Citibank 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.155

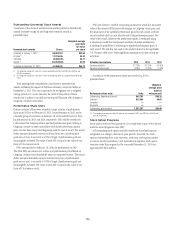

7. INCENTIVE PLANS

Discretionary Annual Incentive Awards

Citigroup grants immediate cash bonus payments, deferred cash awards,

stock payments and restricted and deferred stock awards as part of its

discretionary annual incentive award program involving a large segment of

Citigroup’s employees worldwide. Most of the shares of common stock issued

by Citigroup as part of its equity compensation programs are to settle the

vesting of the stock components of these awards.

Discretionary annual incentive awards are generally awarded in the first

quarter of the year based upon the previous year’s performance. Awards

valued at less than U.S. $100,000 (or the local currency equivalent) are

generally paid entirely in the form of an immediate cash bonus. Pursuant

to Citigroup policy and/or regulatory requirements, certain employees and

officers are subject to mandatory deferrals of incentive pay and generally

receive 25% to 60% of their awards in a combination of restricted or deferred

stock and deferred cash. Discretionary annual incentive awards to many

employees in the EU are subject to deferral requirements regardless of the

total award value, with 50% of the immediate incentive delivered in the form

of a stock payment or stock unit award subject to a restriction on sale or

transfer or hold back (generally, for six months).

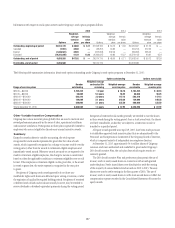

Deferred annual incentive awards may be delivered as two awards—a

restricted or deferred stock award under Citi’s Capital Accumulation

Program (CAP) and a deferred cash award. The applicable mix of CAP and

deferred cash awards may vary based on the employee’s minimum deferral

requirement and the country of employment. In some cases, the entire

deferral will be in the form of either a CAP or deferred cash award.

Subject to certain exceptions (principally, for retirement-eligible

employees), continuous employment within Citigroup is required to vest

in CAP and deferred cash awards. Post-employment vesting by retirement-

eligible employees and participants who meet other conditions is generally

conditioned upon their refraining from competition with Citigroup during

the remaining vesting period, unless the employment relationship has been

terminated by Citigroup under certain conditions.

Generally, the CAP and deferred cash awards vest in equal annual

installments over three- or four-year periods. Vested CAP awards are delivered

in shares of common stock. Deferred cash awards are payable in cash

and earn a fixed notional rate of interest that is paid only if and when the

underlying principal award amount vests. Generally, in the EU, vested CAP

shares are subject to a restriction on sale or transfer after vesting, and vested

deferred cash awards are subject to hold back (generally, for six months in

each case).

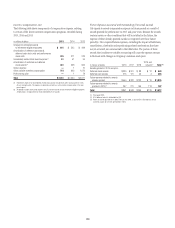

Unvested CAP and deferred cash awards made in January 2011 or

later are subject to one or more clawback provisions that apply in certain

circumstances, including in the case of employee risk-limit violations or

other misconduct, or where the awards were based on earnings that were

misstated. CAP awards made to certain employees in February 2013 and

later, and deferred cash awards made to certain employees in January 2012,

are subject to a formulaic performance-based vesting condition pursuant

to which amounts otherwise scheduled to vest will be reduced based on the

amount of any pretax loss in the participant’s business in the calendar year

preceding the scheduled vesting date. For CAP awards made in February 2013

and later, a minimum reduction of 20% applies for the first dollar of loss.

In addition, deferred cash awards made to certain employees in

February 2013 and later are subject to a discretionary performance-based

vesting condition under which an amount otherwise scheduled to vest

may be reduced in the event of a “material adverse outcome” for which a

participant has “significant responsibility.” Deferred cash awards made to

these employees in February 2014 and later are subject to an additional

clawback provision pursuant to which unvested awards may be canceled

if the employee engaged in misconduct or exercised materially imprudent

judgment, or failed to supervise or escalate the behavior of other employees

who did.

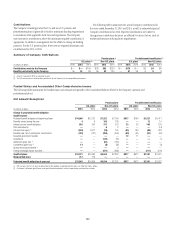

Certain CAP and other stock-based awards, including those to participants

in the EU that are subject to certain discretionary clawback provisions, are

subject to variable accounting, pursuant to which the associated value of the

award fluctuates with changes in Citigroup’s common stock price until the

date that the award is settled, either in cash or shares. For these awards, the

total amount that will be recognized as expense cannot be determined in full

until the settlement date.

Sign-on and Long-Term Retention Awards

Stock awards and deferred cash awards may be made at various times during

the year as sign-on awards to induce new hires to join Citi or to high-potential

employees as long-term retention awards.

Vesting periods and other terms and conditions pertaining to these awards

tend to vary by grant. Generally, recipients must remain employed through

the vesting dates to vest in the awards, except in cases of death, disability or

involuntary termination other than for “gross misconduct.” These awards

do not usually provide for post-employment vesting by retirement-eligible

participants.