Citibank 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

GSIB Surcharge

In August 2015, the Federal Reserve Board issued a final rule which imposes

a risk-based capital surcharge upon U.S. bank holding companies that are

identified as global systemically important bank holding companies (GSIBs),

including Citi. The GSIB surcharge augments the Capital Conservation

Buffer and, if invoked, any Countercyclical Capital Buffer, and would result

in restrictions on earnings distributions (e.g., dividends, equity repurchases,

and discretionary executive bonuses) should the expanded buffer be breached

to absorb losses during periods of financial or economic stress, with the

degree of such restrictions based upon the extent to which the expanded

buffer is breached.

Under the Federal Reserve Board’s final rule, identification of a GSIB

would be based primarily on quantitative measurement indicators

underlying five equally weighted broad categories of systemic importance:

(i) size, (ii) interconnectedness, (iii) cross-jurisdictional activity,

(iv) substitutability, and (v) complexity. With the exception of size, each

of the other categories are comprised of multiple indicators also of equal

weight, and amounting to 12 indicators in total.

A U.S. bank holding company that is designated a GSIB under the

established methodology will be required, on an annual basis, to calculate

a surcharge using two methods and will be subject to the higher of the

resulting two surcharges. The first method (“method 1”) is based on the

same five broad categories of systemic importance used to identify a GSIB.

Under the second method (“method 2”), the substitutability category is

replaced with a quantitative measure intended to assess the extent of a GSIB’s

reliance on short-term wholesale funding. Moreover, method 1 incorporates

relative measures of systemic importance across certain global banking

organizations and a year-end spot foreign exchange rate, whereas method 2

uses fixed measures of systemic importance and application of an average

foreign exchange rate over a three-year period. Generally, the surcharge

derived under method 2 will result in a higher surcharge than derived

under method 1.

Should a GSIB’s systemic importance change year-over-year such that

it becomes subject to a higher surcharge, the higher surcharge would not

become effective for a full year (e.g., a higher surcharge calculated by

December 31, 2016 would not become effective until January 1, 2018).

However, if a GSIB’s systemic importance changes such that the GSIB would

be subject to a lower surcharge, the GSIB would be subject to the lower

surcharge beginning with the next calendar year (e.g., a lower surcharge

calculated by December 31, 2016 would become effective January 1, 2017).

GSIB surcharges under the final rule, which are required to be composed

entirely of Common Equity Tier 1 Capital, initially range from 1.0% to

4.5% of total risk-weighted assets. Citi’s initial GSIB surcharge effective

January 1, 2016, which is based primarily on 2014 quantitative measures

of systemic importance (other than the short-term wholesale funding

measure under method 2, based on 2015 data), is 3.5%. However, Citi’s

ongoing efforts during 2015 in managing balance sheet efficiency has

resulted in lower scores for substantially all of the quantitative measures of

systemic importance, and consequently has reduced Citi’s estimated GSIB

surcharge to 3%, also derived under method 2, which would become effective

January 1, 2017.

Transition Provisions

The U.S. Basel III rules contain several differing, largely multi-year

transition provisions (i.e., “phase-ins” and “phase-outs”) with respect to

the stated minimum Common Equity Tier 1 Capital and Tier 1 Capital

ratio requirements, substantially all regulatory capital adjustments and

deductions, and non-qualifying Tier 1 and Tier 2 Capital instruments (such

as non-grandfathered trust preferred securities and certain subordinated

debt issuances). Moreover, the GSIB surcharge will be introduced in parallel

with the Capital Conservation Buffer and, if applicable, any Countercyclical

Capital Buffer, commencing phase-in on January 1, 2016 and becoming fully

effective on January 1, 2019. With the exception of the non-grandfathered

trust preferred securities which do not fully phase-out until January 1, 2022

and the capital buffers and GSIB surcharge which do not fully phase-in

until January 1, 2019, all other transition provisions will be entirely reflected

in Citi’s regulatory capital ratios by January 1, 2018. Citi considers all of

these transition provisions as being fully implemented on January 1, 2019

(full implementation), with the inclusion of the capital buffers and

GSIB surcharge.

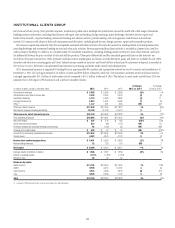

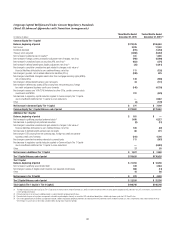

The following chart sets forth the transitional progression to full

implementation by January 1, 2019 of the regulatory capital components

(i.e., inclusive of the mandatory 2.5% Capital Conservation Buffer and

the Countercyclical Capital Buffer at its current level of 0%, as well as an

estimated 3% GSIB surcharge) comprising the effective minimum risk-based

capital ratios.