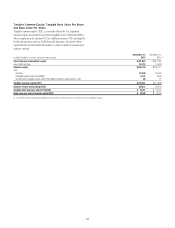

Citibank 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

COMPLIANCE, CONDUCT AND LEGAL RISKS

Ongoing Implementation and Interpretation of Regulatory

Changes and Requirements in the U.S. and Globally Have

Increased Citi’s Compliance Risks and Costs.

As referenced above, over the past several years, Citi has been required to

implement a significant number of regulatory changes across all of its

businesses and functions, and these changes continue. In some cases, Citi’s

implementation of a regulatory requirement is occurring simultaneously

with changing or conflicting regulatory guidance, legal challenges or

legislative action to modify or repeal final rules. Moreover, in many cases,

these are entirely new regulatory requirements or regimes, resulting in much

uncertainty regarding regulatory expectations as to what is definitely required

in order to be in compliance with the requirements. Accompanying this

compliance uncertainty is heightened regulatory scrutiny and expectations

in the U.S. and globally for the financial services industry with respect to

governance and risk management practices, including its compliance and

regulatory risks (for a discussion of heightened regulatory expectations on

“conduct risk” at, and the overall “culture” of, financial institutions such as

Citi, see “Legal Risks” below). All of these factors have resulted in increased

compliance risks and costs for Citi.

Examples of regulatory changes that have resulted in increased

compliance risks and costs include:

• The Volcker Rule required Citi to develop an extensive global compliance

regime, including developing and maintaining detailed trading and

permitted activity mandates for businesses, submitting extensive trading

information to regulatory agencies, conducting independent testing and

audit, training, recordkeeping and similar requirements and governance,

including an annual CEO attestation, beginning on March 31, 2016, with

respect to the global processes Citi has in place to achieve compliance

with the rules.

• Numerous aspects of the U.S. derivatives reform regime require extensive

compliance systems and processes to be maintained by Citi on a global

basis, including electronic recordkeeping, real-time public transaction

reporting and external business conduct requirements (e.g., required swap

counterparty disclosures).

• A proliferation of data protection and “onshoring” requirements adopted

by various non-U.S. jurisdictions, such as in Russia, South Korea,

Vietnam and Indonesia, require Citi to take measures to ensure client

data is stored or processed within national borders. These requirements

could conflict with anti-money laundering and other requirements in

other jurisdictions.

Extensive compliance requirements can result in increased reputational

and legal risks, as failure to comply with regulations and requirements, or

failure to comply as expected, can result in enforcement and/or regulatory

proceedings (for additional discussion, see “Legal Risks” below). In addition,

increased and ongoing compliance requirements and uncertainties have

resulted in higher costs for Citi. For example, Citi employed approximately

30,000 regulatory and compliance staff as of year-end 2015, out of a total

employee population of 231,000, compared to approximately 14,000 as of

year-end 2008 with a total employee population of 323,000. These higher

regulatory and compliance costs also offset Citi’s ongoing cost reduction

initiatives. For example, data protection and “onshoring” requirements

often require redundant investments in local data storage and security and

thus impede or potentially reverse Citi’s centralization or standardization

efforts, which provide expense efficiencies. Higher compliance costs may also

require management to reallocate resources, including potentially away from

ongoing business investment initiatives.

Citi Is Subject to Extensive Legal and Regulatory

Proceedings, Investigations and Inquiries That Could

Result in Significant Penalties and Other Negative Impacts

on Citi, Its Businesses and Results of Operations.

At any given time, Citi is defending a significant number of legal and

regulatory proceedings and is subject to numerous governmental and

regulatory examinations, investigations and other inquiries. The frequency

with which such proceedings, investigations and inquiries are initiated

have increased substantially over the last few years, and the global judicial,

regulatory and political environment generally remains hostile to large

financial institutions. For example, under recent guidance by the U.S.

Department of Justice (DOJ), a corporation (such as Citi) is required to

identify all individuals involved in or responsible for perceived misconduct

at issue and provide all related facts and circumstances in order to qualify

for any cooperation credit in civil and criminal investigations of corporate