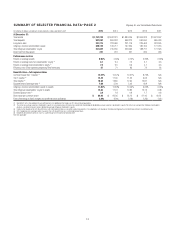

Citibank 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

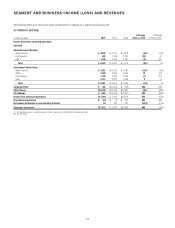

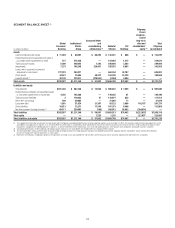

Citicorp

Citicorp net income increased 50% from the prior year to $16.2 billion.

CVA/DVA, recorded in ICG, was $269 million ($172 million after-tax) in

2015, compared to negative $343 million (negative $211 million after-tax)

in the prior year (for a summary of CVA/DVA by business within ICG, see

“Institutional Clients Group” below). Excluding CVA/DVA in both periods

and the tax item in 2014, Citicorp’s net income was $16.0 billion, up 43%

from the prior year, primarily driven by the lower expenses and net credit

losses, partially offset by lower revenues and the net loan loss reserve builds.

Citicorp revenues decreased 1% from the prior year to $68.5 billion.

Excluding CVA/DVA, Citicorp revenues were $68.2 billion in 2015, down 2%

from the prior year, reflecting largely unchanged revenues in ICG and a

6% decrease in Global Consumer Banking (GCB) revenues. As referenced

above, excluding CVA/DVA and the impact of FX translation, Citicorp’s

revenues grew 3%.

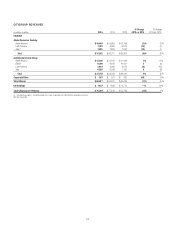

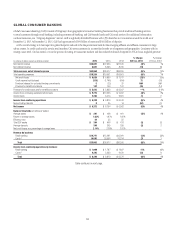

GCB revenues of $33.9 billion decreased 6% versus the prior year.

Excluding the impact of FX translation, GCB revenues decreased 1%, as

decreases in North America GCB and Asia GCB were partially offset by an

increase in Latin America GCB. North America GCB revenues decreased

1% to $19.4 billion, as lower revenues in Citi-branded cards were partially

offset by higher retail banking revenues. Citi-branded cards revenues of $7.8

billion were down 6% versus the prior year, reflecting the continued impact

of lower average loans as well as an increase in acquisition and rewards costs

related to new account acquisitions, particularly during the second half of

2015. Citi retail services revenues of $6.4 billion were largely unchanged

versus the prior year, as the continued impact of lower fuel prices and higher

contractual partner payments was offset by modest growth in average loans.

Retail banking revenues increased 6% from the prior year to $5.2 billion,

reflecting continued loan and deposit growth and improved deposit spreads.

North America GCB average deposits of $172 billion increased 1% year-over-

year and average retail loans of $50 billion grew 7%. Average card loans of

$107 billion decreased 2%, while purchase sales of $263 billion increased 4%

versus the prior year. For additional information on the results of operations

of North America GCB for 2015, see “Global Consumer Banking—

North America GCB” below.

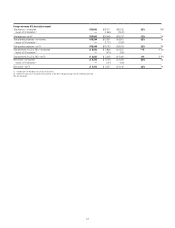

International GCB revenues (consisting of EMEA GCB, Latin America

GCB and Asia GCB) decreased 12% versus the prior year to $14.4 billion.

Excluding the impact of FX translation, international GCB revenues were

unchanged versus the prior year. Latin America GCB revenues increased 3%

versus the prior year, as increases in loan and deposit balances as well as the

impact of business divestitures were partially offset by the continued impact

of spread compression in cards. Asia GCB revenues declined 3% versus the

prior year, reflecting lower investment sales revenues as well as continued

high payment rates and the ongoing impact of regulatory changes in cards,

partially offset by growth in lending, deposit and insurance products. For

additional information on the results of operations of Latin America GCB

and Asia GCB (which includes the results of operations of EMEA GCB

for reporting purposes) for 2015, including the impact of FX translation,

see “Global Consumer Banking” below. Year-over-year, international

GCB average deposits of $129 billion increased 5%, average retail loans

of $99 billion increased 3%, investment sales of $78 billion decreased 8%,

average card loans of $26 billion increased 2% and card purchase sales of

$101 billion increased 6%, all excluding the impact of FX translation.

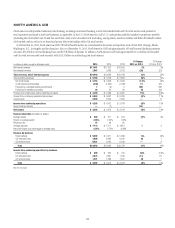

ICG revenues were $33.7 billion in 2015, up 2% from the prior year.

Excluding CVA/DVA, ICG revenues were largely unchanged from the prior year

at $33.5 billion.

Banking revenues of $16.9 billion, excluding CVA/DVA and the impact of

mark-to-market gains on hedges related to accrual loans within corporate

lending (see below), were largely unchanged compared to the prior year,

as lower equity underwriting activity within investment banking as well

as the impact of FX translation was offset by higher advisory revenues and

continued growth in the private bank. Investment banking revenues of

$4.5 billion decreased 3% versus the prior year. Advisory revenues increased

16% to $1.1 billion with sustained wallet share gains for the year. Debt

underwriting revenues increased 1% to $2.5 billion, driven by wallet share

gains in investment grade debt and strong performance in investment

grade loans in the second half of 2015, while equity underwriting revenues

decreased 28% to $902 million, largely reflecting lower industry-wide

underwriting activity during the year.

Private bank revenues, excluding CVA/DVA, increased 8% to $2.9 billion

from the prior year, driven by higher loan and deposit balances as well as

growth in managed investments revenue. Corporate lending revenues rose 8%

to $2.0 billion, including $323 million of mark-to-market gains on hedges

related to accrual loans compared to a $116 million gain in the prior year.

Excluding the impact of FX translation and the mark-to-market impact

of loan hedges, corporate lending revenues increased 3% versus the prior

year, as growth in average loans was partially offset by the impact of lower

spreads. Treasury and trade solutions revenues of $7.8 billion were relatively

unchanged versus the prior year. Excluding the impact of FX translation,

treasury and trade solutions revenues increased 6%, as continued growth in

deposit balances and spreads was partially offset by lower trade revenues.