Citibank 2015 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157

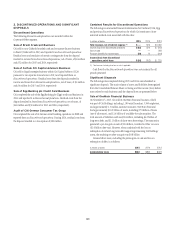

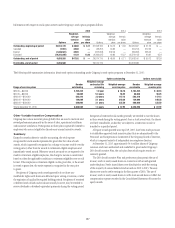

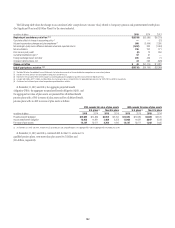

Information with respect to stock option activity under Citigroup’s stock option programs follows:

2015 2014 2013

Options

Weighted-

average

exercise

price

Intrinsic

value

per share Options

Weighted-

average

exercise

price

Intrinsic

value

per share Options

Weighted-

average

exercise

price

Intrinsic

value

per share

Outstanding, beginning of period 26,514,119 $ 48.00 $ 6.11 31,508,106 $ 50.72 $ 1.39 35,020,397 $ 51.20 $ —

Canceled (7,901) 40.80 — (28,257) 40.80 — (50,914) 212.35 —

Expired (1,646,581) 40.85 — (602,093) 242.43 — (86,964) 528.40 —

Exercised (18,203,048) 41.39 13.03 (4,363,637) 40.82 11.37 (3,374,413) 40.81 9.54

Outstanding, end of period 6,656,588 $67.92 $ — 26,514,119 $ 48.00 $ 6.11 31,508,106 $ 50.72 $1.39

Exercisable, end of period 6,656,588 26,514,119 30,662,588

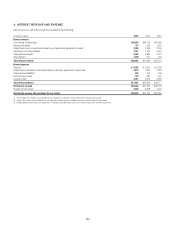

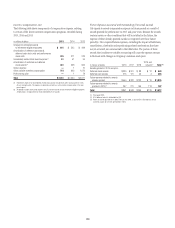

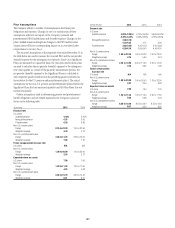

The following table summarizes information about stock options outstanding under Citigroup’s stock option programs at December 31, 2015:

Options outstanding Options exercisable

Range of exercise prices

Number

outstanding

Weighted-average

contractual life

remaining

Weighted-average

exercise price

Number

exercisable

Weighted-average

exercise price

$39.00—$49.99 5,763,424 1.0 year $ 48.16 5,763,424 $ 48.16

$50.00—$99.99 66,660 5.4 years 56.25 66,660 56.25

$100.00—$199.99 502,416 3.0 years 147.13 502,416 147.13

$200.00—$299.99 124,088 2.1 years 240.28 124,088 240.28

$300.00—$399.99 200,000 2.1 years 335.50 200,000 335.50

Total at December 31, 2015 6,656,588 1.3 years $ 67.92 6,656,588 $ 67.92

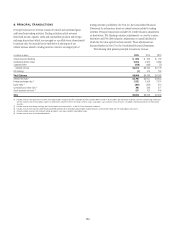

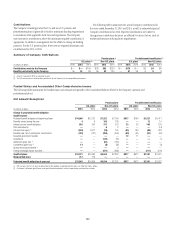

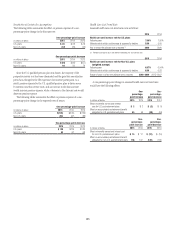

Other Variable Incentive Compensation

Citigroup has various incentive plans globally that are used to motivate and

reward performance primarily in the areas of sales, operational excellence

and customer satisfaction. Participation in these plans is generally limited to

employees who are not eligible for discretionary annual incentive awards.

Summary

Except for awards subject to variable accounting, the total expense

recognized for stock awards represents the grant date fair value of such

awards, which is generally recognized as a charge to income ratably over the

vesting period, other than for awards to retirement-eligible employees and

immediately vested awards. Whenever awards are made or are expected to be

made to retirement-eligible employees, the charge to income is accelerated

based on when the applicable conditions to retirement eligibility were or will

be met. If the employee is retirement eligible on the grant date, or the award

is vested at grant date, the entire expense is recognized in the year prior

to grant.

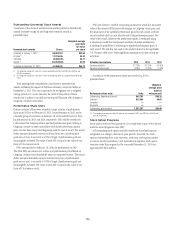

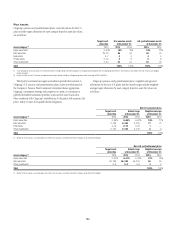

Recipients of Citigroup stock awards generally do not have any

stockholder rights until shares are delivered upon vesting or exercise, or after

the expiration of applicable required holding periods. Recipients of restricted

or deferred stock awards and stock unit awards, however, may be entitled to

receive dividends or dividend-equivalent payments during the vesting period.

Recipients of restricted stock awards generally are entitled to vote the shares

in their award during the vesting period. Once a stock award vests, the shares

are freely transferable, unless they are subject to a restriction on sale or

transfer for a specified period.

All equity awards granted since April 19, 2005, have been made pursuant

to stockholder-approved stock incentive plans that are administered by the

Personnel and Compensation Committee of the Citigroup Board of Directors,

which is composed entirely of independent non-employee directors.

At December 31, 2015, approximately 54.4 million shares of Citigroup

common stock were authorized and available for grant under Citigroup’s

2014 Stock Incentive Plan, the only plan from which equity awards are

currently granted.

The 2014 Stock Incentive Plan and predecessor plans permit the use of

treasury stock or newly issued shares in connection with awards granted

under the plans. Newly issued shares were distributed to settle the vesting

of the majority of annual deferred stock awards in 2012 to 2015. Treasury

shares were used to settle vestings in the first quarter of 2016. The use of

treasury stock or newly issued shares to settle stock awards does not affect the

compensation expense recorded in the Consolidated Statement of Income for

equity awards.