Citibank 2015 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

221

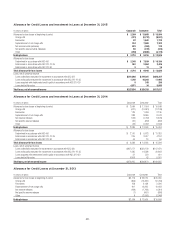

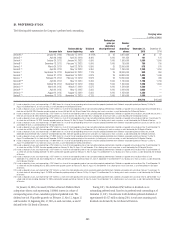

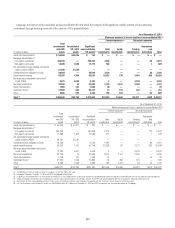

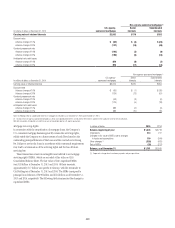

21. PREFERRED STOCK

The following table summarizes the Company’s preferred stock outstanding:

Carrying value

in millions of dollars

Issuance date

Redeemable by

issuer beginning

Dividend

rate

Redemption

price per

depositary

share/preference

share

Number

of

depositary

shares

December 31,

2015

December 31,

2014

Series AA (1) January 25, 2008 February 15, 2018 8.125% $ 25 3,870,330 $ 97 $ 97

Series E (2) April 28, 2008 April 30, 2018 8.400 1,000 121,254 121 121

Series A (3) October 29, 2012 January 30, 2023 5.950 1,000 1,500,000 1,500 1,500

Series B (4) December 13, 2012 February 15, 2023 5.900 1,000 750,000 750 750

Series C (5) March 26, 2013 April 22, 2018 5.800 25 23,000,000 575 575

Series D (6) April 30, 2013 May 15, 2023 5.350 1,000 1,250,000 1,250 1,250

Series J (7) September 19, 2013 September 30, 2023 7.125 25 38,000,000 950 950

Series K (8) October 31, 2013 November 15, 2023 6.875 25 59,800,000 1,495 1,495

Series L (9) February 12, 2014 February 12, 2019 6.875 25 19,200,000 480 480

Series M (10) April 30, 2014 May 15, 2024 6.300 1,000 1,750,000 1,750 1,750

Series N (11) October 29, 2014 November 15, 2019 5.800 1,000 1,500,000 1,500 1,500

Series O (12) March 20, 2015 March 27, 2020 5.875 1,000 1,500,000 1,500 —

Series P (13) April 24, 2015 May 15, 2025 5.950 1,000 2,000,000 2,000 —

Series Q (14) August 12, 2015 August 15, 2020 5.950 1,000 1,250,000 1,250 —

Series R (15) November 13, 2015 November 15, 2020 6.125 1,000 1,500,000 1,500 —

$16,718 $10,468

(1) Issued as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable quarterly on February 15, May 15,

August 15 and November 15, in each case when, as and if declared by the Citi Board of Directors.

(2) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on April 30 and October 30 at a

fixed rate until April 30, 2018, thereafter payable quarterly on January 30, April 30, July 30 and October 30 at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(3) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on January 30 and July 30 at a

fixed rate until January 30, 2023, thereafter payable quarterly on January 30, April 30, July 30 and October 30 at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(4) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on February 15 and August 15

at a fixed rate until February 15, 2023, thereafter payable quarterly on February 15, May 15, August 15 and November 15 at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(5) Issued as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable quarterly on January 22, April 22, July 22

and October 22 when, as and if declared by the Citi Board of Directors.

(6) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on May 15 and November 15

at a fixed rate until May 15, 2023, thereafter payable quarterly on February 15, May 15, August 15 and November 15 at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(7) Issued as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable quarterly on March 30, June 30,

September 30 and December 30 at a fixed rate until September 30, 2023, thereafter payable quarterly on the same dates at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(8) Issued as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable quarterly on February 15, May 15,

August 15 and November 15 at a fixed rate until November 15, 2023, thereafter payable quarterly on the same dates at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(9) Issued as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable quarterly on February 12, May 12,

August 12 and November 12 at a fixed rate, in each case when, as and if declared by the Citi Board of Directors.

(10) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on May 15 and November 15

at a fixed rate until May 15, 2024, thereafter payable quarterly on February 15, May 15, August 15, and November 15 at a floating rate, in each case when, as and if declared by the Citi Board of Directors.

(11) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on May 15 and November 15

at a fixed rate until, but excluding, November 15, 2019, and thereafter payable quarterly on February 15, May 15, August 15 and November 15 at a floating rate, in each case when, as and if declared by the Citi Board

of Directors.

(12) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on March 27 and

September 27 at a fixed rate until, but excluding, March 27, 2020, and thereafter payable quarterly on March 27, June 27, September 27 and December 27 at a floating rate, in each case when, as and if declared by

the Citi Board of Directors.

(13) Issued as depositary shares, each representing a 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on May 15 and November 15

at a fixed rate until, but excluding, May 15, 2025, and thereafter payable quarterly on February 15, May 15, August 15, and November 15 at a floating rate, in each case when, as and if declared by the Citi Board

of Directors.

(14) Issued as depository shares, each representing 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on February 15 and August 15

at a fixed rated until, but excluding, August 15, 2020, and thereafter payable quarterly on February 15, May 15, August 15, and November 15 at a floating rate, in each case when, as and if declared by the Citi Board

of Directors.

(15) Issued as depository shares, each representing 1/25th interest in a share of the corresponding series of non-cumulative perpetual preferred stock. Dividends are payable semi-annually on May 15 and November 15 at

a fixed rated until, but excluding, November 15, 2020, and thereafter payable quarterly on February 15, May 15, August 15 and November 15 at a floating rate, in each case when, as and if declared by the Citi Board

of Directors.

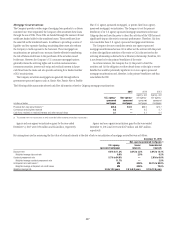

On January 26, 2016, Citi issued $1 billion of Series S Preferred Stock

as depositary shares, each representing 1/1000th interest in a share of

corresponding series of non-cumulative perpetual preferred stock. The

dividend rate is 6.3% payable quarterly on February 12, May 12, August 12

and November 12, beginning May 12, 2016, in each case when, as and if

declared by the Citi Board of Directors.

During 2015, Citi distributed $769 million in dividends on its

outstanding preferred stock. Based on its preferred stock outstanding as of

December 31, 2015, Citi estimates it will distribute preferred dividends of

approximately $1,027 million during 2016, in each case assuming such

dividends are declared by the Citi Board of Directors.