-customer TOB trusts are purchased by the Company.

With respect to both customer and non-customer TOB trusts, the

Company may provide remarketing agent services. If Floaters are optionally

tendered and the Company, in its role as remarketing agent, is unable to find

a new investor to purchase the optionally tendered Floaters within a specified

period of time, the Company may, but is not obligated to, purchase the

tendered Floaters into its own inventory. The level of the Company’s inventory

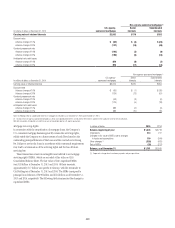

of such Floaters fluctuates. At December 31, 2015 and 2014, the Company

held $2 million and $3 million, respectively, of Floaters related to customer

and non-customer TOB trusts.

For certain customer TOB trusts, the Company may also serve as a

voluntary advance provider. In this capacity, the Company may, but is

not obligated to, make loan advances to customer TOB trusts to purchase

optionally tendered Floaters that have not otherwise been successfully

remarketed to new investors. Such loans are secured by pledged Floaters.

As of December 31, 2015, the Company had no outstanding voluntary

advances to customer TOB trusts.

For certain non-customer trusts, the Company also provides

credit enhancement. At December 31, 2015 and 2014, approximately

$82 million and $198 million, respectively, of the municipal bonds owned

by non-customer TOB trusts are subject to a credit guarantee provided by

the Company.

The Company also provides liquidity services to many customer and

non-customer trusts. If a trust is unwound early due to an event other than

a credit event on the underlying municipal bonds, the underlying municipal

bonds are sold out of the Trust and bond sale proceeds are used to redeem

the outstanding Trust certificates. If this results in a shortfall between the

bond sale proceeds and the redemption price of the tendered Floaters, the

Company, pursuant to the liquidity agreement, would be obligated to make

a payment to the trust to satisfy that shortfall. For certain customer TOB

trusts the Company has also executed a reimbursement agreement with the

holder of the Residual, pursuant to which the Residual holder is obligated

to reimburse the Company for any payment the Company makes under the

liquidity arrangement. These reimbursement agreements may be subject to

daily margining based on changes in the market value of the underlying

municipal bonds. In cases where a third party provides liquidity to a non-

customer TOB trust, a similar reimbursement arrangement may be executed,

whereby the Company (or a consolidated subsidiary of the Company), as

Residual holder, would absorb any losses incurred by the liquidity provider.

For certain other non-customer TOB trusts, the Company serves as tender

option provider. The tender option provider arrangement allows Floater

holders to put their interests directly to the Company at any time, subject to

the requisite notice period requirements, at a price of par.

At December 31, 2015 and 2014, liquidity agreements provided with

respect to customer TOB trusts totaled $3.1 billion and $3.7 billion,

respectively, of which $2.2 billion and $2.6 billion, respectively, were offset

by reimbursement agreements. For the remaining exposure related to TOB

transactions, where the Residual owned by the customer was at least 25%

of the bond value at the inception of the transaction, no reimbursement

agreement was executed.

The Company considers both customer and non-customer TOB trusts

to be VIEs. Customer TOB trusts are not consolidated by the Company, as

the power to direct the activities that most significantly impact the trust’s

economic performance rests with the customer Residual holder, which may

unilaterally cause the sale of the trust’s bonds.

Non-customer TOB trusts generally are consolidated because the

Company holds the Residual interest, and thus has the unilateral power to

cause the sale of the trust’s bonds.

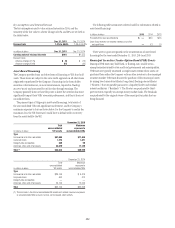

The Company also provides other liquidity agreements or letters of credit

to customer-sponsored municipal investment funds, which are not variable

interest entities, and municipality-related issuers that totaled $8.1 billion and

$7.4 billion as of December 31, 2015 and 2014, respectively. These liquidity

agreements and letters of credit are offset by reimbursement agreements with

various term-out provisions.

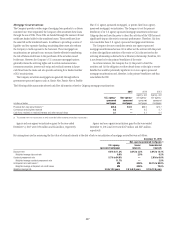

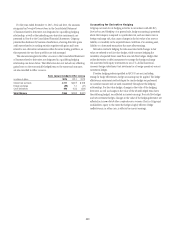

Municipal Investments

Municipal investment transactions include debt and equity interests in

partnerships that finance the construction and rehabilitation of low-income

housing, facilitate lending in new or underserved markets, or finance

the construction or operation of renewable municipal energy facilities.

The Company generally invests in these partnerships as a limited partner

and earns a return primarily through the receipt of tax credits and grants

earned from the investments made by the partnership. The Company may

also provide construction loans or permanent loans for the development or

operation of real estate properties held by partnerships. These entities are

generally considered VIEs. The power to direct the activities of these entities

is typically held by the general partner. Accordingly, these entities are not

consolidated by the Company.